One of the most well-known play-to-earn games, Axie Infinity, may soon experience massive sell pressure on its native token, AXS.

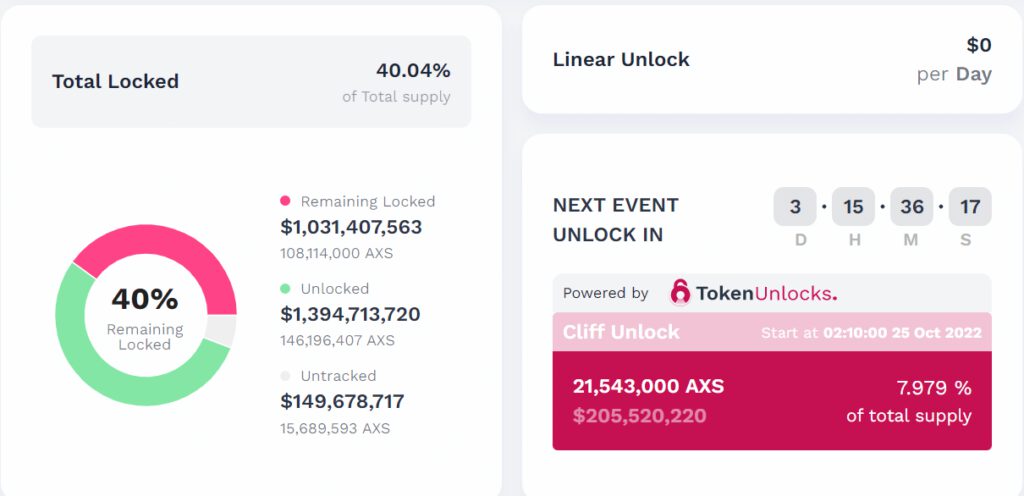

Approximately 21.5 million tokens, or 8% of the entire supply, would become available after the vesting period concludes around 24 October, as stated by TokenUnlocks. In total, 40% of AXS tokens worth more than $1 billion were still locked, per the statistics.

Here’s AMBCrypto’s Price Prediction for Axie Infinity(AXS) for 2022-2023

The unlock process

Early investors and insiders are expected to retain their assets for a minimum amount of agreed time throughout a vesting period.

This is in part to prevent them from cashing out just as new investors are coming in and causing a dump.

When the vesting period is over, investors can sell their shares, which occasionally causes strong sell pressure and a downward trend in asset prices.

TokenUnlocks estimates showed that the developer team ($57 million), advisors ($25 million), and early investors in a private sale round ($20 million) were going to receive nearly half of the AXS tokens that will shortly be unlocked.

Theoretically, these holders could opt to sell tokens in order to make a profit.

The Chief Operating Officer (COO) of Axie Infinity and co-founder of Sky Mavis, Aleksander Larsen, claimed that this unlock would not necessarily have an impact on AXS.

This was because they operate under a different issuance schedule that was more adaptable and can be customized to user numbers. In his Twitter post, he also added that Sky Mavis, the blockchain game studio that created Axie, would not be selling their own AXS once it acquired it.

AXS dives

The price decline of the AXS token was pretty apparent on the daily timeframe chart that was observed. The price dropped by over 6% from the end of the previous trading period.

As of the time of writing, it had lost more than 8% of its value during the current trading period. The asset had also been seeing a lot of selling volume recently, according to the volume indicator.

With its line below the zero line in the daily timeframe, the Relative Strength Index (RSI) indicated that the price trend was bearish.

In addition to the volume indicator that indicated sell pressure, the RSI had also entered the oversold territory. There will be a correction in the asset’s price, although when exactly is unknown.

However, if the selling pressure remains strong, a further decline is possible. After initially finding support between $10.8 and $9.8, the price eventually settled at $8.

Recent reports and data showed that the typical monthly number of players on Axie Infinity had declined dramatically.

This underlines the fact of how the once-popular NFT game was now on the decline. The game’s popularity and the value of AXS could both benefit from the completion of new developments and the introduction of further features.