The crypto market is currently experiencing a downturn that has seen the value of crypto assets drop significantly, but some assets are experiencing a higher level of FUD compared to others.

Major caps are taking a beating in the recent market conditions, with a particular look at Bitcoin (BTC), Binance Coin (BNB), Chainlink (LINK), and Dogecoin (DOGE). These majors have experienced a high level of fear, uncertainty, and doubt (FUD) that could position them for breakouts, Santiment claims. The crypto market intelligence platform indicates that sentiment surrounding these large caps has experienced the most fear, uncertainty, and doubt within the market. Santiment explains the “Crowd has become extremely negative as top cap prices have failed to rebound.” The 2022 bear market has offered little respite to investors and holders, with Bitcoin dropping to new yearly lows as buyers begin to lose hope of a market recovery anytime soon.

Bear market wreaking havoc on prices

The ongoing bear market continues to play a huge part in price decreases across the industry. However, it seems that major caps are suffering the most as holders and community members begin to question if there is more blood in store for the market.

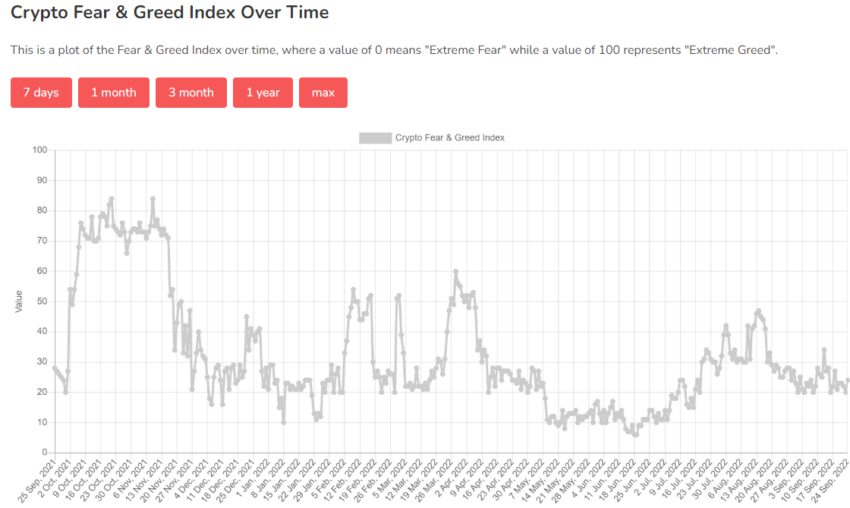

According to the Fear & Greed Index, the current market sentiment remains relatively unchanged compared to last month. The current sentiment sits at 24 out of 100, putting the current sentiment as “Extreme Fear.” The index has only hit a high of 60 in 2022. Compared to 2021, when it hit 95 in Feb, and 84 in Oct.

Binance Coin (BNB)

BNB is currently down 59% from its all-time high, but the asset is also one of the few major cap tokens with positive price performance in the last 24 hours. It is up 2.4% over this period.

Notably, the BNB/BTC pair is currently at an all-time high, meaning that BNB is trading at its highest price against BTC.

Dogecoin (DOGE)

DOGE is another token that might be set for a breakout. Following the Ethereum merge, the meme coin is the second largest PoW token and has recently seen increased interest from whales.

In the past week, it attracted six whales who bought 620 million DOGE. Over the past 24 hours, its price has increased by 7.8% against the dollar to trade at $0.0649. Against BTC, it is up 8.9%.

Dogecoin users may soon have access to Ethereum smart contracts as the bridge between the two networks is close to completion. Besides, Vitalik Buterin hopes that the leading meme token moves to the PoS consensus soon.

Chainlink (LINK)

LINK has also trended upward despite the significant bearish market. It is also up 7.9% in the past 24 hours and now trades at $7.6.

Since it dropped to $6.50, it has found support and has a bullish outlook with its V-shaped recovery. It’s now pushing to reach the $8.15 highs from where it lost support.

An analysis of its price suggests this is possible. IntoTheBlock’s IOMAP model Insights show that over 7,500 addresses bought 290 million tokens when trading between $6.63 and $6.83.

This group of investors would likely hold their positions with the hope that the price could go higher. Santiment also reported that new investors were entering the market as addresses that hold between 10,000 to 100,000 tokens increased from 2,852 to 3,015 on September 13.

Bitcoin (BTC)

Meanwhile, Bitcoin is the only cryptocurrency out of the four that has had a negative price performance in the last 24 hours.

According to analysts, if Bitcoin’s price continues to decline, the next support zone might be in the $14,000 – $16,000 range.

However, if the asset is able to buck the trend and trade above the $20,000 range, it might meet resistance at the $20,300 – $20,600 level. After that, the next resistance is $22,800.

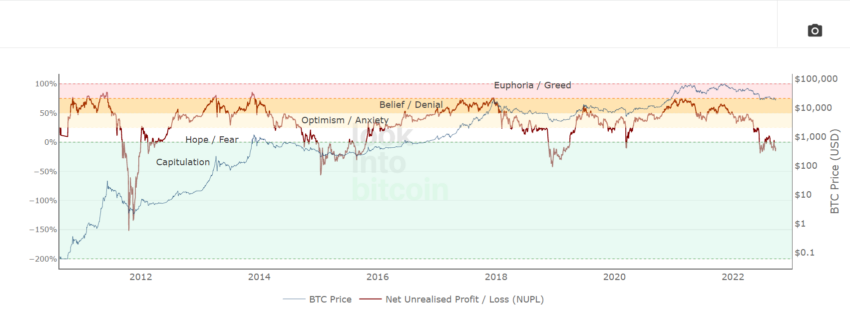

NUPL indicates market capitulation

Looking at the current Net Unrealized Profit/Loss (NUPL) statistics, it is evident that the current market climate is in a state of capitulation following a pro-longed bear market. NUPL represents on-chain data that shows if the market is in a state of profit or loss. This is calculated by dividing relative unrealized profits by relative unrealized losses. As long as the chart is under zero, the climate is currently in a state of capitulation. Currently, the NUPL is -10% at the time of writing.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.