- Terra’s algorithmic stablecoin UST has lost its peg and is coming under immense pressure as LUNA, the token it’s pegged to, lost 50 percent of its value overnight.

- Binance has suspended LUNA and UST withdrawals, blaming it on a high volume of pending withdrawal transactions as panic sets in for the Terra community.

There’s trouble in the Terra paradise. As CNF reported, the Luna Foundation Guard revealed it’s lending $1.5 billion in BTC and UST to try and salvage the peg for the UST stablecoin. But as it turns out, even this isn’t enough to save UST. It has now lost its peg again and what’s even more worrying is that LUNA, the crypto that UST’s peg is based on, has dipped by 50 percent in the past day alone.

UST is an algorithmic stablecoin. This means that its price is maintained through algorithmic pegging to $1 through a burn and mint mechanism for LUNA, the native token of the Terra ecosystem. Other big stablecoins such as Tether and USD Coin depend on a central entity to maintain dollar reserves.

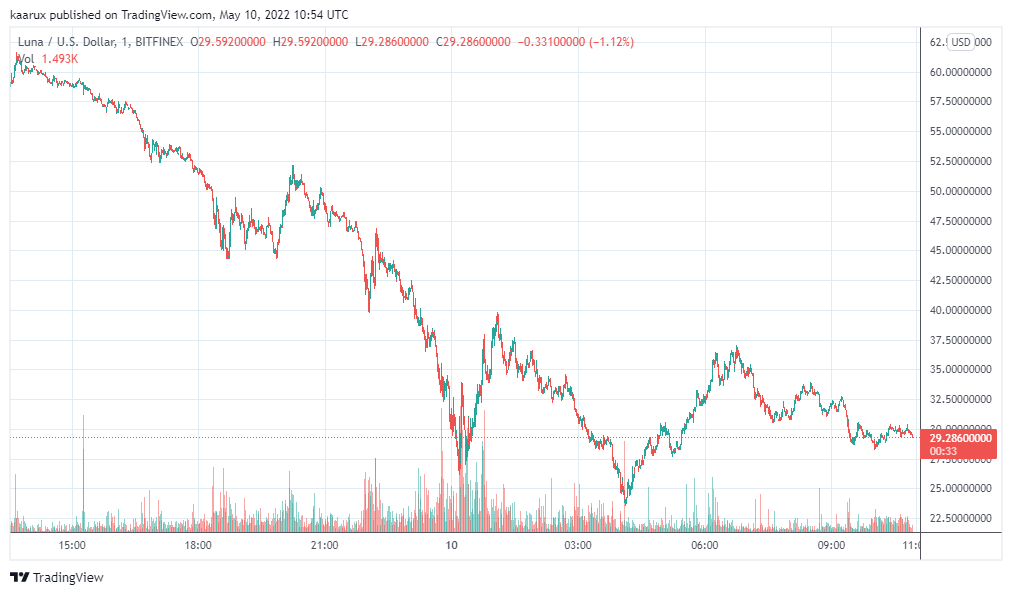

The mint and burn mechanism is all well and good, but what happens when the price of LUNA takes a massive dip? This is the scenario UST is in today. LUNA’s price has dipped by 50.35 percent in the past day, the biggest drop for any of the top 100 coins by far, to trade at $29.75, down from $61.

On Monday, the price of UST dipped to as low as $0.65, a 35 percent dip, which even for a volatile cryptocurrency is bad, but for a stablecoin is catastrophic.

At press time, it has recovered to now trade at $0.9. This gives UST a market cap of $16.3 billion, making it the tenth-largest crypto. Most notably, this is $6 billion higher than Terra LUNA’s market cap.

Binance suspends and reinstates LUNA, UST withdrawals amid market panic

For many traders, the market cap flip was a major concern, so much so that they started withdrawing their UST and LUNA from major exchange Binance. The exchange ended up having to suspend the withdrawals on Monday.

In a blog post, it explained:

Withdrawals for LUNA and UST tokens on the Terra (LUNA) network were temporarily suspended. due to a high volume of pending withdrawal transactions. This is caused by network slowness and congestion.

Binance promised to reopen withdrawals for the two tokens “once we deem the network to be stable and the volume of pending withdrawals has reduced.” And it did.

Withdrawals for $LUNA and $UST on the Terra network have now resumed on Binance.

We will continue to monitor the network conditions and provide further updates here if required.

— Binance (@binance) May 10, 2022

Several traders took to Twitter to claim that they were unable to sell their UST for anything below $0.70. Terra would later urge its UST holders not to spam the network, stating:

If you are using the public infra, please do not spam it at this time as we are experiencing naturally high levels of transaction volume. Please be mindful of our public infra usage.

LUNA still has the backing of several big-money institutions and has been one of the best performing tokens this year, prior to the past week. One of these, Mike Novogratz, even went ahead and got a tattoo of LUNA on his hand. However, as soon as LUNA dipped, he became the subject of attack on social media, including a jab from Cardano founder Charles Hoskinson.

I’m always wondering why the VCs and cryptomedia love certain alts and hate on Cardano. Just can’t figure it out….. https://t.co/zAfHQYrAFN

— Charles Hoskinson (@IOHK_Charles) May 10, 2022