Apecoin [APE], and its supporting NFT collection, Bored Ape Yacht Club [BAYC] have not had the best of times lately. In fact APE is largely down from its all-time high (ATH).

In fact, BAYC sales volume has been in the red, giving way for CryptoPunk to surpass it in the leading spot.

However, it looks like it is celebration time for both APE holders and the BAYC community. According to CoinMarketCap, APE’s 24-hour price was at a 14.15% increase from 27 July.

This rise represents its highest single–day increase between the whole of June and July. At press time, APE was changing wallets at $6.54.

A bonding trend

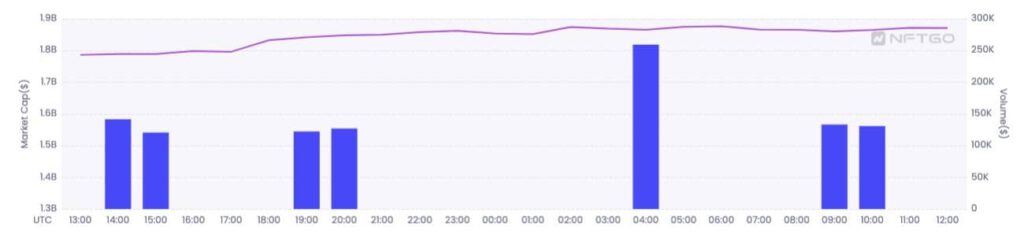

Similarly, BAYC surged in 24-hour trading volume. At the time of this writing, NFTGo reported a 9.64% increase, valued at $1.03 million.

Following its uptick is also the BAYC floor price which picked up a 0.98% rise with the minimum worth at 80.73 ETH.

Before now, BAYC had gone on so many lows. In the past seven days, its market cap reduced 4.15% to $1.87 billion. Also, its 30-day volume was down 42.56%.

Now, the recent boom may be a breath of fresh air for the NFT holders.

In APE’s case, the 24-hour volume increased massively. The rise has also been vital to the price increase. At press time, it was a 72.82% increase to $715.63. In line with the uptick, the amount of addresses who bought NFTs within the APE ecosystem also boomed, according to Santiment data.

These metrics suggest that APE could sustain its bullish momentum for the time being. It might, however, be too early to conclude. This now leads to checking what the technical indicators project.

Price analysis

The four-hour price chart showed that APE is still solid. This is because the 20 EMA remains above the 50 EMA.

Also, the Relative Strength Index (RSI) seems to have maintained the same momentum. At press time, it was at 60.52. Thus, indicating that the buyer calls were solid than the sellers.

Hence, both APE investors and BAYC HODLers may have a prolonged season of profits.

However, reaching their all-time high (ATH) may seem extremely difficult as the crypto and NFT market have refused to hit their highest points.

Investors should also note that there are few signs of selling from the indicators’ perspective.