Binance Smart Chain (BSC) total value locked (TVL) continued to fall steeply in the third week of May due to a market crash that has seen decreased interest in decentralized finance (DeFi).

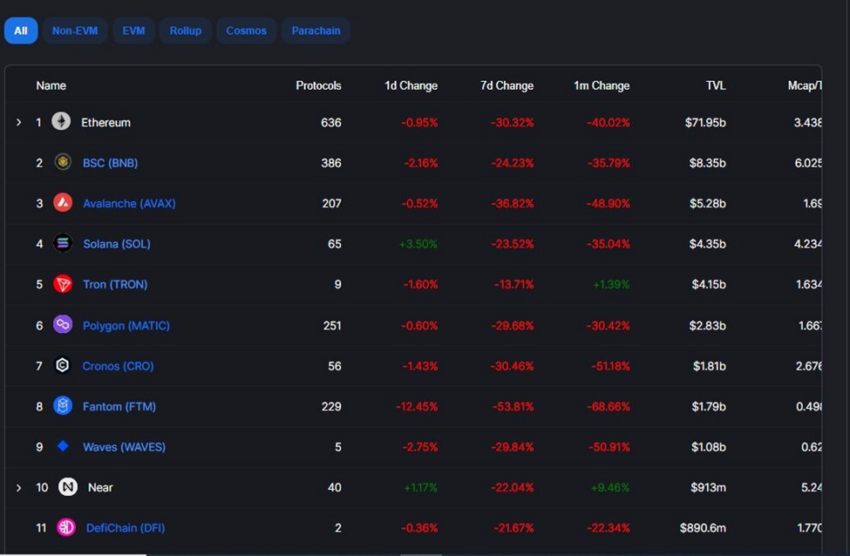

Binance Smart Chain has been one of the most patronized platforms in the last 12 months. BSC has lost 47% in total value locked since the start of 2022, according to Be[In]Crypto Research. On Jan 1, BSC had a TVL of around $15.83 billion, falling to approximately $8.35 billion on May 16.

BSC is a blockchain network that facilitates the building and running of smart contract-based applications. As one of the networks that have found the solution to the blockchain trilemma (decentralization, security, and scalability), it has a growing ecosystem that comprises some of the most innovative decentralized applications (dApps), and non-fungible tokens (NFTs).

Why the decrease in TVL?

BSC TVL crashed to a 2022 low this week due to protocols in its ecosystem also falling.

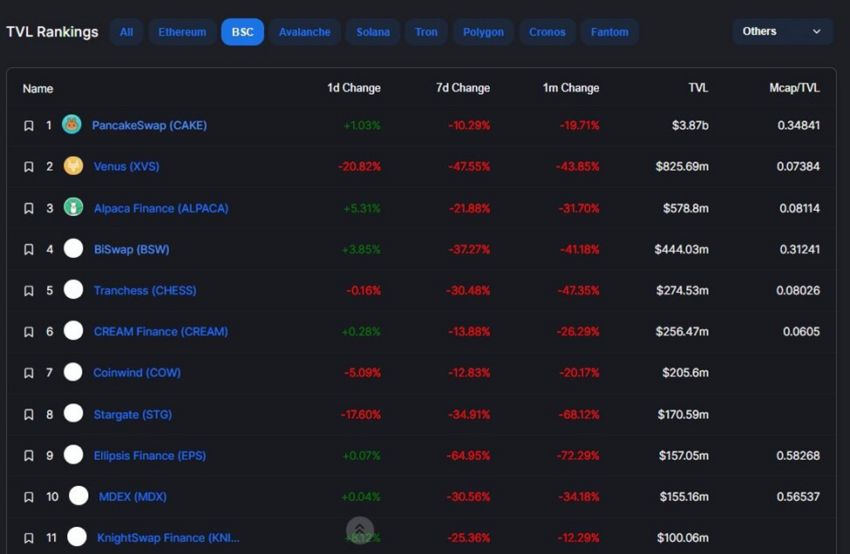

Decentralized exchange (DEX) PancakeSwap, for example, has tumbled by more than 19% in the last month, while money market protocol Venus has also dipped by more than 43% in TVL within the same period.

While Decentralized lending protocol Alpaca Finance and decentralized exchange Biswap, have lost more than 31% and 41%, respectively, of their total values locked.

Other decentralized applications that have made contributions to the drop in total value locked include Tranchess, CREAM Finance, Coinwind, Stargate, Ellipsis Finance, MDEX, and KnightSwap.

Despite falling by more than $7 billion, BSC has regained its place as the blockchain with the second most value locked after Terra lost more than 90% of its TVL.

BSC still commands a relatively higher value locked over Avalanche, Solana, TRON, Polygon, Fantom, Cronos, Waves, Near, Terra, Osmosis, Kava, and DefiChain.

Binance Coin price reaction

Binance Coin (BNB) opened the year with a trading price of $511.91, reached a yearly high of $533.37 on Jan 2, and was changing hands for $301.32 as of writing. Overall, this equates to a 41% decline in the price of BNB since the start of the year.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.