The BAT/USDT pair reaches a potential reversal point with the double bottom formation. However, the pattern breakout must sustain the rise in trading volume for bullish commitment. However, the long-coming correction brings multiple operating forces to keep the trend going. Will the bullish intentions overpower formidable selling pressure?

Key points:

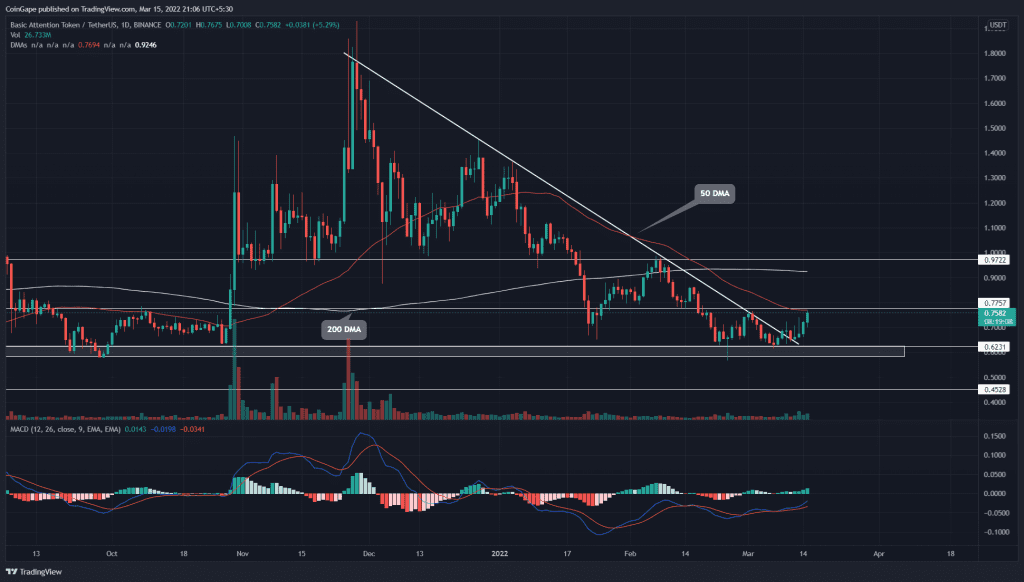

- A sudden spike in volume activity bolsters the breakout from the $0.75 resistance

- The intraday trading volume in the BAT token is $947.5 Million, indicating a 58.91% gain.

Source- Tradingview

Since November 21′, the BAT traders have been selling on downtrend pullbacks, using the descending trendline. The downtrend marked its current lower low at $0.62, indicating a 67% loss from the All-Time High($1.93).

The altcoin rebounded twice from $0.62 yearly support, indicating a strong accumulation zone for traders. The follow-up rally managed to breach the dynamic resistance on March 9th, providing the first recovery sign.

Sustaining through the restest phase, the buyers drive the altcoin to its nearest resistance level of $0.75, registering an 18.6% gain. The coin chart revealed a double bottom pattern in the daily chart, encouraging a bullish breakout.

If BAT price breach and sustain above the $0.75 resistance, the potential rally could hit the $1 mark, following the $0.88 breakout.

On the other hand, if sellers rejected the altcoin from 50 DMA resistance, the coin price would continue to resonate within a $0.77 and $0.62 range.

Technical indicator

The crucial EMA levels(20, 50, 100, and 200) strive to achieve the bearish alignment with the 100 and 200-day EMA crossover. However, the potential double bottom breakout could result in a trend reversal and sabotage the bearish intentions.

The MACD and signal lines rise higher in a bullish alignment with the lack of spread, keeping the lines under bearish tension. However, the lines passing over the zero line will boost the bullish drive.

- Resistance levels- $0.77, and $1

- Support levels are $0.62 and $0.45