Avalanche network has been losing its validators while other blockchains are dealing with the loss of their investors.

The exodus of validators from the Avalanche network started towards the end of April. Of late, the issue is taking the centre stage. But, investors needn’t worry about it.

Is Avalanche about to slow down?

The network currently boasts 1,240 validators, with each of these validators holding a weight of about 192k AVAX on average.

The weight here includes the total amount of AVAX staked by the validators. And, the total amount of tokens delegated to them by other users.

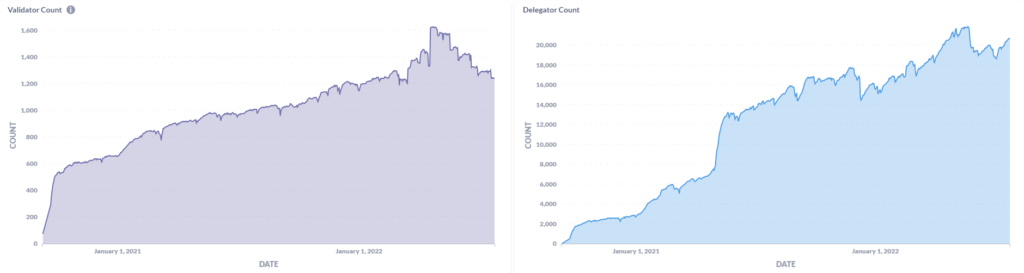

The network at its peak had about 1,625 validators towards the end of April. But it has since declined by 26%.

The crash of May and June also led to a decrease in the total delegators on the network. It came down from 21k to 18k before recovering to 20k.

As both the cohorts reduced in size, it affected the total weight they held.

In the case of validators, the combined weight dropped from 234 million AVAX to 205 million AVAX, at the time of writing.

The delegators’ weight also noted a decrease as it fell from 37 million AVAX to 33 million AVAX.

It’s not just on the governance front that Avalanche is taking a hit. It hasn’t been doing well when it comes to investors’ faith in its price action.

Since May, the transaction count has been decreasing. The last month observed only 18 million transactions, which was a little over half of May’s 31 million.

This month with less than a week left before it ends, Avalanche has observed 13.4 million transactions.

The situation is similar on the NFT front as well since the weekly volume on its NFT marketplaces is reducing significantly.

Last week the combined volume of the NFT transactions came up to a little over 13k AVAX, which was the lowest recorded volume in more than four months.

Avalanche NFT transactions | Source: Dune – AMBCrypto

This is due to the consistent decline in unique buyers on the marketplaces, which affects the inflows. Thus, leaving the network dependent on old buyers.

Although the lack of validators is not a concern, the rest of everything is which will only be fixed once the market is in better condition.