BeInCrypto takes a look at the five projects that dumped the most last week in the crypto market, more specifically, from Oct. 14 to Oct. 21.

These are the worst-performing cryptocurrencies in the crypto market in the past week:

- Axie Infinity (AXS) price is down 22.12%

- EthereumPoW (ETHW) price is down 20.48%

- Terra Classic (LUNC) price is down 17.19%

- Ethereum Name Service (ENS) price is down 17.84

- Aptos (APT) price is down 15.76%

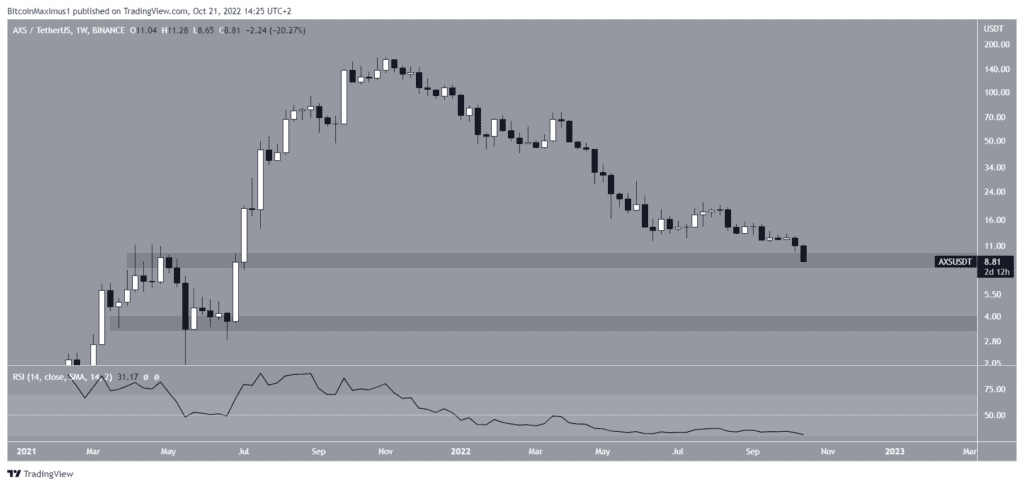

Axie Infinity AXS Price Prediction: Falls to New Yearly Low

The AXS price has been falling since reaching an all-time high price of $166.09 in Nov. 2021. The downward movement led to a low of $8.80 in Oct. 2021.

The low represents a new yearly price minimum. Additionally, it reached the $8.70 horizontal support area, which had previously not been reached since June 2021.

While the area is expected to initiate a bounce, the weekly RSI is still bearish, casting some doubt as to whether the bounce will occur.

A weekly close below this area would indicate that the AXS price could fall all the way to $3.70.

Conversely, a bounce and the creation of a long lower wick would be bullish signs that support a bottom formation.

EthereumPoW ETHW Price Prediction: Approaches Crucial Support

ETHW has been decreasing inside a descending parallel channel since reaching a high of $13.89 on Sept. 24.

While descending parallel channels usually contain corrective movements, there are no bullish reversal signs in place. Moreover, the price is trading inside the lower portion of the channel, reducing the possibility of a successful breakout.

The closest support area is $5.50. Whether the ETHW price breaks down below it or bounces will likely determine the direction of the future trend.

Terra Luna Classic LUNC Price Prediction: Completes Upwards Correction

LUNC completed an A-B-C corrective structure (black) between Sept. 25 and Oct. 2. The movement led to a high of $0.00037 before LUNC was rejected (red icon). Since the corrective structure moved upwards, this means that the underlying trend is downwards.

Since the Oct. 2 high, LUNC has been decreasing underneath a descending resistance line. The price has already decreased below the 0.618 Fib retracement support level and has not shown any bullish reversal signs.

As a result, a fall below $0.00020 seems to be the most likely scenario. A close above the $0.00037 area would invalidate this prediction in the crypto market.

Ethereum Name Service ENS Price Prediction: Deviates and Breaks Down

On Oct. 14, ENS reached a high of $20.37, seemingly breaking out from the $17.90 horizontal resistance area. However, the breakout turned out to be only a deviation (red circle), since ENS was not able to sustain its higher prices.

On Oct. 21, the ENS price fell below the $17.90 area once more. The area is now expected to provide resistance.

ENS is now at risk of breaking down from an ascending support line that has been in place since Aug. 29. If it does, it could quickly fall toward $12.

Conversely, a reclaim of the $17.90 area would mean that the trend is still bullish in this crypto market.

Aptos APT Price Prediction: This Crypto Struggles After Listing

Since its much-maligned launch on Oct. 18, the APT price has been trading inside a symmetrical triangle. On Oct. 21, it broke down from the triangle and was validated as resistance (red icon).

This is a sign that lower prices are expected within this crypto market. If the APT price falls below $6.60, the rate of the decrease could accelerate greatly.

For the latest BeInCrypto Bitcoin (BTC) and crypto market analysis, click here

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.