As the crypto market struggles to recover from the shakedown last week, let’s take a look at #10 on the top 10 crypto list. Avalanche [AVAX], sandwiched between Terra [LUNA] and Dogecoin [DOGE], was trading at $76.90 at press time. This was after slipping by 0.86% in a day but losing 12.03% of its value in the past week.

However, these numbers don’t quite do justice to the drama-filled first quarter Avalanche had in 2022 – and the hopes riding on it for the future.

Don’t take SNOW for an answer

Messari’s Q1 report on Avalanche told the story of a rising crypto asset and ecosystem which was experiencing both growth and stability after breaking through multiple all-time highs in the last quarter of 2021.

2/ Adoption continued as active addresses reached an all-time-high of 140,000 in January.

For perspective, Avalanche had more active users in the first week of January than in all of October 2021. pic.twitter.com/wzUbOawOU0

— James Trautman (@JamesTrautman_) April 12, 2022

In particular, Messari’s report repeatedly stressed the importance of subnets when it came to Avalanche’s ecosystem. Apart from the Ethereum Virtual Machine [EVM] subnet that would boost interoperability between Avalanche and Ethereum, the launch of GameFi subnets also triggered excitement and activity within the community. About one such subnet, the report stated,

“Crabada quickly passed 5,000 users…Daily transactions grew from 60,000 to over 400,000 over Q1, measured by transactions made to Crabada’s smart contracts.”

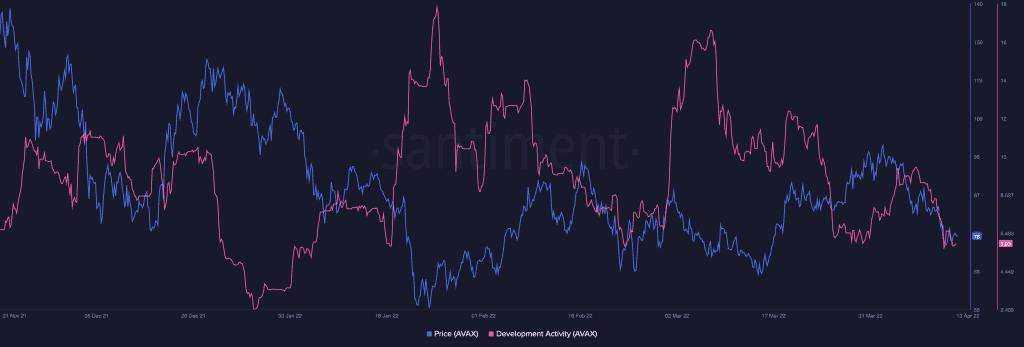

Keeping this in mind, it’s apt to look at Avalanche’s development activity to see how the metric is faring. According to Santiment, however, dev activity has been gradually falling since about early March.

January 2022 was a key month for Avalanche in terms of adoption, but now investors need to see when this ATH will be crossed.

Source: Santiment

All work and no play makes Jack a dull boy

No project can be perfect and Avalanche is no exception. One particular challenge was the ecosystem’s falling total value locked [TVL]. Messari’s report stated,

“While TVL on Avalanche experienced a slight decline, top DeFi protocols Aave, Benqi, and Trader Joe experienced TVL declines of 4%, 18%, and 20%, respectively. Their collective TVL declined by 12% — more than twice the total Avalanche DeFi ecosystem’s decline.”

At press time, Avalanche’s TVL had recovered from its January dip but was still below its levels achieved in 2021.

Source: Defi Llama

Most recently, Avalanche was making headlines as Bloomberg reported that Terra’s Luna Foundation Guard had plans to add $100 million in AVAX to its reserve for the TerraUSD [UST] stablecoin.

This is yet another milestone for the project, and one for investors to note since Terraform Labs co-founder Do Kwon reportedly picked AVAX due to its “user familiarity.”