It is definitely a crypto bear market when the mainstream media is awash with catastrophic price crash predictions such as the most recent one for bitcoin from Guggenheim’s Scott Minerd.

Guggenheim Partners’ Chief Investment Officer Scott Minerd is back with his bearish predictions claiming bitcoin prices could crash all the way down to $8,000, a level it has not seen for two years.

Not only did he suggest that BTC will crash that hard, but he also said that the current market has become a “bunch of yahoos,” presumably in reference to the Terra ecosystem fiasco. The comments came during Bloomberg Television interview from the World Economic Forum in Davos.

The crypto derision continued with him stating “everything is suspect” before adding:

“No one has cracked the paradigm in crypto. We have 19,000 digital currencies … most of them are junk.”

The comments mark a complete U-turn from Minerd who just last year said that a fair value for BTC would be $400,000 to $600,000.

Guggenheim bought bitcoin at around $20,000 and sold it at $40,000 according to the report which added that the firm no longer holds any of the asset.

An unlikely scenario

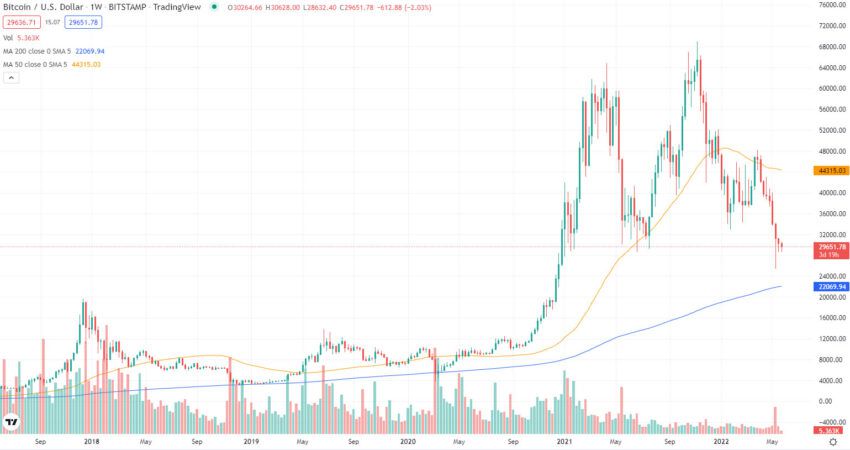

History usually rhymes with crypto market cycles and the previous two have seen corrections of just over 80% from cycle peak to bear market trough. If history rhymes with the current cycle, bitcoin prices could realistically fall to around $12K to $14K following a correction of similar magnitude.

Minerd’s gloomy outlook would be a correction of more than 88%, which has not happened in the previous two market cycles. The last peak to trough fall was 84% in 2018, as was the one in 2014.

Such a dramatic fall would mean that major corporate holders of bitcoin such as MicroStrategy and Tesla selling their stashes at a massive loss. Between them, they hold 172,418 BTC worth more than $5 billion according to Bitcoin Treasuries. It could also occur if El Salvador started liquidating its BTC treasury at a loss.

This is unlikely to happen as these entities believe strongly in the asset and are likely to hold on to it and even accumulate more in anticipation of the next bull cycle. Selling at a major loss would not be a smart move by a CEO or President.

More pain for bitcoin

The current correction stands at 57% as BTC has just dropped below $30K once again on Wednesday and has failed to reclaim it during the Thursday morning Asian trading session.

One major level of support, which has been held during previous bear cycles, is the 200-week moving average. This is currently at the $22K price level according to Tradingview so that could be where things are heading in the next couple of months. However, a fall to this technical indicator would be a correction of 68%.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.