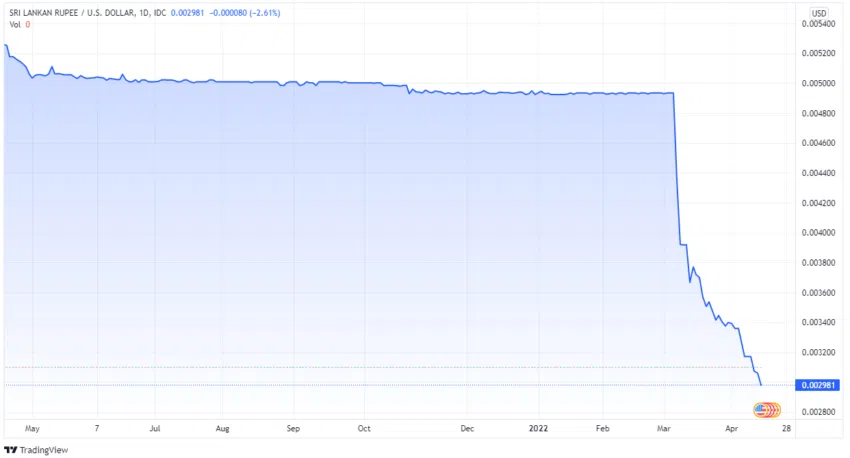

The Sri Lankan rupee has hit a historic low as it experiences a tremendous economic and political crisis. At the same time, bitcoin trading volume in the country has been going up.

The Sri Lankan rupee has dropped to an all-time low as a result of the economic emergency the country is facing.

Against the U.S. dollar, the Sri Lankan rupee is down more than 30% and is lagging even the Russian rouble. The country’s economy has collapsed due to debt payments, protests, and general economic and political crises.

Sri Lanka finance minster quits 24 hours into job

In addition to high inflation, the country has also been facing food and power shortages. Government ministers have been resigning including central bank governor Ajith Nivard Cabraal. New finance minister Ali Sabry quit just 24 hours into the job.

source: tradingeconomics.com

The country’s currency is plummeting because it faces international bond payments soon, and a default could lead to even further trouble. Amid the turmoil, the volume of bitcoin traded in Sri Lanka is on the rise. The Sri Lankan rupee is now 12,685,329 against bitcoin.

But Sri Lanka is not the only country facing inflation troubles. The United States, United Kingdom, and Denmark are facing higher rates. And bitcoin might be a solution.

This is not the first time that a country experiencing economic woes has seen its citizens start trading bitcoin more. Venezuela, Argentina, and others are turning to bitcoin and crypto as a solution.

The narrative that bitcoin can be a good asset in times of crisis is one that is often used by pro-crypto supporters. When difficult situations arise, the asset can be used as a good hedge and help families purchase essentials.

Entrepreneur Peter Thiel has also spoken of how cryptocurrency prices prove that inflation is a concern. Those concerns will not end anytime soon, as 2022 looks like it could be a rough year for traditional markets.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.