Some regulatory bodies worldwide are becoming more oppressive and hostile towards Bitcoin and digital assets. This has been exacerbated by the Russian invasion of Ukraine, as policymakers mistakenly think that the former will suddenly switch to using cryptocurrencies.

Other watchdogs are growing concerned about the excessive energy demands of proof-of-work Bitcoin mining (though it still uses less than all of the fridges and TVs in the United States alone).

Banning Bitcoin a Big Mistake

The European Union is preparing to vote on a Markets in Crypto Assets (MiCA) framework today that could result in heavy restrictions on PoW mining.

According to the draft law, crypto assets traded in Europe “shall be subject to minimum environmental sustainability standards and set up and maintain a phased rollout plan to ensure compliance.” On March 13, Bloomberg reported that new law could be a de-facto ban of Bitcoin and Ethereum (still PoW) in the EU.

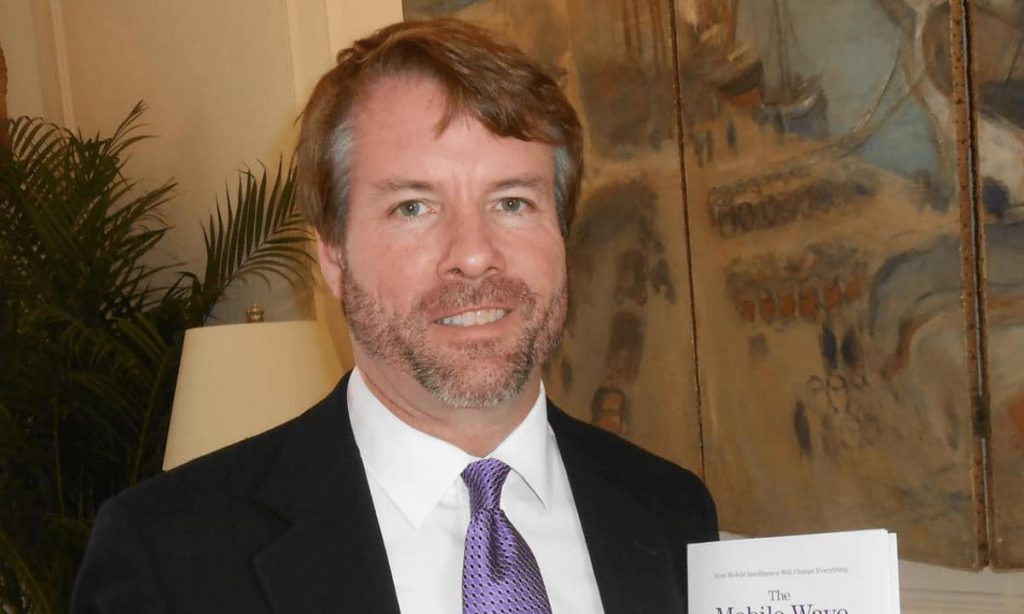

On Sunday, Saylor tweeted that proof-of-stake assets will be deemed securities which is why proof-of-work is still highly relevant and needed:

“The only settled method to create digital property is via Proof-of-Work. Non-energy based crypto approaches like Proof-of-Stake must be deemed to be securities until proven otherwise. Banning digital property would be a trillion dollar mistake.”

Saylor, who has welcomed productive regulations, added that Bitcoin is digital property and the “most cost-efficient method we have yet discovered for converting energy into prosperity.” MicroStrategy is the largest corporate holder of BTC with 125,051 coins worth around $4.8 billion at current prices.

Europe comprises around 12-14% of the total BTC mining hash power according to August 2021 figures from Cambridge University. Ireland and Germany have the lion’s share of that total so global hash rates are unlikely to be impacted.

What could happen is a wider ban or heavy-handed regulation, which could harm the markets and the industry. Mining operations have already seen major migration from China to North America in recent years and there could be more to come.

BTC Price Volatility

As if in anticipation of more bad news today, BTC had lost 2% in a fall below $38,000 hours ago.

However, the situation changed once Elon Musk reaffirmed his support for bitcoin, saying earlier that he will not sell his cryptocurrency holdings. BTC jumped by about $1,000 and currently sits around $39,000. The billionaire also outlined the assets that should perform well while inflation skyrockets.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.