Bitcoin [BTC] continues to surprise investors with new movements every day as the coin has been hovering near the $25K mark.

The most interesting movement seen in BTC is the drawdown in the coin’s circulation lately.

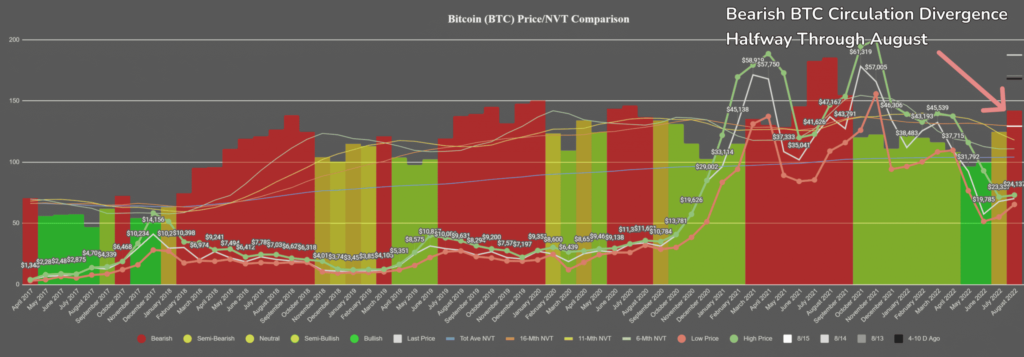

According to data from Santiment, the king coin followed a healthy circulation rate from October 2021 running into June 2022.

Even so, the price rebound in July coincided with this decrease in BTC’s circulation.

However, price reversals as seen in July and August 2022 led to a jump in the circulation as the “fear of missing out” on accumulating BTC was evident.

This was also aided by the willingness of previous sellers to begin trading again.

It is also possible that these reversals were not strong enough to create a demand. The other obstacle can be the persistent inflation fears that continue to hamper BTC trading.

In this regard, the analytic firm Santiment stated,

“August is showing the first bearish divergence in circulation vs. market cap, since September 2021. Until this improves, a swift rebound to $30k would be a bit surprising.”

Go with the flow

There has also been a change in the whale accumulation along two key lines in the crypto market.

Bitcoin and Tether whales are continuing to hold a low supply compared to their supplies earlier in 2022.

Addresses holding between 100 to 10K BTC are in possession of 46.1% of the overall supply as compared to 49.5% (ATH) over 10 months ago.

However, there is a change among the Tether whale holdings as a minor increase has been witnessed.

Addresses holding between 100K and 10 million USDT have added 0.6% of Tether’s supply back to their wallets.

Additionally, they have a long way to go towards accumulating 13% of the supply that they dumped last year.

There has been an increase in the FUD sentiment among traders which has led to a price rise since July.

In the past 12 out of 14 weeks, traders have been more negative than usual towards BTC on various social platforms.

Historically speaking, a negative crowd sentiment increases the chance of a price rise as it usually runs against the crowd’s general sentiment.

On the other hand, we can also witness a larger cohort of addresses in profit recently.

According to the analytic firm Glassnode, the number of addresses in profit (7d MA) recently reached a three-month high of 26,704,683 as of 17 August after reaching the same milestone on 15 August.

Where is Bitcoin headed now?

Recent reports have already shown the new changing ownership pattern among BTC holders which could prove to be crucial up ahead.

According to this report, a subsequent accumulation has taken place which puts Bitcoin in the hand of low-cost basis owners.

Will this have bearing on the market in future remains a waiting game for everyone in the crypto space.