After a three-month winter, the crypto market saw a return from January’s floor: the Bitcoin price has found support above $40,000, up more than 20% from the lows set in late January.

Following the recovery, the price of $MX is now rising and could accelerate further above the $2 resistant zone. $MX is the native token of the crypto trading platform MEXC Global.

A slowdown of the global economy and expectations of increasing interest rates mark a period of growing uncertainty in the financial markets. As MEXC Global works to expand to more markets and businesses this year, the platform is making efforts to prove $MX has the power to be a strong long-term hold in uncertain times.

Brand Efforts and Ambitions

Over the past few months, the MEXC team has been particularly active. In October, MEXC Global strategically partnered with Bybit and launched a joint launchpad to promote top-tier projects. In November, MEXC Pioneer launched with a $100M growth fund, which supported projects like Solana, Polygon, Avalanche and Algorand in their early days. As of the turn of the year, MEXC announced its sponsorship of Bitcoin 2022, the biggest event in the blockchain industry.

As global operations grow quickly, more marketing campaigns are planned to win the attention of traders globally.

In November, MEXC won the title of the best crypto exchange in Asia at the Crypto Expo Dubai 2021. The accolade places MEXC as the best crypto trading platform in Asia, and demonstrates the strength of its global marketing strategy and ambitions to adapt to changing markets.

Winning the CEX Competition

According to Coinmarketcap, MEXC boasts more than $500 million trading volume every day and has a growing user base in more than 200 countries.

Evidence of its fast growth is the diversified portfolio and increasingly more initial listing tokens. There are now 1400+ tokens listed on MEXC, which gives investors more choice in finding new tokens with investment potential.

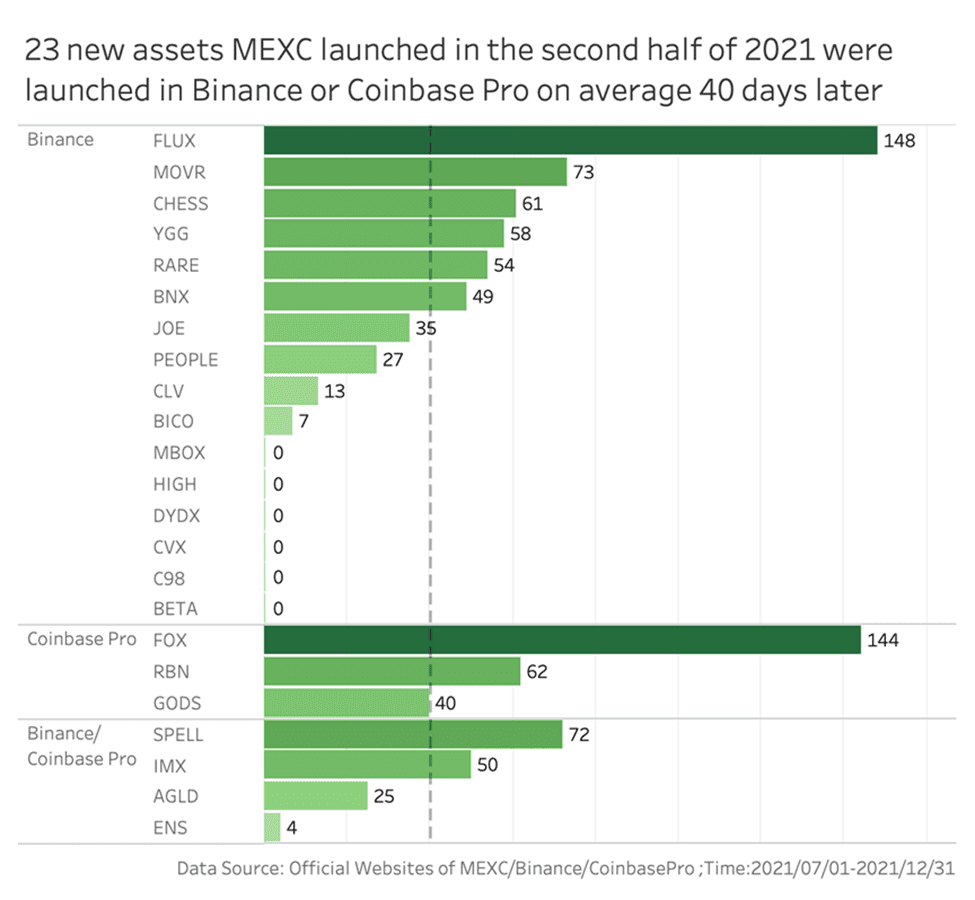

Research shows of the 300 new assets launched in the second half of 2021 on MEXC, 29 were also listed on Binance and Coinbase Pro, with 23 of them IEO on MEXC and then listed on Binance and Coinbase Pro.

It is recognized the more exchanges on which an asset is listed, the better its market recognition as a high-quality asset. In this regard, numerous high-quality assets were originally listed on MEXC, and it has exceeded Binance and Coinbase in terms of asset selection and IEO speed, making MEXC stand out among centralized exchanges. MEXC is ranked #16 at CoinGecko, and is expected to grow even further this year.

Outperforming All the Way in Bulls and Bears

$MX has progressively gained in value since its introduction in 2018, and hit an all-time high of $3.7 last November, giving early investors a 400x return.

As investors expect monetary policy to tighten this year, market sentiment toward cryptocurrencies looks to be shifting. In other words, 2022 could mark another crypto winter.

It’s difficult to anticipate which of the 17,000+ cryptocurrencies will recover the fastest or rise the most. However, certain tokens still remain competitive and performed in recent weeks. $MX is definitely on the watchlist, despite the shift to a mostly risk-off environment.

At the time of writing, $MX token was up by 4.5% to $1.7. The first key resistance level will be January’s high around $2. A breakout from $2 levels would bring December’s high of $2.5 per token and November’s all-time high of$3.7 into play.

Disclaimer: Any information written in this press release does not constitute investment advice. CoinQuora does not, and will not endorse any information on any company or individual on this page. Readers are encouraged to make their own research and make any actions based on their own findings and not from any content written in this press release. CoinQuora is and will not be responsible for any damage or loss caused directly or indirectly by the use of any content, product, or service mentioned in this press release.