Ethereum, the largest altcoin has a massive ecosystem of decentralized finance use cases with rapidly growing adoption. More institutional investors are seeing ether as a store of value. As per a Coinbase’s report, a growing number of its institutional clients have taken positions in ether, the native currency of the Ethereum network, for its strong returns. Surprisingly, these clients predominantly bought bitcoin in 2020.

ETH vs banks

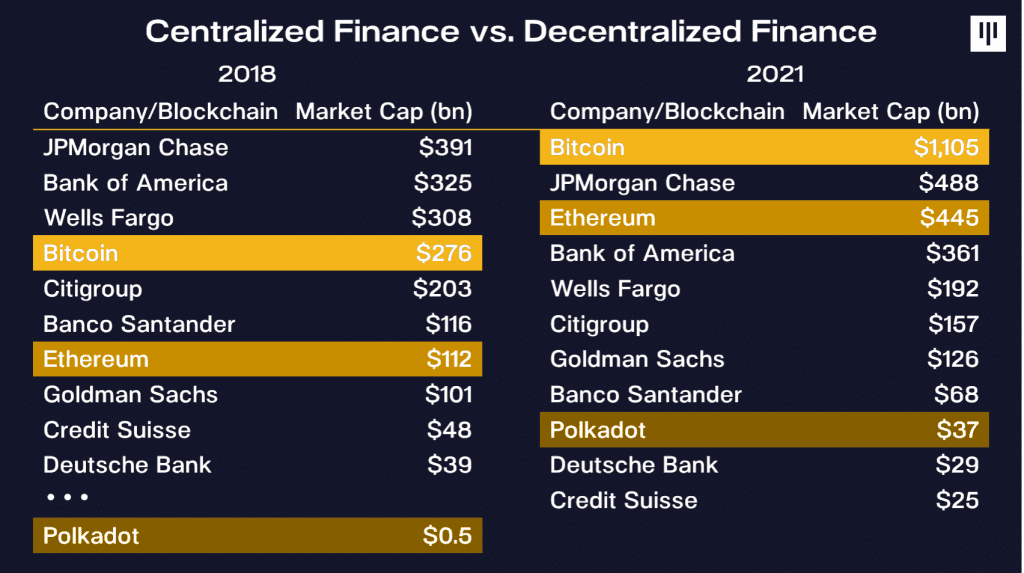

The grip centralized finance companies have on the world’s population is waning. Ethereum – the largest platform for decentralized finance – is now worth more than every bank except JP Morgan Chase. Consider the table below – it provides the sheer growth of ETH and its ecosystem.

Source: Pantera Capital

Although, here’s the latest development that could give ETH the push it needs. A slight push that just might help ETH overtake JP Morgan Chase.

More adoption

One of the largest banks in Europe has announced that it is going to widen its cryptocurrency trading service offering by adding Ethereum to its portfolio. Banco Bilbao Vizcaya Argentaria or BBVA – Switzerland becomes the first traditional bank in Europe to incorporate Ether into its service. The private banking clients of BBVA Switzerland will be able to manage Bitcoin and Ethereum on its platform.

For context, earlier this June, BBVA (Spain’s second-largest bank) began Bitcoin trading for all private banking clients interested in crypto assets.

Fast forward now, the private banking clients of BBVA Switzerland will be able to manage Bitcoin and Ethereum on its platform. Moreover, customers with a New Gen account will be able to access BTC and ETH. Ethereum and Bitcoin are available on the BBVA app along with other traditional investments.

The said institution has witnessed a substantial increase in interest from its clients. On the same line, Alfonso Gómez, CEO of BBVA Switzerland stated:

“We decided to add ether to our crypto asset ‘wallet’ because, together with Bitcoin, they are the protocols that spark the most interest among investors, while also offering all the guarantees to comply with regulation.”

The inclusion of ETH is somewhat justified here. As the greatest demand came from investors who want to diversify their portfolios. Ranging from individual customers and family offices to institutional investors.

BBVA Switzerland is also going to continue expanding its offering of digital assets in the upcoming months.

The official press release asserted:

“With this innovative offer, BBVA has positioned itself as a leading bank in the adoption of blockchain technology, thus making it easier for its customers to invest in this new digital world.”

The road ahead

BBVA is offering this new service in Switzerland as it has a very advanced blockchain ecosystem, with clear regulation and high level of adoption of these digital assets. Their expansion to new countries or other types of customers will depend on whether the markets meet the right conditions in terms of maturity, demand and regulation.

Overall, the market cap of digital currencies increased by almost 200% in 2021. It won’t be a surprise to find more banking institutions jumping into this pool.