Since the crypto industry has widened its boundary in recent years, it has pushed law enforcement agencies globally to supervise the digital assets ecosystem to prevent unpleasant activities. It resulted in sanctions on the crypto service companies and investigations into suspected entities facilitating illegal transactions linked with money laundering or other financial crimes.

Similarly, Binance, the world’s largest crypto exchange with 120 million users, comes under the radar for undermining U.S. imposed sanctions for Iran.

Chainalysis, a blockchain research and security firm, discovered the crypto exchange has facilitated around $8 billion in trade with Iran since 2018 and violated U.S. sanctions aimed at disconnecting Iranian from the world’s financial system.

Chainalysis revealed that a total of $7.8 billion had been exchanged between Iran-based exchange Nobitex and Binance. Notably, the biggest exchange in Iran also educates users on its site to prevent punishment.

Nevertheless, around 75% of Iranian crypto assets that passed through Binance were invested in a mid-tier crypto coin named Tron.

Ranked at the 15th spot by market cap, Tron is known to be a comparatively obscure crypto asset, allowing users to protect sensitive information and hide identity. In a last year’s blog post, the Nobitex crypto exchange also cited the coin’s ability to be traded without “endangering assets owing to penalties.”

More Legal Troubles For Binance

New discoveries appear while the U.S. Department of Justice (DOJ) has already been investigating the giant exchange of the crypto market and accused it of proceeding with money laundering activities.

Denying to provide thorough reports on the newly discovered transactions with Iran, Patrick Hillmann, Chief Strategy Officer at Binance, added in a statement;

Contrary to other platforms that have exposure to the same U.S. sanctioned businesses, Binance.com is not a U.S. firm. We have, however, taken aggressive measures to reduce our exposure to the Iranian market, utilizing internal resources and partners in the business.

Likewise, Reuters signalled in July about Binance facilitating Iranian residents undermining the U.S. sanctions. It came as part of the Reuter’s investigations on the most active crypto exchange in the industry, operating more than half of a 1 trillion crypto market.

A day after the accusations by Reuters, Binance mentioned in an official blog post that the company follows the international sanctions and understands compliance importance to keep the system transparent. The billionaire Chengpang Zhao (CZ) said;

Binance banned Iranian users following sanctions, 7 got missed/found a workaround, they were banned later nevertheless.

In August 2021, Binance claimed it would only approve accounts with identifying users. But the data analyzing firm Chainalysis uncovers that Binance processed nearly $1.05 billion in trades with Iranian exchanges till November 2022. The figure of trade with Iran, per Chainalysis, has reached $80 million after the CZ claimed in July that his company complies with regulations.

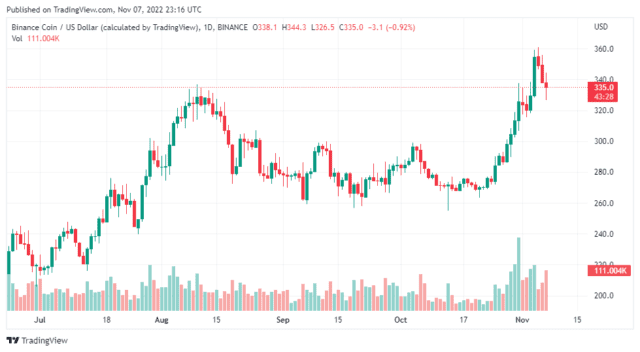

Featured image from Pixabay and chart from TradingView.com