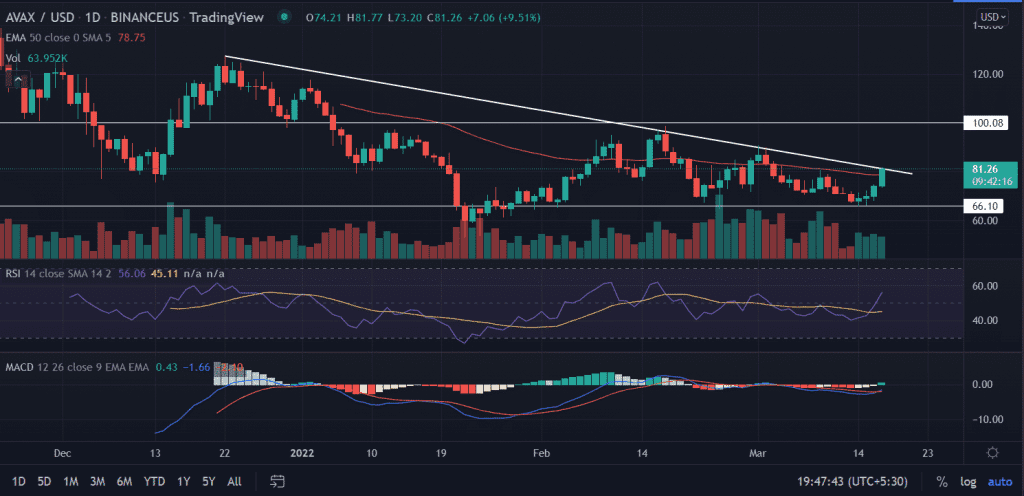

AVAX price extends the previous three session’s gains. The formation of a strong green candlestick indicates strength in the current upside price action. Sellers find reliable support at $0.66.

- AVAX price trades with significant gains on Thursday.

- A breakout above the descending trendline open the gates for $100.0

- A bullish setup is under formation.

AVAX price looks for bullish reversal

On the daily chart, the AVAX price action is set for further gains with a bullish formation. After taking multiple support at $66.0 for nearly two months the price once again attempts to break away the upside boundary at $80.00. The attempt is, however, successful as the price breached the 50-day Simple Moving Average (SMA) at $78.73. The recent technical set-up confirms the continuation of the bullish momentum.

An acceptance above $80.0 with rising volume shall revisit $90.0 as this is the immediate target with no in-between stoppage.

Furthermore, a resurgence in the buying pressure will bring the $100.0 horizontal resistance level into play.

On the flip side, if the price is not able to close above the descending trendline then it will turn out to be just a dad-cat bounce. On the moving downside, the interim support is located at $0.66.

AVAX’s price depreciated 55% from the highs of $127.40 made on December 22. In addition to that, the bearish slopping line is a constant hurdle for the bulls. The asset faces multiple rejections near the mentioned trendline, but the downside remained capped toward $66.0 since January 22.

Technical indicators:

RSI: The daily Relative Strength Index pierced sharply above the average line on March 16. This indicated a strong underlying bullish current.

MACD: The Moving Average Convergence Divergence attempted to cross above the midline with an impeding bullish momentum.