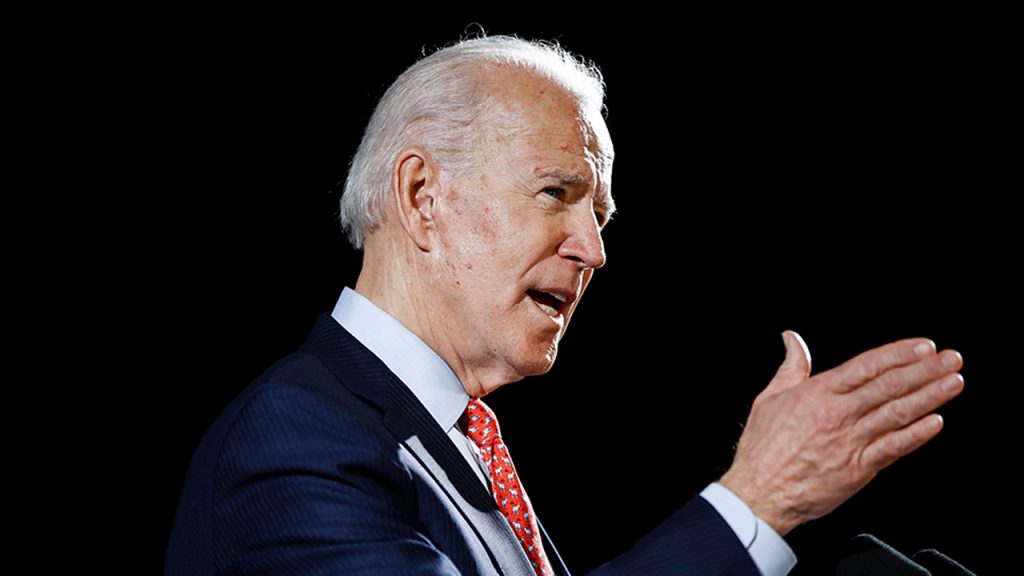

As inflation continues to wreak havoc on American wallets, the U.S. dollar’s lack of purchasing power has been affecting nearly every U.S. resident’s spending decisions. On Monday, U.S. president Biden and his administration predicted lower inflation forecasts as officials announced Biden’s proposed budget for the 2023 fiscal year. According to marketwatch.com author Victor Reklaitis, the Biden administration’s inflation forecast “doesn’t look realistic.”

Biden Administration Expects ‘Inflation Will Ease Over the Coming Year’

The Biden administration and White House economist, Cecilia Rouse, are predicting very low estimates as far as future inflation rates are concerned. This is despite the inflation rate in February skyrocketing to 7.9%, and rising at the fastest pace since 1982. Prices across the nation have been growing across the board and reports show that inflation is causing people to make different spending decisions. While the inflation rate jumped close to 4x higher than the Fed’s target inflation rate of 2%, rent and housing have both jumped even higher.

For instance, data shows that home prices have surpassed the rate of inflation by a long shot. “Home prices have increased 1,608% since 1970, while inflation has increased 644%,” explains a recent study written by anytimeestimate.com’s Taelor Candiloro.

The White House economist Rouse detailed on Monday that initially, economists expected “inflationary pressures to ease over the coming year.” But since the Russia-Ukraine conflict, Rouse stressed, the issue has “created additional upward pressure on prices.” Rouse further added:

There’s tremendous uncertainty, but we and other external forecasters expect that inflation will ease over the coming year.

Political Ammo, the so-Called ‘Money Illusion,’ and Self-Fulfilling Prophecy

Marketwatch.com author, Victor Reklaitis, said the predictions don’t “look realistic” after the Biden administration explained its position about inflation in the future. Quoting analysts at Beacon Policy Advisors, the report further noted that the Biden administration’s forecasts could become ammo for the Republican party.

“Too low an inflation estimate and it won’t be believable, but too high and it will become political ammunition for Republicans,” the Beacon Policy Advisors wrote in a note on Monday. Furthermore, a report published by NBC calls people’s angst against inflation a “money illusion,” one that allegedly bolsters emotional responses, rather than rational responses.

Corporate media’s narrative has changed over and over again as inflation was once “transitory,” then it was “good for you,” then it was caused by every excuse under the sun except the Fed’s monetary expansion, and now inflation is becoming illusionary.

“As the inflation rate climbs, people are more likely to stockpile goods and let emotions drive financial decisions, which can drive up prices even more,” NBC’s Martha C. White explains in her report.

In another article published by CNN Business reporter, Anneken Tappe, the report says that “inflation can become a self-fulfilling prophecy.” Reports like these, however, never tap into things like bipartisan government spending and monetary easing tactics. In the words of many editorials this week, inflation’s now becoming a “psychological effect” or simply a fixation on the value of the U.S. dollar.

Michael Finke, a professor of wealth management at the American College of Financial Services details that people have an emotional response to loss. “People tend to have a rational response to gains but an emotional response to loss,” Finke said. “We tend to view things in terms of dollars and not in terms of spending power. If your wages have gone up over the last decade, the total cost of gas represents a smaller part of your salary. But we tend to fixate on the dollar value.”

What do you think about the Biden administration predicting that inflation will ease over the coming year? What do you think about the NBC report that says Americans tend to fixate on the dollar’s value? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer