Chainlink [LINK] holders and investors may have something to rejoice about. The new Economics 2.0 may be the key to save an ailing and struggling LINK. The latest launch will enable Chainlink to surge its fees and revenue capture as well as increase the blockchain’s security via staking.

However, what remains to be seen is that if this new launch can improve Chainlink‘s declining market cap.

_____________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for Chainlink for 2022-2023.

_____________________________________________________________________________________

Chainlink made the announcement on 14 October via Twitter. Furthermore, Chainlink plans to make a lot of improvements and alterations to the current functioning of the network.

1/ The goal of #Chainlink Economics 2.0: unlock the immense value of Web3 by ensuring it has the sustainable, secure infrastructure it needs to go mainstream.

Econ 2.0 hinges on:

• Increasing fees & revenue capture

• Reducing operating costs

• Increasing security via staking pic.twitter.com/wAMI9vLZlu— Chainlink (@chainlink) October 14, 2022

In terms of generating revenue from fees, the blockchain announced that it would help pre-revenue dApps. Chainlink would share its oracle services and technical support with the dApps. Furthermore, in exchange, the dApps would commit a part of their token supply to Chainlink as network fees.

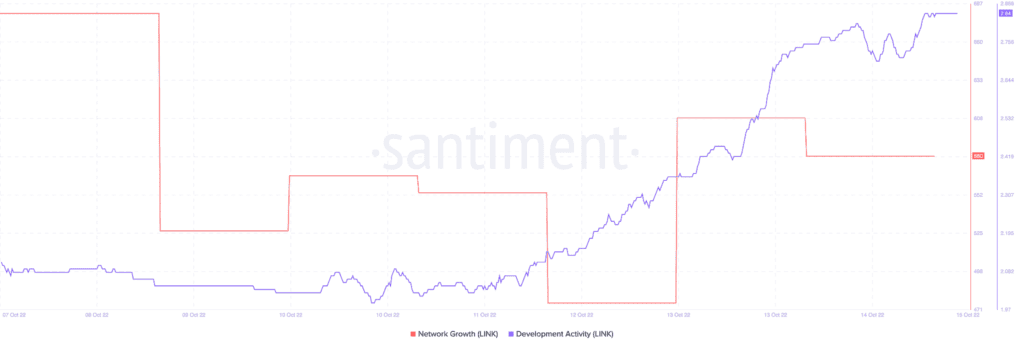

Some other improvements also included lower costs and improved security. In lieu of these events, Chainlink’s development activity witnessed a rise over the past week.

This may be a strong indication that developers at Chainlink were making progress in terms of development and new features. Additionally, Chainlink’s network growth also witnessed an uptick, indicating that the number of new addresses that transferred Chainlink for the first time grew.

This implied a spike in interest from new addresses towards LINK.

Will it ever be enough?

The aforementioned development wasn’t the only positive development as LINK had something more in store. Institutional investors and whales too showed a new-found interest towards Chainlink.

WhaleStats, an organization responsible for tracking crypto whales, tweeted that LINK was among the top 10 purchased tokens by 500 biggest Ethereum whales in the last 24 hours.

JUST IN: $LINK @chainlink now on top 10 purchased tokens among 500 biggest #ETH whales in the last 24hrs 🐳

We’ve also got $UMA, $DAR, $UNI, #FTX Token & $LPT on the list 👀

Whale leaderboard: https://t.co/tgYTpODGo0#LINK #whalestats #babywhale #BBW pic.twitter.com/Ab3rDcTwhf

— WhaleStats (tracking crypto whales) (@WhaleStats) October 14, 2022

However, despite significant interest from huge investors, there were some areas, such as velocity and market cap, where there were signs of stagnancy.

As can be seen from the image below, Chainlink’s velocity witnessed a decline over the past few days. This meant that the average number of times Chainlink changed wallets each day witnessed a drop. This factor along with Chainlink’s declining market cap, could be perceived as a bearish signal for potential investors.

In addition to the decline mentioned above, Chainlink deprecated by 3.40% in the last 24 hours and was trading at $6.87 at press time. Its volume also depreciated by 40% during the same time period.

However, despite Chainlink’s bearish price action, companies continued to show faith in Chainlink’s team as integrations and developments with multiple organizations in the DeFi and GameFi spaces continued to happen.