Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

Axie Infinity, the blockchain-based monster battle NFT game, soared in popularity in 2021. Its token, Axie Infinity Shard (AXS), also registered massive gains over the past year. However, like many altcoins before it, AXS faced relentless selling after making phenomenal gains.

Will AXS see any further downside? If it does dip too far, it might join the legions of altcoins before it which have never been able to recover back their previous worth in the market. Can AXS bulls steer away from this fate?

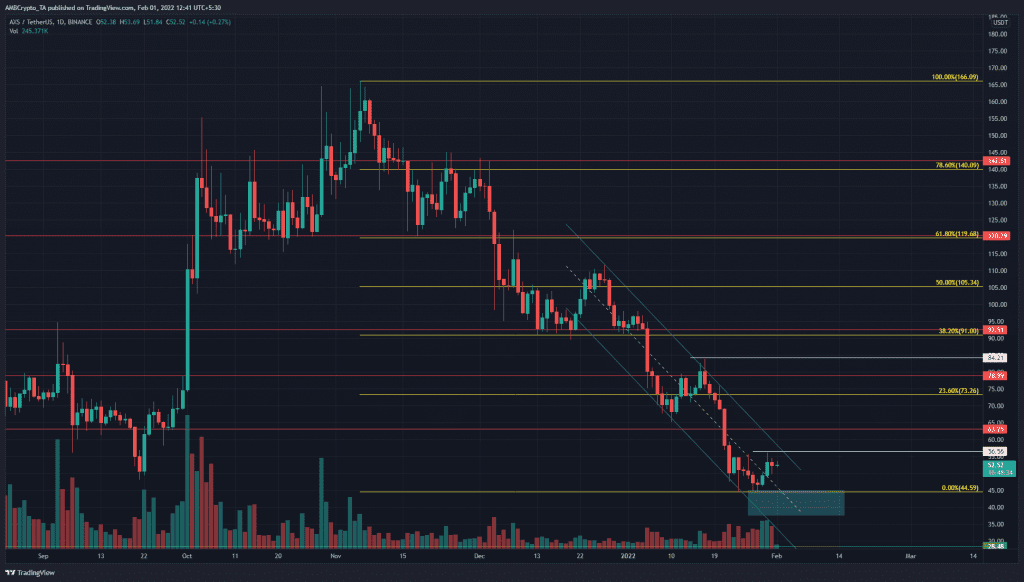

Source: AXS/USDT on TradingView

The $40-area (cyan box) is an area where demand has been seen in the past. In early August, this area was cemented as an area of demand, and in late September, the price also found strong demand at the $50-area.

Fibonacci retracement lines were drawn based on AXS’s drop from $166.09 to $44.59, and it showed $73.26 as the 23.6% retracement level for this move. Apart from this level, the lower highs formed at $56.56 and $84.21 on the daily timeframe represent levels of importance, especially the $56-level. If AXS can climb above this level and retest it bullishly, the market structure could flip bullish.

However, the descending channel (blue) remains unbroken, though equal lows have been formed at $44.59 on lower timeframes.

The longer-term trend remains bearish, and a move past $56 and $84 in the coming weeks or months would be needed to persuade risk-averse investors that AXS is on the path higher.

Rationale

Source: AXS/USDT on TradingView

The daily RSI presented a forlorn picture over the past two months as the neutral 50 level held as resolute resistance. The oversold territory has been visited regularly over the past month, while the CMF has also been below the -0.05-level for significant periods of time over the past few weeks.

This pointed to strong bearish momentum and selling pressure. The DMI showed a significant bearish trend in play as well, with both the ADX (yellow) and the -DI (red) above 20.

Conclusion

Market structure and momentum were bearish for AXS. On shorter timeframes, Bitcoin looked bullish and could climb as high as $40.6k and $42k. This could see a positive reaction from AXS as well. However, such a bounce would likely be for selling and not a buying opportunity.

A move past $56 would be a breakout from the descending channel, but rather than a bullish reversal, it would most likely be that the price of Axie Infinity would grab the liquidity at $63, before facing intense selling pressure once more.