Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

Bitcoin’s gains in the past few days have seen Axie Infinity rise in value as well. The longer-term outlook has not yet shifted to bullish, despite the strong bounce from $44.59. There remained levels of resistance and areas of supply for AXS to climb past overhead.

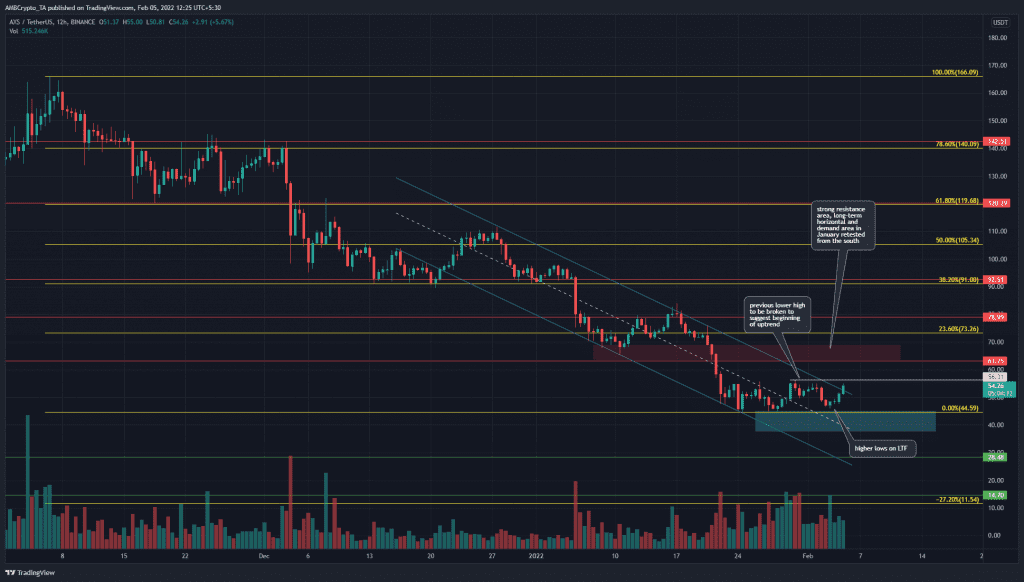

Fibonacci retracement lines were plotted based on AXS’s move from the swing high at $166 to the swing low at $44.59. On the lower timeframes (LTF), the price has made a higher low. Moreover, the price looked set to close a session above the descending channel that AXS has traded within since mid-December.

A break outside channels generally sees a decent retracement of the move within the channel. For AXS, the $56.31 represents the closest previous high, and a move above this level and retest as support would suggest that the market structure has flipped bullish for the near term.

Above $56.3, AXS has horizontal resistance at $63.25 and bears could eye the $64 area (red box) as a place to stack sell orders at.

Rationale

The RSI on the 12-hour chart was at the neutral 50 mark. Therefore, if it so occurred that the RSI retested neutral 50 from above in the coming days while AXS also retested $56.3 as support, a short-term move upward to $63 could be likely.

The Awesome Oscillator climbed from bearish territory toward the zero line to suggest that bearish momentum from the recent sell-off has been slowing down. The OBV did not make significant gains, although selling volume has been greater in recent weeks. That could change if the OBV continued to climb as it has in the past week.

The Chaikin Money Flow showed strong capital flow into the market in the past couple of weeks.

Conclusion

Bitcoin has climbed past $40.6k, and the next levels to watch out for lie at $42k, $44.4k, and $46.2k. It was not yet clear whether bulls are at the steering wheel once again, or whether bears have temporarily ceded the position as they bide their time waiting for the next junction where they could force a wave of intense selling. For AXS too, the next few weeks were beginning to appear bullish- but by no means has another bull run been sparked.