On Wednesday, June 15, the world’s largest cryptocurrency Bitcoin (BTC) entered another brutal crash moving close to $20,000. Since then, the BTC price has recovered along with the broader crypto as the Fed announces interest rate hikes on the expected lines.

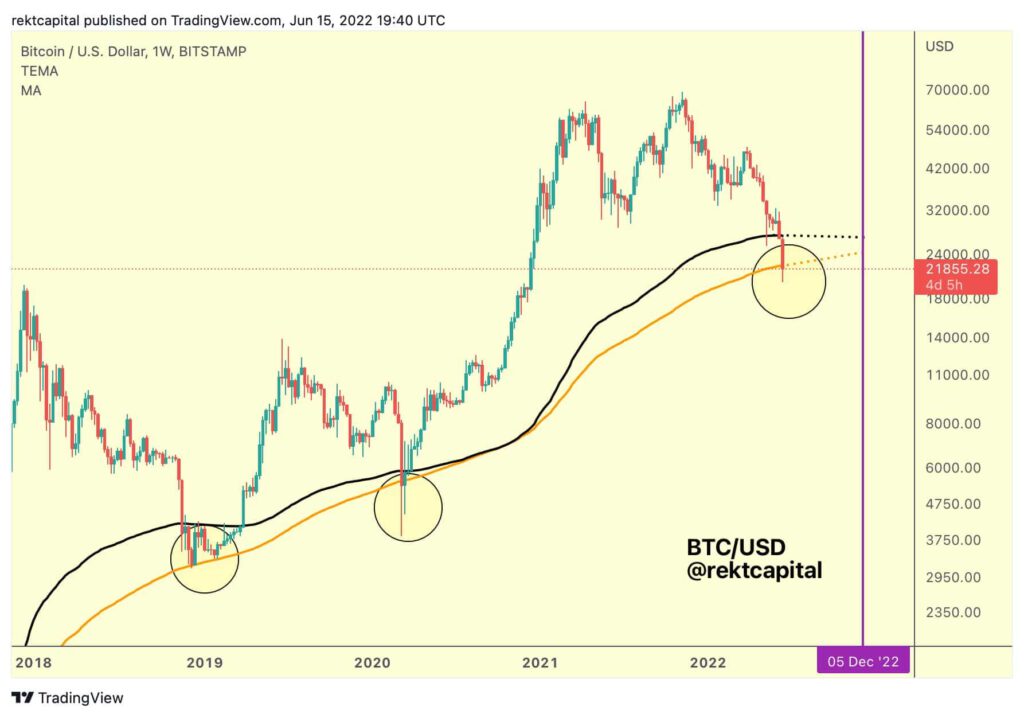

As of press time, Bitcoin is trading 2% up at a price of $22,423, however, it still remains 25% down on the weekly charts. As per crypto analyst Rekt Capital, Bitcoin might be entering a multi-month consolidation phase. The analyst wrote:

If BTC continues to hold the orange 200-week MA as support and the black 200-week EMA figures as resistance… $BTC could form an Accumulation Range here, just like in 2018 This would enable multi-month consolidation to even as far as December 2022.

Besides, Rekt Capital has another interesting theory to explain why the bear market could be months away from here. Explaining the correlation between Bitcoin and the next halving cycle, Rekt Capital predicts that the bottom can come in Q4 2022. He writes:

In 2015, BTC bottomed 547 days before the Halving. In 2018, $BTC bottomed 517 days before the Halving (discount March 2020 crash). If Bitcoin is going to bottom 517-547 days before the upcoming April 2024 Halving… Then the bottom will occur in Q4 this year.

Trending Stories

On-Chain Bitcoin (BTC) Metrics

This week has seen the most amount of realized losses inflicting maximum pain on traders. As on-chain data Santiment explains:

It’s no surprise to see Bitcoin transactions being made in waves of realized losses. And this past week has actually seen the most realized losses since this data was available in 2009. High capitulation spikes can & will eventually foreshadow bottoms.

Furthermore, the Bitcoin token circulation has touched the highest in 4.5 years. As per Santiment, “Traders are certainly reacting to the major price drops this week, and the 4.5 year high in Bitcoin‘s daily token circulation indicates how polarized we are. 497k unique $BTC were moved to start the week, the highest amount since December 6, 2017″.