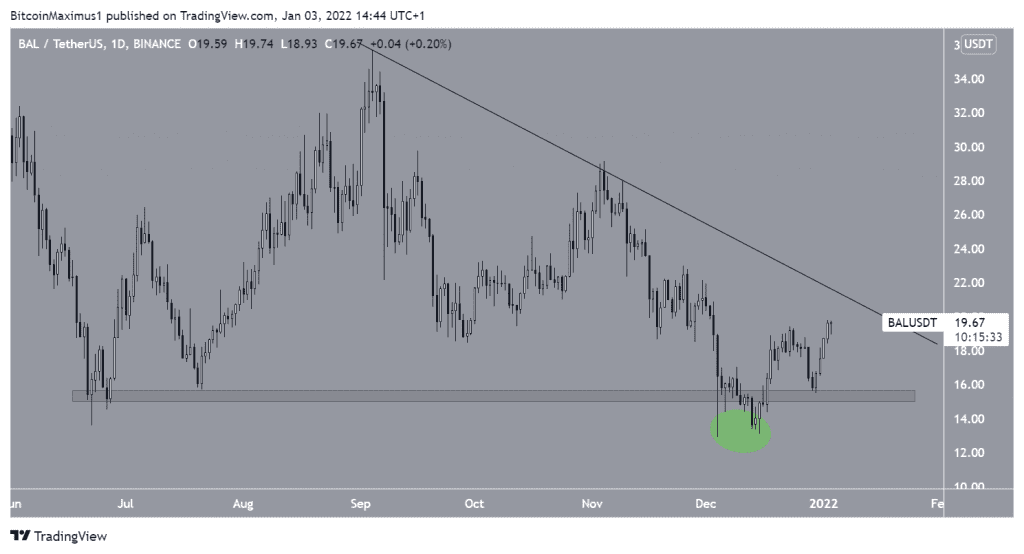

Balancer (BAL) has reclaimed a crucial horizontal level and is likely to accelerate its rate of increase once it breaks out from the current diagonal resistance.

BAL has been decreasing alongside a descending resistance line since reaching a high of $35.72 on Sept 4. The downward movement led to a low of $12.89 on Dec 14.

However, the token has been moving upwards since and increased above the $15.4 horizontal area on Dec 17. This was a very bullish development, since it rendered the previous decrease as a deviation only. Such deviations are often followed by significant movements in the other direction.

BAL has nearly reached the descending resistance line which is currently at $20.50.

Ongoing bounce

Technical indicators for BAL in the daily time-frame support the continuation of the upward movement. The RSI and MACD are both increasing, and the former has even crossed above 50 (green icon). This is a bullish sign that very often precedes significant upwards movements.

The main resistance area is between $27-$29. It is created by the 0.618 Fib retracement resistance level (white) and a horizontal resistance area.

Once BAL breaks out from the current descending resistance line, it is likely to move towards this level.

BAL wave count

Cryptocurrency analyst @CryptoCapo_ tweeted a BAL Chart, stating that the correction is complete, and the token is expected to increase towards $18 and potentially $33.

While the long-term count does not seem definitively clear, the decrease from Sept 4 to Dec 4 is likely a corrective pattern. This means that an upward movement is expected.

If the outlined decrease was part of a short-term correction, BAL would be expected to increase to at least $34, giving waves A:C a 1:1 ratio.

If however the drop completed a longer-term correction, as outlined in the tweet, BAL would increase towards a new all-time high price.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.