Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

Ethereum Classic has oscillated within its 38.2% and 23.6% Fibonacci levels since early October, with breakouts on either side rejected immediately. However, the market’s bulls, at press time, were attempting to turn the tide in their favor following a recovery along the RSI and MACD.

A potential rally awaited ETC should its price break above its immediate price ceiling backed by good buy volumes. At the time of writing, ETC was trading at $56.08, up by 1.5% over the last 24 hours.

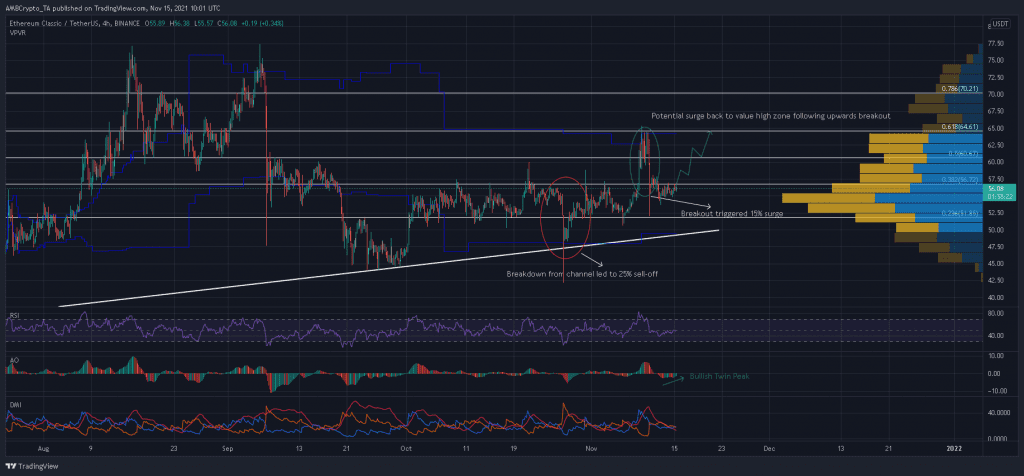

Ethereum Classic 4-hour Chart

Ethereum Classic has seen two breakouts from its current channel between the 38.2% and 23.6% Fibonacci levels and each has led to strong price action. For instance, a breakdown on 27 October triggered a 27% sell-off to the 3-month low at $42.2, while a breakout on 9 November paved way for a 15% price surge and marked a 2-month high.

Should ETC now register a close above the 38.2% Fibonacci level, a potential rally could carry the alt all the way to its value high zone (upper blue line) present at $64. Overall, this would mark a 13% increase from ETC’s press time level. In order to match its September local high of $72.4, ETC would have to negate a double top at $65.3 and maintain good buy volumes to sustain above the value high zone.

However, should ETC falter at the 61.8% Fibonacci level, another sell-off could come to light. The 50% and 38.2% Fibonacci levels have not proved to be reliable support thus far and losses could extend all the way to the bottom sloping trendline.

Reasoning

The 4-hour RSI and Awesome Oscillator pictured an optimistic outlook. The RSI formed higher lows and attempted to break above the mid-line, while the Awesome Oscillator formed a bullish twin peak setup.

Moreover, the DMI was also close to a bullish crossover, but the -DI and +DI lines remained intertwined for the time being. Should the RSI and AO recover above their respective mid-lines following such signals, a favorable outcome can be expected.

Conclusion

If buyers react to positive signals along the RSI and AO, an upwards price swing might be incoming for ETC. Traders should be on the lookout for a close above the 38.2% Fibonacci level as this could lead to a potential 13% hike towards the value high zone.