Cryptocurrencies have taken the world by storm over the past few years. As their popularity continues to grow, more and more people are looking for ways to get involved in the market.

One of the most popular ways to do this is through margin trading. In this article, we will discuss some of the best crypto exchanges for margin trading. We will also provide a brief overview of what margin trading is and how it works.

What Is Crypto Margin Trading?

Crypto margin trading is where a trader borrows money from a decentralized exchange and uses it to make more trades or increase the trade’s size. In essence, margin trading is the equivalent of taking a loan to buy stocks in the crypto market. This has become a popular way of making some cash on cryptocurrencies and assets.

How Does Crypto Leverage Trading Work?

Once a trader borrows money and places it on a particular trade, you say that they have opened a position. Positions can either be long or short.

Long positions mean you expect the value of the trade you are making will rise, and hence you are buying it to make profits when it does. On the other hand, short positions mean you anticipate a drop in prices, and therefore you are selling before it hits a low value.

To determine how much profit you can make from a position, you need to know what leverage you will place on it. For most trades, you can place leverage of 3x, 5x, 10x, 20x, or even 100x.

For example, if you put $200 into a long trade and the price rises by 10%, you will make a $20 profit. Leveraging such your trade by, say, 10x would give you $200 on your investment.

Now let’s look at the best crypto exchanges for margin trading.

11 Best Crypto Exchanges For Margin Trading

Crypto margin trading is growing popular by the day, which means many crypto exchanges are offering it. However, you don’t want to go to just any exchange without a clear understanding of how it operates. Here’s a breakdown of some of the best exchanges you can rely on for seamless cryptocurrency margin trading.

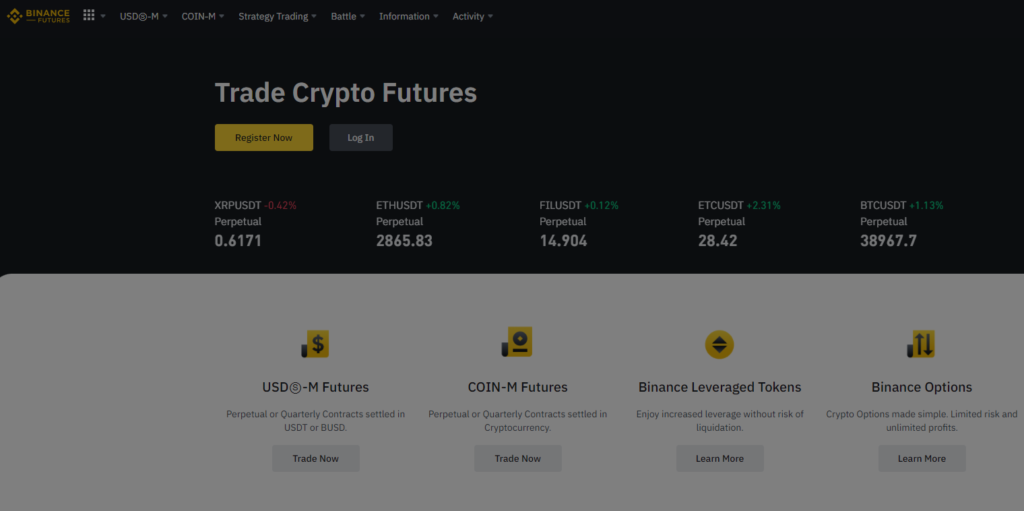

Binance Futures

Top of the margin trading list in cryptocurrencies is Binance Futures. Binance Futures is the margin trading arm of the Binance Exchange. This centralized exchange was founded in 2019 to give users separate accounts for their crypto leveraging efforts. Since it launched, Binance Futures has grown massively to accommodate margin trading interests. At the time of writing, the exchange has trading volume of 1,078,062.671,078,062.67 and an open interest of 249,242.37.

As a Binance Futures user, you will be able to trade over 600 cryptocurrencies. The most popular being ETH, BTC, BNB, and even stablecoins like USDT. The most active trading pair on Binance Futures is BTC/USD, and you can leverage 3x, 5x, or 10x on leveraged spot market trades or 20x to 125x with Futures.

Binance Futures takes pride in being one of the most affordable crypto exchanges in the market regarding trading costs. This crypto exchange has two significant fees that traders should focus on.

Makers fee is the first fee, and it is charged when you place an order limit that is either above or below the market price to add liquidity to the order. Makers fee often ranges between 0.0000% and can go as high as 0.02%. There’s also a Takers fee charged when you take liquidity from the order book. Takers fee on Binance costs at least 0.017% or at most 0.04%.

ByBit.Com

ByBit.Com might be a lesser-known option for crypto derivative margin trading, but it is one of the best platforms in the crypto space. This crypto exchange was established in 2018, and since then, it has over two million registered users and a trading volume of $8,576,001,392.

The major margin trading items on ByBit.Com are derivatives. There are secondary contracts that have their value determined using underlying assets. BiBit.Com has multiple derivative items, including Futures like BTCUSD quarterly and ETHUSD quarterly. You can also trade inverse perpetual contracts like XRPUSD or EOSUSD or margin linear perpetual contracts like BCHLINK or DOGEUSDT. One of the best things about trading derivatives on this exchange is its flexible leverage from 1x to 100x that you can adjust to your liking.

Besides the impressive list of derivatives, ByBit.COm also has pocket-friendly fees. The Makers fee on the platform is 0.025%, and the Takers fee is 0.075%. This makes the platform easily accessible, even for low-range traders.

Gate.io

One of the top-ten crypto exchanges in the world is Gate.io. Gate.io boasts of over 8 million registered users in over 130 countries globally and an impressive $2.12 billion trading volume for Futures.

Margin trading in Gate.io gives you access to over 100 cryptocurrencies to trade with. The platform has some popular coins, including ETH, BTC, and EOS. Besides that, you can also trade on several perpetual contracts on the site, including APE USDT, LUNAUSDT, and BNBUST. The leverage ratios for Futures range from 3X to 10 x. Gate.io, however, gives a 100x leverage on perpetual contracts, but leveraging such an amount is risky, so work with lover leverage, especially if you are still new to margin trading.

The Gate.io makers fee for Future markets is 0.0150%, while the Takers free is 0.0500%. These fees change for the Spots market, which charges 0.2% on Makers and Takers fees. You will also be expected to pay an interest that Gate.io regulates every hour. The interest you pay is also calculated on an hourly basis, and you can read more on how to calculate Gate.io’s interest rate on margin trading.

BitMex

Another popular crypto exchange for margin trading is BitMex. The Bitcoin Mercantile Exchange has been around since and has grown famous for allowing users to convert crypto for free. BitMex also has good performance, with a 24-hour trading volume of $16,621.98 and an open interest of $26,569.34.

The pool of trading pairs that you can access on BitMex is also impressive. There are at least 53 trading pairs on the platform. These pairs are live perpetual contracts ranging from AVAXUSD, BNBUSD, ETHUSD, and BCHUSD. These pairs have varying leverages placed on them, and the maximum leverage you can put on them is 100x.

Margin trading on BitMex will cost you 0.01% for the Makers rebate and 0.075% for the Takers fee. However, high-volume trades get discounts on their Takers fee. Depending on the Average Daily Volume (ADV) you roll in for 30 days, BitMex has a specified scale for how much Takers fee discount you can get.

Among the best of BitMex’s features is its flexible interest rates for every product. You can use this table to read through the coin you want to trade and understand how much interest you will pay for margin trading it.

PrimeXBT

If you want to margin trade crypto with ease, PrimeXBT should be one of the platforms you give prime consideration. This Bitcoin-based platform executes 12,000 orders every second and has an average trade volume of $545 million every day. This platform also provides real-time market data and trading tools that make it easier for beginners and crypto trading experts to trade efficiently.

.

On PrimeXBT, there are multiple coins and over 30 assets that you can trade. Once you have an account, you can do margin trading on AUD/CAD GBP/USD ADA/BTC and even Gold, Silver, and Oil. PrimeXBT charges a maximum leverage of 0.01%. Unlike other platforms, PrimeXBT charges the same for the Makers fee as it does for the Takers fee. At the time of writing, this figure is 0.05% for cryptocurrencies and 0.0001% for Forex, Commodities, and Indices.

If this feels a little bit on the high end for you, the platform also offers promo codes from time to time that you can use to lower the trading fee. Alternatively, you can strive to achieve a high turnover within 30 days, because it earns you a 50% discount.

AscendEx

For traders who want to maximize the returns on their crypto portfolio, AscendEx is one of the most promising platforms. This cryptocurrency derivative trading platform was formed in 2018 and has grown stronger since, allowing users to margin trade and profit from over 50 tokens.

The range of leverage crypto trading pairs you get on AscendEx is wide.

AscendEx allows you to trade SOL/USDT, SHIB/USDT, MATIC/USDT, LINK/ETH, and even BNB/BTC. The amount of leverage you can place on AscendEx is determined by your Margin Asset balance, the current balance in your margin account. Additionally, the trading fees on this AscendEx vary with every user. AscendEx’s fee structure is dependent on one’s 30-day trade volume (in USDT), and 30-day average unlocking ASD holdings. This fee is also discounted on the same basis.

For interest rates, you get updates of the new interest rate on your account every eight hours. Keep in mind that even if you hold the loan for less than eight hours, you will have to pay the interest rate for eight hours.

CEX.IO

CEX.IO is one of the top centralized cryptocurrency exchanges. This UK-based exchange is home to four million registered traders, and on average, about 1,500 people carry out crypto leverage trading on the platform every month.

As a CEX.IO user, there’s a lot to explore on the platform. The exchange has about 230 trading pairs, and the most popular of them include ETH/BTC, BCH/USD, BTC/EUR, BCH/BTC, BTC/USD, and ETH/USD. Leverages for any trading pair on the platform will range from ratio 1:2 to 1:3. This means half or a third of the funds in your account cover your position.

The trading fee on CEX.IO is also affordable. You will pay a Makers fee of 0.0% – 0.16% or a Takers fee of 0.10% – 0.25%. The exact amount you will pay depends on your 30-day trading volume. However, the one thing you will enjoy most about this platform is its risk protection mechanism. On CEX.IO, you will always be guaranteed that if the market goes in a direction opposite from what you anticipated, you will not make losses that you can’t afford.

FTX

FTX may be a new crypto leveraging platform, but it is worth mentioning. The exchange came to life in 2019, offering users a chance to trade crypto derivatives. So far, it has over 250 quarterly features, perceptual features, and over100 spot markets that users can run trades in.

Spot margin trading is the most popular type of margin trading on FTX. Spot margin trading works when you lend a particular token to the exchange to borrow another. For instance, you can lend $50000 to receive 1BTC.

To facilitate margin trading transactions on FTX, you need to pay a Makers and Takers fee. The platform has a price structure for what these fees translate to. You can also opt into their VIP program if you are a professional trader because this can get you discounts on the fee.

The whole concept behind margin trading is to help make profits for all parties involved. That is why you pay an interest rate for every loan or token you borrow on FTX. FTX interest rates are relatively affordable and are calculated based on the borrowing rate. The platform has a price structure explaining how to arrive at the interest rates required.

StormGain

StormGain is another margin trading platform suitable for a majority of traders. What’s unique about this exchange is that it offers users all the features they need to buy, sell, store and learn crypto while charging 0% commission for maintaining the account.

Trading margins on StormGain will also open you up to a long list of trading pairs that you can trade. The platform ranks USDT/BTC, BTC/ETH, ETH/LTC, and BTC/LTC as some of its most active trade pairs. Besides this, you will also find StormGain to be the platform with the highest leverage limit in the crypto space. On this centralized exchange, you can leverage up to 500x for your trades.

Despite this enormous chance to make more out of your trades, be mindful of setting high leverage because it might empty your pockets if the markets aren’t in your favor. StormGain charges a Makers and Takers fee of 0.25%. This may be higher compared to other exchanges. But, the fact that you only pay this fee when you make a profit, and the convenience the platform offers as you trade, makes it a platform worth considering.

Kraken

Despite significant competition in the crypto scene, Kraken remains one of the most renowned trading platforms for crypto margin trading in the U.S.A. This exchange rakes about $573,763,487 in daily trade volume.

Kraken is also well packed when it comes to trading pairs. You can get some of the world’s leading tokens, including XRP, XMR, EUR, ETH, and USD. If you choose to trade one of these, the maximum leverage you can put on any trading pair is 5x. For many trades, this may look like a small value, but it is enough to earn you substantial profits and reduce your losses if used well.

The fees and interest rates on Kraken are also well affordable. Traders pay at least 0% – 0.26% as Makers and Takers fee. These inexpensive rates, plus the spot-on customer support that the site offers, will help you navigate as little hassle as possible and maximize your chances of making some real cash through crypto leverage trading.

Phemex

Phemex is a crypto trading platform that has earned its way into this list because of its efficient crypto leveraging option. This award-winning trading site has over two million users and a $5,103,058,386 24-hour trading volume.

What you will find yourself trading extensively on Phemex as far as margin trading is concerned is perpetual contracts. The spot market, too, has interesting trading pairs to look at, like SOL/USDT, SHIB/USDT, and MASK/USDT. Leverage for perpetual contracts can be as high as 100x. This gives you a higher potential to make significant profits.

It’s also important to note that Phemex charges a trading fee. This sums up to a 0.025% Makers fee and a 0.075% Takers fee. It is a decent figure for the market and coupled with the platform’s zero withdrawal fee, you can consider Phemex your go-to investment platform for margin trading.

How to Reduce Losses From Crypto Margin Trading

Margin trading is highly profitable, but it is also a high-risk investment strategy given the price fluctuations of digital currencies. To reduce these risks, it is essential first to understand the terms and conditions that apply and the three terms listed below.

Liquidation Price

Liquidation price refers to the process of swelling off crypto assets during a market crash.

When the token you are trading reaches its liquidation price, the exchange automatically closes your position and begins to liquidate your assets to avoid losing the money they gave you. Knowing the liquidation price ensures you make the right call when markets are not in your favor.

Maintenance Margin

Maintenance margin is the amount of money you should always have in your account to facilitate a particular leverage purchase. A drop in your maintenance margin could easily result in liquidation, so you always have to know what percentage the exchange requires you to have as a maintenance margin and ensure you never go below it.

Margin Call

A margin call is a warning that your maintenance margin is dropping below the required amount. When you get a margin call, you can either add more money to boost your maintenance margin or lose your assets through liquidation.

FAQs

Does Coinbase Allow Margin Trading?

Coinbase doesn’t allow margin trading. It used to allow users to leverage, but it disabled the feature following guidance that they received from the Commodity Futures Trading Commission

Does Binance Us Offer Margin Trading?

Binance doesn’t offer margin trading. You can only trade tokens on stake on the platform.

Which Crypto Exchange Gives Highest Leverage?

The crypto exchange with the highest leverage is Stormgain. The exchange allows you to leverage up to 500x for your trade. However, such a leverage is rarely ever used because of the high level of risk it poses.

Can You Margin Trade Crypto in the U.S.?

No, you cannot margin trade crypto in the U.S on any platform other than Kraken. Although America is home to many crypto exchanges that offer margin trading, the U.S. government has not legalized margin trading in the country, so all other platforms restrict people living in the U.S. from crypto leverage trading.