Avalanche is facing a testing day in the past 24 hours with the Ava Labs cryptocurrency facing massive volatility. The AVAX token initially went through a 16% dip before gaining momentum and rising above by 10%.

What does the future hold for AVAX?

If you expected volatility to be a thing of the past in crypto, you probably are too optimistic! The AVAX token plummeted earlier today to $27.9 before rising to $31 and consolidating there, at press time. Currently the #13 on the list of the largest cryptocurrencies by market cap, AVAX continues to test market volatility trends.

It is fair to say the crypto market just got back from a massive crypto crash caused by the TerraUSD de-pegging. AVAX also suffered during the crash like other crypto assets. At the end of the second week of May, Avalanche saw its market cap shed 60% to $7 billion.

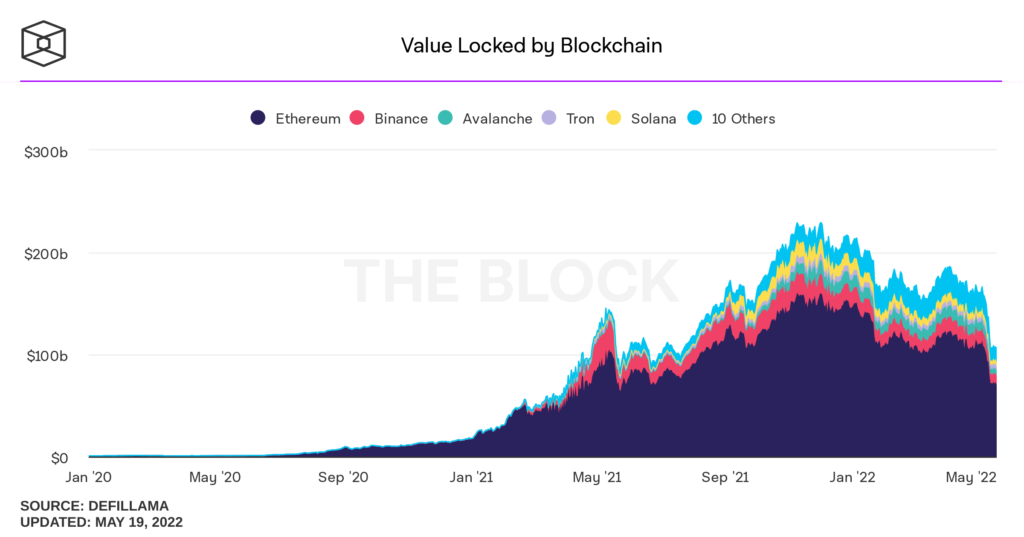

But that is not all. DeFi projects on Avalanche have also taken a hit following the crash. The Avalanche TVL in Defi has fallen by more than 8.5% in the past 24 hours to $4.63 billion.

This is a more than 60% fall from its December 2021 of $13.7 billion. Another worrying indicator is the drastic fall in the daily transactions on Avalanche. It reached its all-time high on 27 January, 2022 with 1.1 million transactions. But the pattern has seen only a downward trend since early May when it dropped to a lowly 326,000 transactions.

AVAX founder calls out Terra

In other news, Avalanche founder Emin Gün Sirer spoke in an interview with Forbes that the Terra crash can lead to increased regulations. He even went on to compare the crash with the infamous 2014 Mt. Gox hack.

The Mt. Gox hack was one of the biggest scams at the time as the crypto exchange went bankrupt afterwards. This hack was also a catalyst to a major dip in BTC prices which of course have recovered to lofty heights.

The Luna Foundation admitted to $60 million of AVAX holdings which weren’t liquidated during the sell off. Nevertheless, the Terra confirmed no AVAX token were sold, as reported by U.Today. This came off as a relief for users despite the stark volume of the Avalanche blockchain which would remain largely unaffected even if the tokens were sold.