The thought of investors dumping such a huge chunk of the supply in one go would be scary for any cryptocurrency. Not Shiba Inu, however.

The meme coin with a supply of more than 400 trillion SHIB has established its reputation for being a victim of its own investors. And, they might continue to uphold the tradition this time as well.

Shiba Inu faces a threat

SHIB holders are known for accumulating when the price is low and selling as soon as the altcoin runs up a profit.

This has been observed in the past as well. And, now that SHIB is at its lowest in 8 months, any hike from here on will be treated as an opportunity for booking profits. And knowing SHIB holders to be profit-hungry, they won’t hesitate to leave the token high and dry.

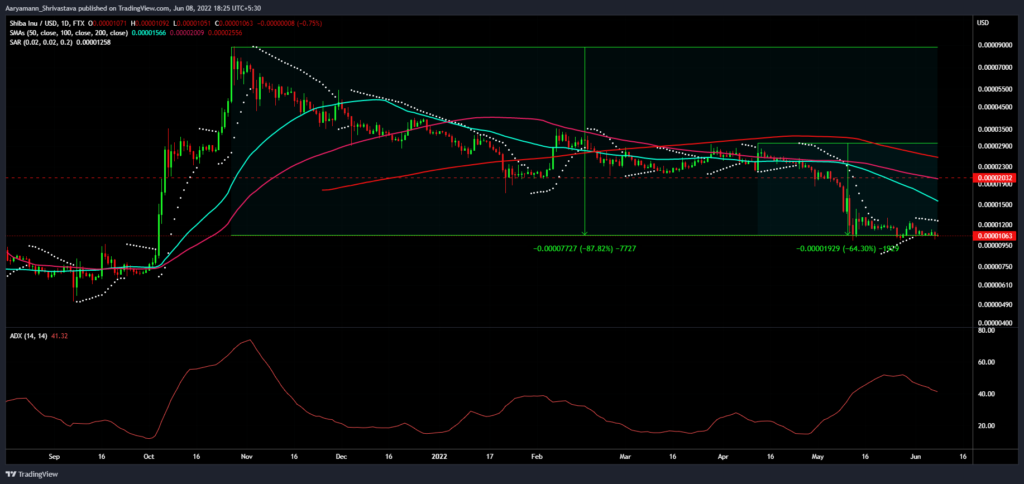

Shiba Inu price action | Source: TradingView – AMBCrypto

Over the last two months, since SHIB declined by 64.3%, investors have amassed about 1.02 trillion SHIB worth $10.6 million. All in the hopes of selling when the meme coin starts rallying again.

Shiba Inu supply on exchanges | Source: CryptoQuant- AMBCrypto

Usually, SHIB’s volatility helps the cryptocurrency observe sharp spikes and steep drops every other day. Alas, at the moment, all indicators point towards a gradual depreciation in price as the uptrend lost its strength days ago, giving control to the bears.

The impact has been such that on 31 May, Shiba Inu registered the highest single-day losses in more than a year. This was when 3.71 trillion SHIB were involved in transactions conducted in losses.

Shiba Inu supply in losses | Source: Santiment – AMBCrypto

This further demotivated investors from participating on-chain, which is an issue for SHIB since it sincerely needs its investors.

After the price began falling following the May ATH, SHIB holders’ presence began waning. As a result, the transactions conducted also fell significantly. From an average of almost 70k, the transactions fell to just 4.5k, at the time of writing.

Shiba Inu on-chain transactions | Source: CryptoQuant- AMBCrypto

Ergo, given the investors’ lack of dedication towards Shiba Inu’s growth, it is very likely they will sell the acquired 1 trillion SHIB. Especially since it anyways accounts for less than 0.25% of the entire supply.