“Our lives are the result of the seeds that we’ve planted over time. It takes a while before we see the results of our planting. But know that the seeds you plant today will affect your tomorrow in ways that you may not anticipate.”

No, not a philosophy class, but this phrase might just stand for one of the developed crypto ecosystems- Polygon.

Here, the context was Polygon’s successful collaboration with a DEX protocol and the green report card.

Here’s AMBCrypto’s Price Prediction for MATIC for 2022-2023

Thanks to you

In 2021, Polygon partnered with the Khyber Network to reach new heights within the DeFi ecosystem. The latter worked closely with the Polygon team to ensure a successful KyberSwap deployment, enhance liquidity for DeFi, and bring more users, developers, and Dapps to Polygon.

Safe to say that the flagship token, KNC, reaped benefits of the same as highlighted by Santiment.

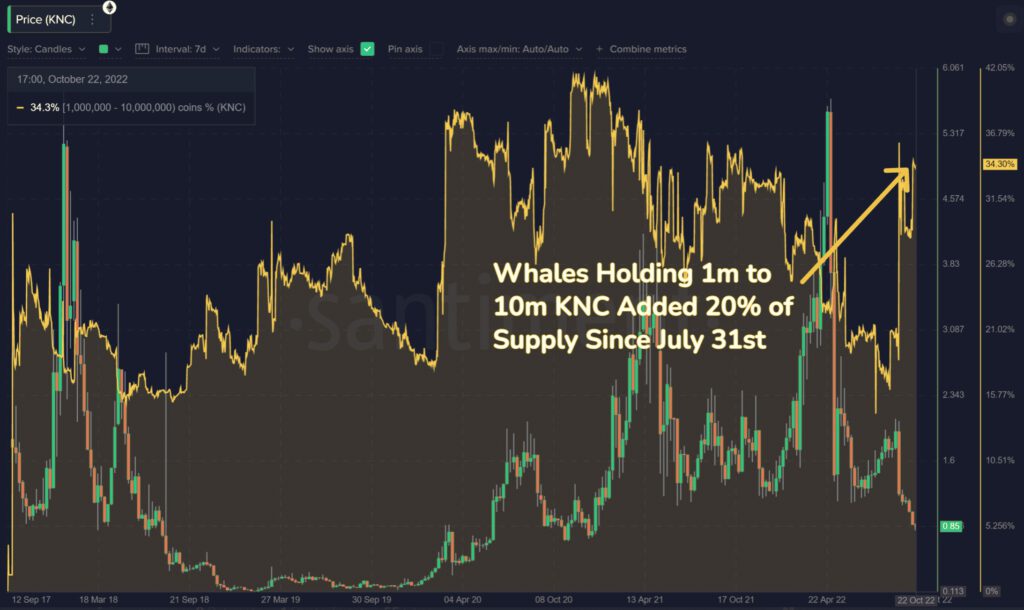

Herein, whales accumulated rapidly over the past three months, with key wallets holding 1M to 10M KNC, adding 20% of the supply to their holdings since 31 July.

Fair to say, whales have been busy scooping up more coins during the dip. But could this actually help the respective crypto? Well, the last time this kind of accumulation was seen, KNC grew +67% in six months.

Meanwhile, Polygon (MATIC) too showcased a similar picture as it traded amidst the “crypto price correction” phase. Unlike others, MATIC enjoyed significant gains on the trading day as it gained 0ver 6% in the last 24 hours. On-chain metrics such as trading volume showed shocking stats as evidenced below.

Source: Twitter

In addition to this, there was a mass awakening of old addresses observed on the Polygon network. The consumed token age on the Polygon network reached a high of 29.9B, a significant hike of ~27,000% in just 24 hours.

Source: Santiment

Herein, old and dormant addresses moved large amounts of MATIC. To support this cause, active addresses too reiterated the same scenario. In fact, Polygon surpassed ETH in weekly active addresses (WAA).

1/ @0xPolygon passes Ethereum in weekly active addresses (WAA)! It is the 3rd consecutive all time high.

WAA: 2.27mm, +45.7%

Tx: 19.7mm, +3%

Rev: $464k, +196%Today we explore the cause of this week’s spike, its sustainability, broader crypto growth+more. Full analysis 👇👇👇 pic.twitter.com/oA9DAB9gtZ

— Raphael (@RaphaelSignal) October 22, 2022

While Santiment did not specify the reason for this awakening, one could speculate the relation to its partnership with Nubank.