Avalanche total value locked (TVL) declined to new high lows in the third week of May due to the bearish trend of the market causing a decline in TVL on all blockchains.

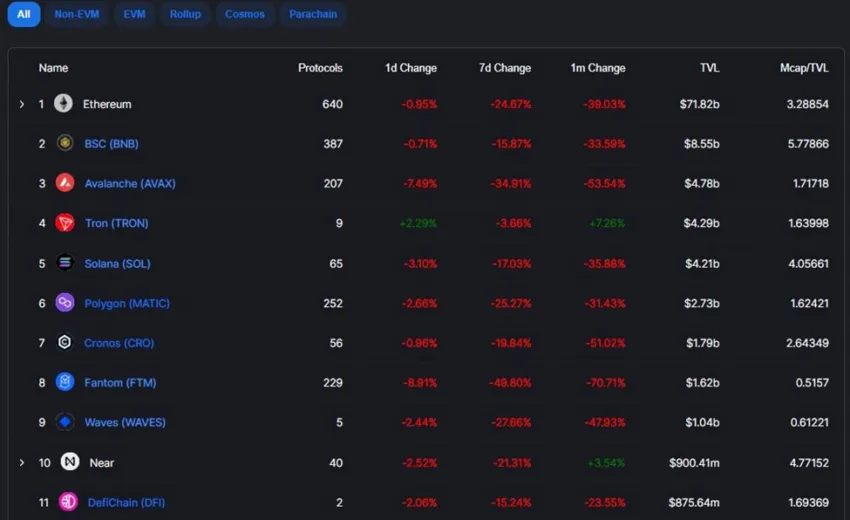

According to Be[In]Crypto Research, Avalanche has shed 59% in total value locked since the beginning of the year. On Jan 1, Avalanche had a TVL of around $11.7 billion, and this declined to approximately $4.77 billion on May 18.

Avalanche is an open, programmable smart contracts platform that facilitates the building of fast, low-cost, Solidity-compatible decentralized applications (dApps). Crypto projects employing the possibilities of Avalanche to build applications include Chainlink, Securitize, Injective Protocol, The Graph, Polyient Games, Trust Token, and Copper.

Aside from being an integral force in DeFi, Avalanche is one of the biggest NFT blockchains by sales volume.

Why the crash in TVL?

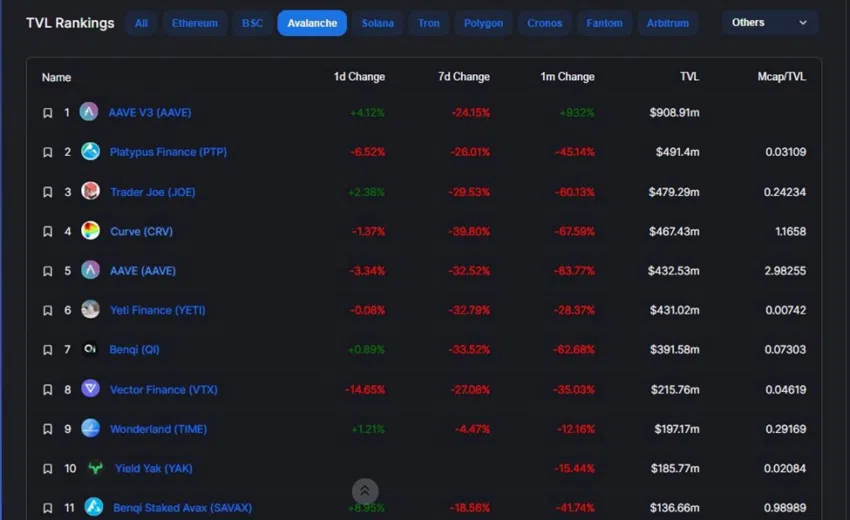

Avalanche TVL plunged to a 2022 low this week due to several decentralized applications in its ecosystem also tumbling.

Automated market maker (AMM) Platypus Finance, for example, has dipped by more than 45% in the last month, while open-source liquidity protocol Aave has also fallen by more than 83% within the same period.

Decentralized trading platform Trader Joe and exchange liquidity pool Curve have lost more than 60% and 70%, respectively, of their total values locked.

Other dApps that have contributed to the drop in total value locked include Yeti Finance, Benqi, Vector Finance, Wonderland, Yield Yak, and Benqi Staked Avax.

Despite crashing by $6.93 billion due to the aforementioned dApps, Avalanche still commands a higher TVL than TRON, Solana, Polygon, Cronos, Fantom, Waves, and Terra.

With that said, TVL is still behind Binance Smart Chain and Ethereum.

AVAX price reaction

AVAX opened the year with a trading price of $109.38. The coin reached a yearly high of $117.32 on Jan 2 and was exchanging hands for $30.92, as of writing.

Overall, this equates to a 71% loss in the price of AVAX since the start of the year.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.