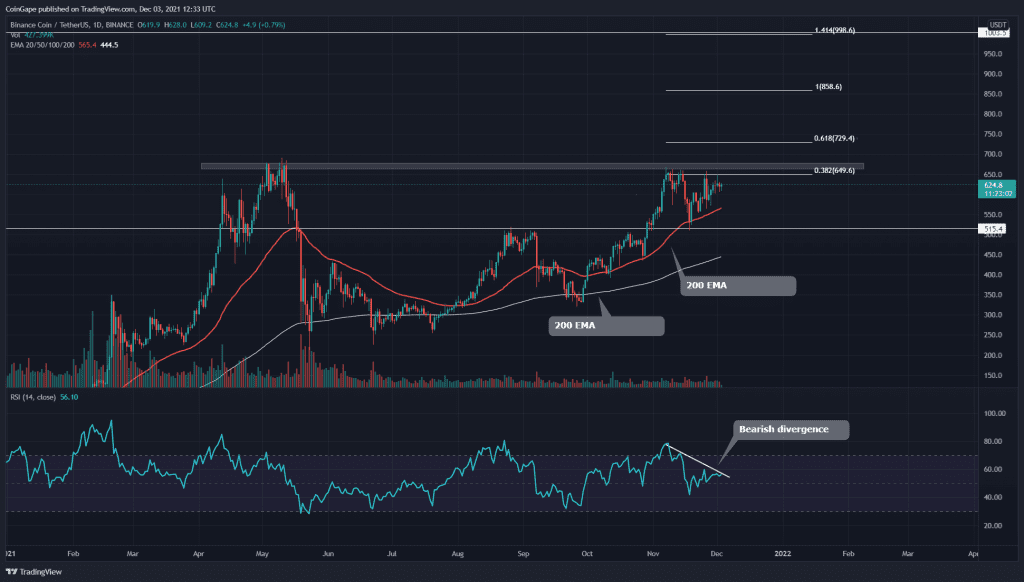

The BNB coin price provides an impressive recovery from its recent correction to the $515 mark. The price is up by 26% from November’s low and seems ready to retest the All-Time High resistance around $680. With this same resistance as the neckline, the coin also shows a Cup and Handle pattern, indicating even more potential for the coin after a bullish breakout

Key technical points:

- The BNB coin obtains dynamic support from the 50-day EMA

- The BNB daily RSI significant divergence in the daily RIS chart

- The intraday trading volume in the BNB coin is $33 Million, indicating a 16.43% hike.

Source- BNB/USD chart by Tradingview

As mentioned in my previous article on BNB/USD, the technical chart displays a Cup and Handle pattern in the daily time frame. This pattern’s neckline or the crucial resistance zone is around the $670 mark. The price is currently standing at the doorstep of this resistance, and the crypto traders should be patient till we see a proper breakout from this level.

The BNB coin price is trading above the EMA line(20, 50, 100, and 200), supporting a strong uptrend in this coin. Moreover, the 50 EMA line act as strong dynamic support for the price.

The Relative Strength Index(56) presents an evident bearish divergence in its chart, indicating weakness in this rally.

BNB/USD 4-hour Time Frame Chart

Source- BNB/USD chart by Tradingview

This lower time frame chart shows a steady uptrend for the BNB coin. Though the price action and bearish divergence in RSI are contracting each other, the safe traders can maintain a bullish sentiment until the price is sustaining above the ascending trendline, which has provided multiple support to the coin price.

As per the Fibonacci extension level, the crypto traders can expect some good target/resistance level for the coin price at $850( 1 FIB level), followed by $1000( 1.414 FIB level)