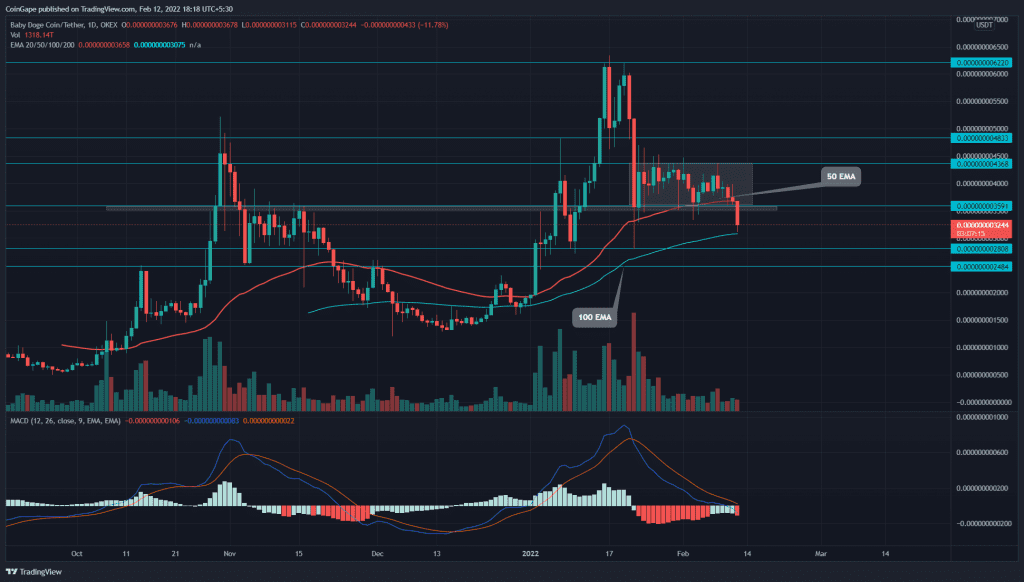

Despite the fundamental perks the BabyDoge showed regarding its entry to Metaverse and recent achievement of 1.4 Million Holders according to BscScan, the technical chart indicates a red flag for this memecoin. Over the past few weeks, the token price has fluctuated in a narrow range, which today saw a bearish breakdown from its $0.00000000359 support. Can this fallout lead to an extended correction?

Key technical points:

- The BabyDoge buyers plunge below the 20 and 50-DAY EMA

- The daily-MACD indicator’s lines are poised to enter the bearish territory

- The 24-hour trading volume in the BabyDoge token is $12.8 Million, indicating a 15.6% fall.

Source-Tradingview

On January 21st, the BabyDoge price took a hard turn from the $0.00000000622 resistance and sank right to the $0.00000000359 support. In just two days, the memecoin registered a 44.2% loss and started hovering above the bottom support.

For the next three weeks, the BabyDoge buyers defended the $0.00000000359 support, resulting in a minor conditional phase. This confined range, stretching from the mentioned support and $0.00000000359 resistance, provided an excellent trading setup once the coin price breached either of these levels.

The MACD indicator shows the fast and slow lines are on the verge of dropping below the neutral zone(0.00), offering an additional confirmation for sellers.

BabyDoge Price Could Sink To $0.0000000028 Mark

Source- Tradingview

Today, the bear finally took the lead and breached $0.00000000359 support, with a long decisive bearish candle. The token price is currently trading a $0.00000000323 mark, indicating an intraday loss of 12%.

The buyers might retest the breakdown level to validate the sufficient supply. If sellers could sustain this fallout, the memecoin would sink to January 22nd low($0.0000000028) and $$0.00000000248.

Moreover, the recent downfall plummeted the token price below the 20-and-100 EMA, providing an extra edge to coin sellers.