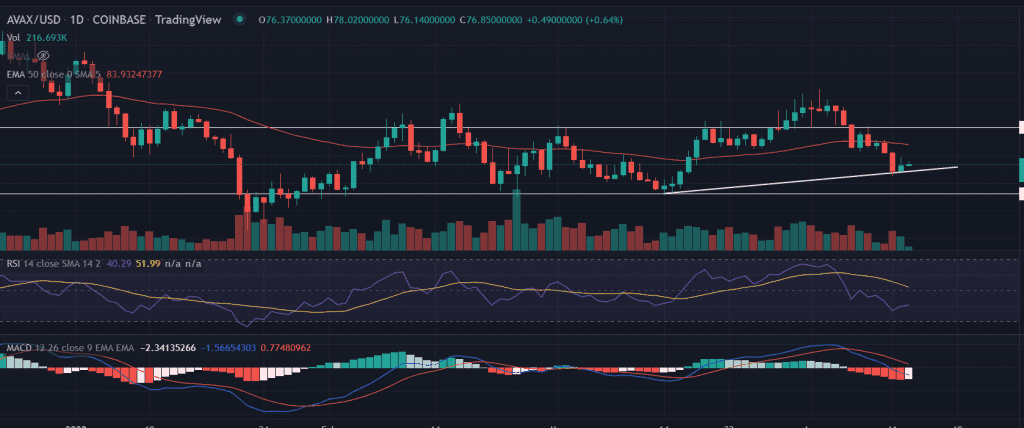

AVAX price treads water with no clear directional bias. The price sliced through a crucial support level near $85.0 in the past few sessions. Now, the recent downswing could find a stoppage that could result in a short-term bounce back.

- AVAX price remains muted on Wednesday with limited price action.

- A decisive break above the 50-day EMA would reverse the prevailing downtrend.

- However, a daily candlestick below $0.72 will ignore the bullish outlook.

AVAX price expects a bounce-back

On the daily chart, the AVAX price surged 46% from the lows of $65.56 made on March 14. However, the buyers lack the conviction to carry forward the gains beyond the swing highs of $104.0. The ascending trend line, which is extending from the mentioned level acts as a support for the bulls.

Now, a resurgence in the buying order would push the price upward toward the highs of April 10 at $85.67. Further, an extended buying would see the upside hurdle of $90.0.

An acceptance above the mentioned level would see an ascent of 22% from the above-mentioned level at $110.0

On the contrary, if the price breaks below the bearish slopping line it would invalidate the bullish outlook. In that case, the first downside target could be found at the horizontal support line at $66.16.

As of publication time, AVAX/USD is exchanging hands at $0.77, up 0.85% so far. The 10-largest cryptocurrency is holding the 24-hour trading volume at $804,653,709 as updated by CoinMarketCap.

Technical indicators:

RSI: The daily relative strength index slipped below the average line on April 4, and continued to move lower. The indicator hovers near the oversold zone.

MACD: The moving average convergence divergence shows a neutral stance. However, the indicator trades below the mid-line.