As Bitcoin poked the $44,000-mark over the past day, Avalanche moved above its 20-50-200 SMA while eyeing at the $91-level. Also, Dogecoin bulls stepped in to defend the $0.143-mark as the buyers kept exerting pressure. Additionally, Litecoin also reclaimed the $128-support.

The near-term technicals of these cryptos depicted increasing buying pressure. However, the Crypto fear and greed index failed to show any improvements in the last 24 hours.

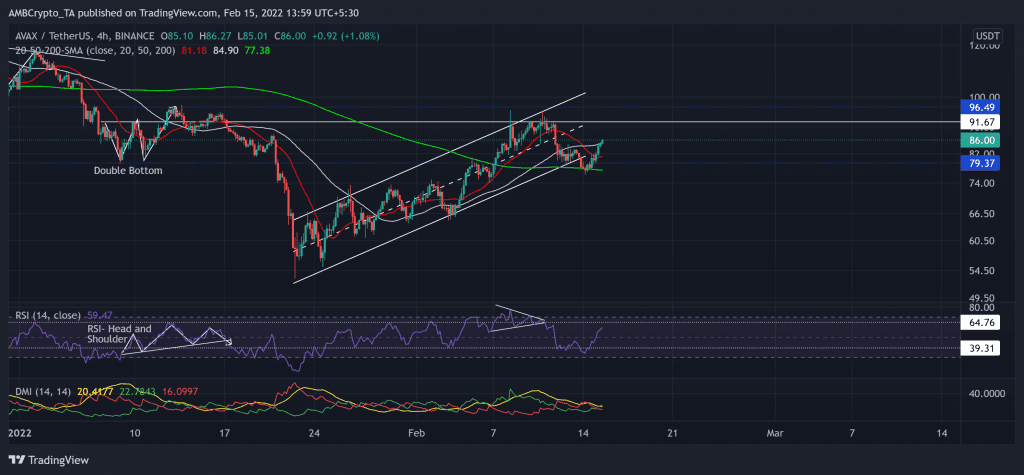

Avalanche (AVAX)

AVAX saw a 54.8% retracement (since 2 January) and poked its 14-week low on 22 January. Since then, the alt noted a staggering 78% gain as it poked the $95-mark on 10 February.

Over the past four days, it saw a pullback as it broke out of the up-channel (white). However, the bulls quickly initiated a recovery above the 20-50-200 SMA. From here on, the immediate resistance stood at the $91-mark.

At press time, the AVAX was trading at $0.0 after noting a nearly 8% 24-hour gain. After testing the 39-mark multiple times, the bullish RSI saw a 22-point surge in the last day. Moreover, the +DI looked north and affirmed the bullish edge, but the ADX was on a downtrend and depicted a weak directional trend.

Dogecoin (DOGE)

Since hitting its nine-month low on 22 January, the meme coin recovered its previous losses by registering a 43.5% ROI and testing the $0.167-level.

This phase witnessed an ascending channel (yellow) on its 4-hour chart. While the $0.167-mark stood sturdy, DOGE saw a 13.4% pullback over the last week. Now, the immediate hurdle for the bulls stood near the $0.151-level.

At press time, DOGE traded at $0.1495. After heading into the oversold region, the RSI revived above the half-line and displayed a bullish bias. Any close above 54 would propel a retest of the $0.1515-level. To top it up, the AO marked higher peaks. Any close above the zero line would confirm a bullish twin peak rally.

Litecoin (LTC)

LTC’s previous 47.9% rally from its 13-month low halted near the 23.6% Fibonacci resistance. As a result, it lost over 15% of its value until 14 February.

Over the last day, LTC saw a nearly 7% gain and jumped above its 20 EMA (red) 50 EMA (cyan). The bulls flipped the vital $128-level from resistance to immediate support. Now the testing point for the bulls stood at the $133-mark.

At press time, LTC was trading at $130. The RSI crossed the 52-mark resistance as it looked north and displayed a bullish bias. Nevertheless, the ADX continued its slide downwards and, like AVAX, revealed a weak directional trend.