The overall trend for the AVAX coin is still bullish, where the recent correction phase in its price has found good support from the $78 mark. Moreover, this impressive price recovery in the last few days could be triggered by a flood of positive news like Circle launching its stable coin USD Coin (USDC) on Avalanche. In addition, A report by Nasdaq mentioned Bank of America analysts calling Avalanche a viable alternative to the leading smart contract platform Ethereum.

Key technical points:

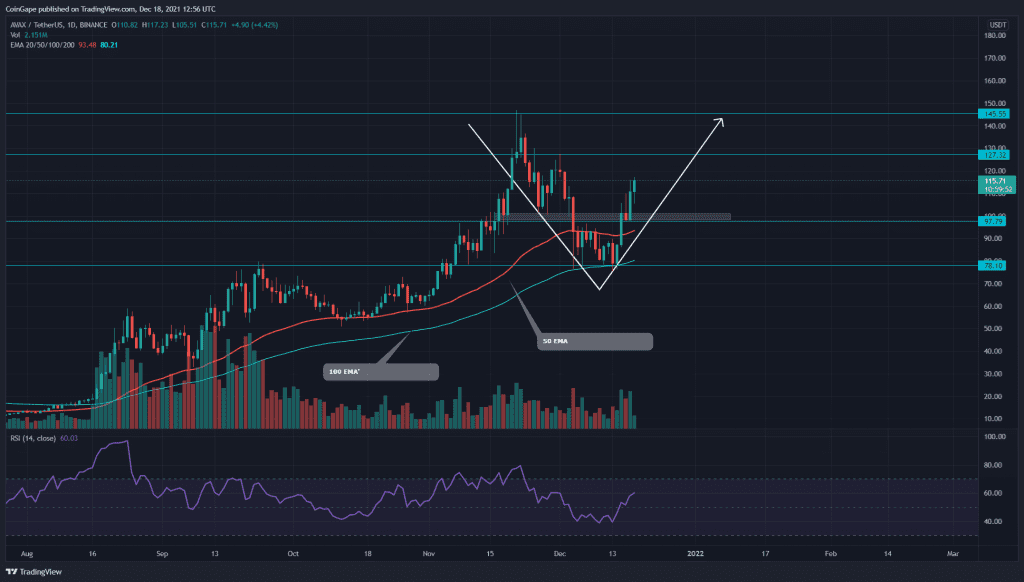

- The AVAX coin price reclaims the 50-day EMA

- The intraday trading volume in the AVAX coin is $2.4 Billion, indicating a 21.2% gain.

Source- chart by Tradingview

The last time when we covered an article on AVAX/USD, the correction phase brought a 30% discount on this coin, as the price plummeted to 0.5 Fibonacci retracement level. The coin hovered above this level for almost two weeks before giving a proper signal for a bullish reversal.

On December 15, the AVAX coin tried to breach its nearest resistance around $100-$97.8, and after a short retest, the coin continued its rally aiming at the All-time high of $146.

The crucial EMAs (20, 50, 100, and 200) have recovered their bullish alignment in the daily chart, indicating a strong uptrend. The Relative Strength Index (60) line has jumped above the neutral zone, indicating a bullish sentiment in price.

AVAX/USD 4hr time frame chart

Source- chart by Tradingview

So far, the AVAX coin has soared 48% from its bottom support of $78. Now it is steadily charging towards its next resistance of $127. If the price managed to reclaim this overhead resistance, the coin would soon challenge ATH resistance of $145 for a bullish breakout.

On the contrary, even if the price rejects the above resistance, the crypto traders can maintain a bullish sentiment until the price sustains above the $100 mark.

The traditional pivot shows remarkable confluence with the AVAX/USD chart level. According to these pivot levels, these traders can expect the nearest resistance at $117, followed by $127. As for the opposite end, the support levels are $97.7 and $87.3.