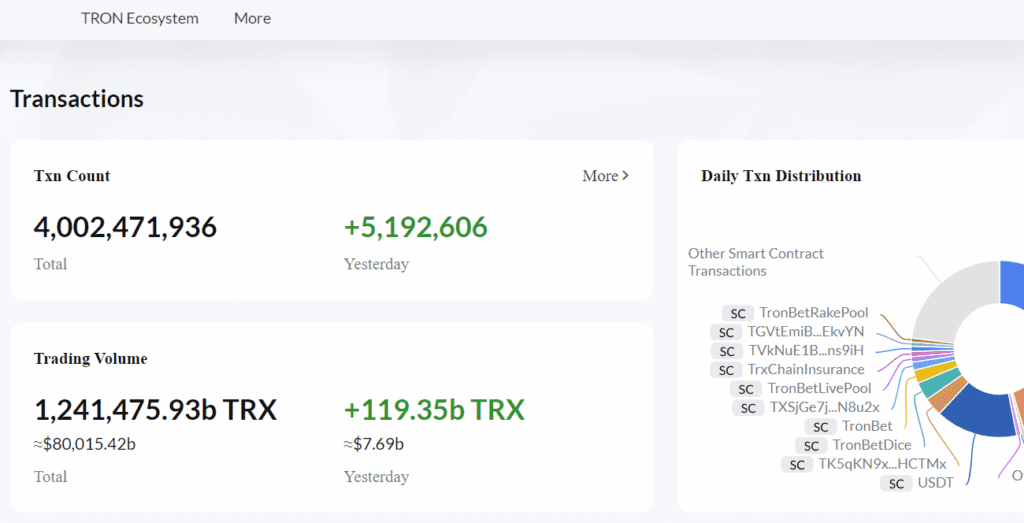

According to data gathered from Tron blockchain explorer, Tronscan, the total amount of transactions on the TRON network reached and surpassed $4 billion. The network’s ability to offer lower transaction fees with faster speed than Ethereum [ETH] was one of the factors that contributed to its popularity.

A serene and stable metric front

Messari reported that the TRON network stood sixth among the most valuable smart contract platforms. Tron’s market valuation also stood at $6 billion. This was behind the likes of Ethereum, Cardano, and Polkadot.

Furthermore, data acquired from DefiLlama showed that the network had a Total Value Locked (TVL) of more than $5.6 billion. Additionally, he TVL surged by 0.89% in the past 24 hours.

The TVL dropped to around $3 billion in June before rising to above $5 billion and stayed there in recent months. This is depicted in the image below.

Price sets a good mood

Observing the price chart on the daily timeframe, it could be seen that TRX had been meeting resistance at the area of $0.0658, where the 50 Moving Average (MA) and the 200 MA had both also acted as resistance levels.

A descending triangle may be seen using the trend lines, and using the price range tool, it was possible to observe that the price had declined by more than 37% since the start of the decline. The support range was also seen between $0.0599 and 0.0576.

Breaking above the MAs that have been acting as resistance, especially the long MA, would signal the start of a potential uptrend. After breaking through the $0.0658 barrier, TRX could make a test of the level where the descending triangle trend began. This would be at $0.0894, for a gain of nearly 37%.

The asset’s low volatility was also reflected in the narrowing of the Bollinger Band (BB). In accordance with the MA’s confirmed observation, a breakout above the band’s upper band will usher in a bull run for the asset.

With an opening price of $0.0623, TRX gained more than 2% in the trading period and was trading at $0.063. The Relative Strength Index (RSI) showed the line above the neutral line signifying a bullish trend on the daily timeframe. It could also be observed that the line had an upward inclination, signifying a potential move to the overbought zone.

If the present upward trend on the chart continues, a break of the short MA resistance level is possible. At this juncture, investors should be on the lookout. Crossing of the short MA above the long MA could lead to a buying opportunity for the asset, whether for the long or short term.