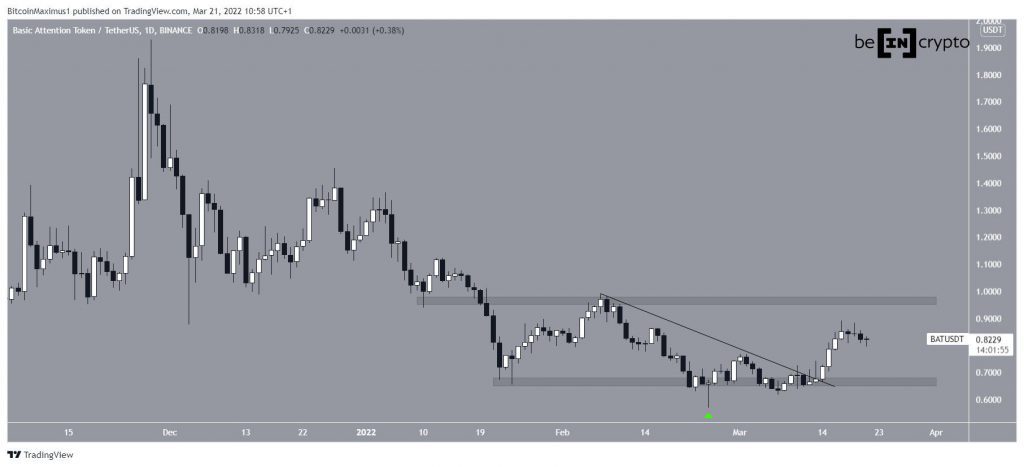

Basic Attention Token (BAT) has been increasing since Feb 24 and broke out from its main resistance line on March 14. The decrease was preceded by bullish signs in both the RSI and MACD.

BAT has been falling since reaching an all-time high price of $1.92 on Nov 28. So far, the downward movement led to a low of $0.57 on Feb 24.

However, the price reversed trend the same day and created a long lower wick (green icon). It has been moving upwards since.

On March 14, it broke out from a descending resistance line marking an end to the consolidation above the $0.67 support area that has been ongoing since Jan 22.

If the upward movement continues, the next closest resistance area is at $0.96.

BAT creates bullish pattern

A closer look at the movement shows that BTC broke out after creating a triple bottom. The triple bottom is considered a bullish pattern and often leads to bullish trend reversals, as was the case here.

Furthermore, the pattern was combined with a very significant bullish divergence (green lines) in both the RSI and MACD. Such divergences are also associated with bullish trend reversals.

Therefore, the daily time-frame suggests that BAT will likely reach the $0.96 resistance area.

Wave count analysis

Cryptocurrency trader @TheTradingHubb tweeted a chart of BAT, and suggested that the correction may be complete.

It is possible that the entire BAT movement since March 9 is part of an A-B-C corrective structure. In it, waves A:C have had an almost exactly 1:1 ratio.

Wave C likely developed into an ending diagonal, as evident by its wedge shape. Diagonals are usually swiftly retraced, so a rapid upward movement would be expected to develop if this is the correct count.

In order for the current increase to be a bullish reversal, BAT has to hold on above its March 1 highs (red line), and break out from the current ascending parallel channel.

A decrease below the line would suggest that the increase is corrective instead and will not lead to new highs.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.