Public bitcoin mining companies have been an unusually prominent fixture of the crypto market for the past couple of years as investors, media and regulators observe their financial growth and operational expansions. While share prices for nearly all of these companies significantly outperformed bitcoin during the latest bullish market trend, the opposite effect is clearly in play now as public miners try to weather the on-going bear cycle. In fact, none of these companies have managed to outperform bitcoin so far in 2022.

This article explores a bunch of data relevant to the performance of public mining companies, different strategies from these companies in current market conditions, and why the public mining market matters to the broader bitcoin economy.

Public Bitcoin Mining Company Data Overview

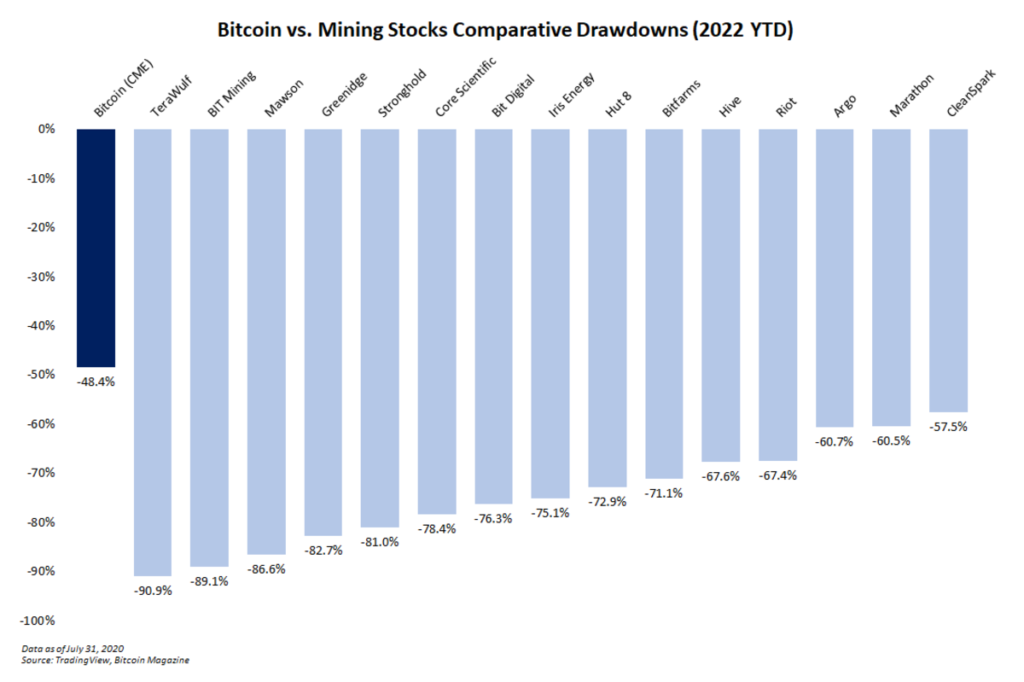

Bitcoin has had a tough year so far. But public mining companies have had an even tougher year. The bar chart below visualizes the brutality with bitcoin’s year-to-date drawdown alongside drawdowns for 15 leading public mining companies over the same time period.

Bitcoin’s year-to-date drawdown alongside the drawdowns of the leading public bitcoin mining companies demonstrates the brutality of this bear market.

There’s no productive reason for overemphasizing the drawdowns. The numbers speak for themselves.

The five worst performers to date this year that trade on the Nasdaq are:

- TeraWulf (-90.9%)

- BIT Mining (-89.1%)

- Mawson (-86.6%)

- Greenidge (82.7%)

- Stronghold (-81%)

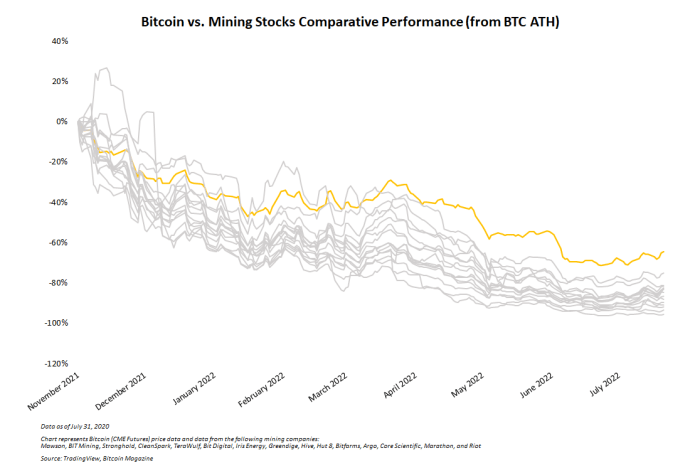

Of course, this sort of performance is not unexpected considering the current market environment. A more complete picture of the comparative performance from bitcoin and mining companies is shown in the line chart below that includes price data from bitcoin’s all-time high in late 2021 to the time of writing (the end of July 2022). Bitcoin and all mining companies naturally trended down together, but not a single mining company outperformed (or had a drawdown less than) bitcoin.

It’s worth noting that even over this nine-month period, the tightened correlation between all mining stocks is apparent after May 2022, compared to the still-close-but-noticeably-weaker correlations in the preceding months.

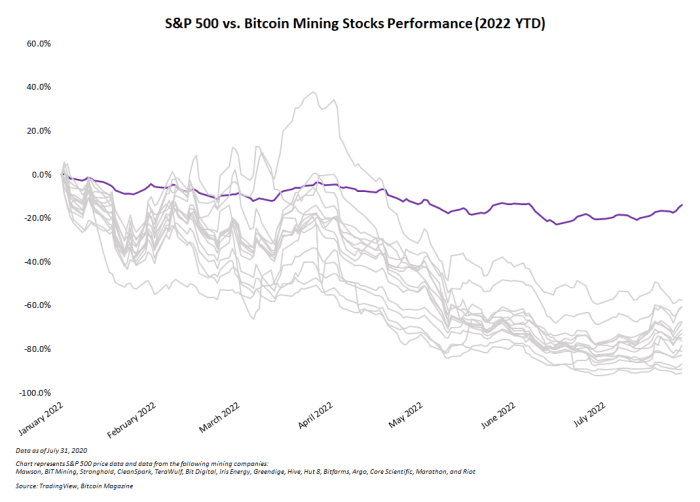

Even worse than comparing mining stocks to bitcoin’s drawdown is comparing them to the Standard and Poor’s 500 stock market index. The line chart below shows this data, and it’s apparent that the S&P 500 has trounced mining stocks so far in 2022.

Bitcoin mining company stock performance compared to the S&P 500’s is even worse than it is compared to the bitcoin price.

Is this sort of underperformance unusual? In bearish market trends, no. Mining companies perform much better than bitcoin when bitcoin goes up. And when bitcoin goes down, mining companies fall even harder. It wouldn’t be surprising, however, to see one or two miners fare slightly better than bitcoin. But the market has been brutal across the board, and none of them have outperformed.

Summer Update On The Bitcoin Mining Sector

Setting aside the doom and gloom of the article up to this point, miners are still operating well despite market conditions. In many cases, monthly bitcoin production is growing, new financing is being secured and expansion plans are continuing.

Specifically on monthly bitcoin production, for example, the past few months have seen:

- Iris Energy boost production by 10% in May

- Hive mine over 278 BTC in June

- Greenidge boost production by 18% in June

Some public miners are continuing to sell larger-than-usual amounts of their regular bitcoin production to weather the bear market. Core Scientific and Argo are examples of this. Other miners are continuing to hold many or virtually all of the coins they mine, including Hut 8, which is expanding its holdings, and Marathon, which sold no bitcoin in Q2 2022.

And despite the bear market, many public miners continue planning expansion projects.

Compared to six months ago, margins are still significantly tighter for miners. Hash price, bitcoin price, yada yada. But what is arguably one of the most important sectors in the bitcoin economy is alive and growing even as the broader market is somewhat battered and beaten down. Core Scientific secured $100 million in fresh financing and signed a 75 megawatt (MW) hosting deal. CleanSpark continues acquiring discounted mining hardware. Compute North and Compass Mining signed a 75 MW expansion agreement. And Marathon secured a 200 MW hosting deal.

Bitcoin’s price may still be well off its highs, but growth in the mining sector is still humming along.

Who Cares About Public Miners?

In many Bitcoin circles, small-scale and at-home miners are the darlings, not institutional mining entities. Even though all types and sizes of mining units have their place in Bitcoin, some readers may wonder why the public mining market matters at all?

Share price performance for mining companies is a reasonably good gauge for broader investor interest in bitcoin, aside from the bitcoin price itself. As more traditional financial analysts are paying attention to the mining market, it’s increasingly useful to gauge general sentiment around bitcoin.

Mining companies are also a high-beta investment vehicle (or leveraged play) for bitcoin investors. So, if a particular investor is bullish on bitcoin and wants to outperform bitcoin itself, they might consider investing in a basket of mining stocks.

The state of the industry’s largest miners can also be a signal of the bitcoin economy’s health. Miners are always the bulls of last resort for bitcoin. And even though trouble for public miners doesn’t always mean trouble for bitcoin, the inverse is often true. Good times for public mining companies often signal good times for bitcoin.

Public Bitcoin Miners Are HODLing On

The current bitcoin bear market has been brutal for public mining companies as the charts in this article show. Despite this, most public mining companies continue to hold bitcoin, secure new hosting and financing deals, and prepare for the next bull market and the rapidly approaching halving event. Whether the market will get worse before it gets better is an open question. But the mining sector is far from dead or beaten down. Bitcoin mining is weathering the bear market as well as anyone could expect.

This is a guest post by Zack Voell. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.