Ethereum took a further step back in total transactions in February as Binance Smart Chain saw a 378% increase in transactions over the first smart contracts-backed blockchain network.

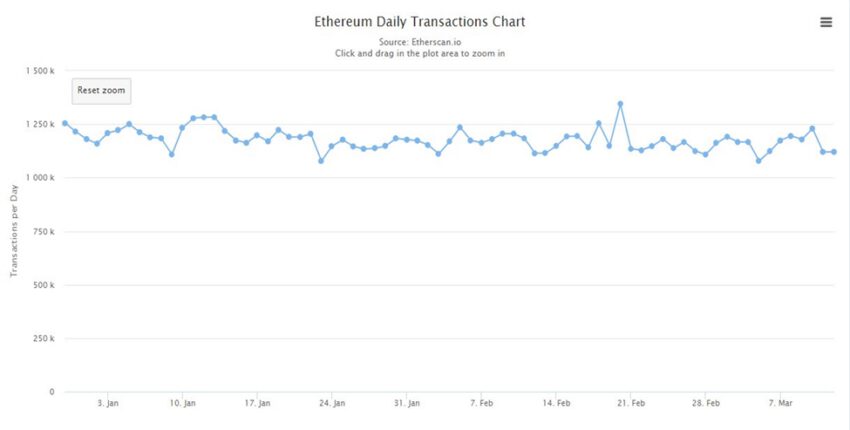

Last month proved to be a tough month for the Ethereum blockchain. The largest chain in terms of total value locked (TVL) managed to record approximately 32,739,456 transactions during February, according to Be[In]Crypto Research.

To readers that do not know much about the blockchain technology space, this figure is impressive when compared to the total transaction counts of other chains. With that said, Ethereum took a hit in terms of transaction counts for February.

The total transactions counts by the end of January 2022 was 36,851,128. This means that approximately 4,111,672 was wiped off January’s figure in February, an 11% decrease in total transactions in the space of 28 days.

Ethereum transaction count decreased from 2021

The total transaction count for Ethereum over the past year was down by 7% since February 2021, which saw 35,758,516 in total transaction counts recorded.

Aside from this, Ethereum reached its peak in May 2021. This was a time when the native coin of the Ethereum ecosystem (ETH) surpassed $4,000 for the first time and reached new milestones. This was buoyed by the increasing usage of decentralized protocols and applications (dApps) on the Ethereum blockchain as many users took advantage of decentralized lending, exchanges, and yield aggregation protocols. This reflected positively in the total transaction count for Ethereum.

Total transaction count on May 31, 2021, stood at 45,055,042. This was a 26% increase from February 2021.

In January 2022, the single-day high in transactions for Ethereum was 1,283,346. The single-day high in transactions on Ethereum in February 2022 was a 4% increase than the best-day high in the first month of 2022. The single-day high for February 2022 was 1,343,869.

Binance Smart Chain continues to surpass Ethereum in total transactions

Although Ethereum managed to record 32 million transactions in February, Binance Smart Chain managed to record approximately 156,512,579 (156 million). After being affected by a bearish engulfing in the early days of the month, Russia’s invasion of Ukraine towards the end of February deepened the bearish cycle. Binance Smart Chain saw total transactions decrease by 18% from January 2022.

January 2022 saw Binance Smart Chain bring forth total transaction counts of approximately 192,096,842 (192 million). In sharp contrast to Ethereum’s falling year-over-year transactions in February, Binance Smart Chain saw a year-on-year monthly increase for February.

February 2021 saw the recording of 51,983,356 (51 million) transactions, with 2022’s figure increasing by 201%.

As of March 2022, Ethereum remains the largest in terms of total value locked, and Binance Smart Chain is third in terms of TVL. The two chains have the most vibrant ecosystems in the space today with leading decentralized applications such as Uniswap (UNI) and PancakeSwap (CAKE) respectively. However, despite Ethereum’s position in terms of TVL, Binance Smart Chain remains the clear favorite in terms of user activity which has been reflected in total transaction counts.

Before the decline in total transactions in February, January 2022 saw Binance Smart Chain transactions outpace Ethereum by 421%. In addition to this, BSC surpassed Ethereum by 45% in February 2021, with Binance Smart Chain being the clear favorite in February 2022, with 378% more transactions than Ethereum.

What’s more, Binance Smart Chain reached an all-time high in total monthly transactions in November 2021 and managed to record approximately 391,847,392 (391 million). With an eye on Ethereum’s aforementioned monthly high in May 2021, BSC still maintained its dominance over Ethereum in terms of all-time highs by a staggering 769%.

What caused the fall in transactions?

Decreasing transaction counts which led to decreasing volumes on the decentralized applications of Binance Smart Chain and Ethereum are largely responsible for the decline.

The largest dApp in terms of total value locked, Curve (CRV) runs on the Ethereum blockchain. The total transaction count for CRV in February 2022 was approximately 45,468. This was a 34% decrease from January 2022’s figure of 69,281, according to Be[In]Crypto Research.

Aside from this, Curve’s total transaction count saw a year-over-year decrease of 21% from February 2021’s figure of 58,051.

One of the most vibrant areas in crypto in the last year is non-fungible tokens (NFTs). A decrease in total transaction counts impacted NFT Marketplace OpenSea which runs mostly on Ethereum. A reduction in total transactions saw OpenSea plunge by 27% in volume from January 2022’s figure of $4.95 billion to February 2022’s volume of $3.57 billion.

On the other hand, Binance Smart Chain also saw decreasing transaction counts largely due to the decreasing usage of its top dApp, PancakeSwap. Eventually, the fall in transaction count saw the decentralized exchange decrease in volume from $25.25 billion in January to $15.73 billion, a 37% decrease in the space of 28 days.

Unfortunately, the decline in total transaction counts has been reflected in the price of their respective native assets, ETH and BNB.

ETH opened Jan. 1, 2022, at $3,683.05 and increased by 5% to reach a yearly high of $3,876.79 on Jan. 4. ETH is currently trading at a price that is 27% below its yearly high recorded in January and has been trading in the region of $2,308.91 and $3,185.52 within the past 30 days.

BNB opened on Jan. 1, 2022, at $511.91 and increased by 4% to reach a yearly high of $533.37 on Jan. 2. BNB is trading at a price that is 27% below the yearly high recorded in the early days of the year. BNB continues to trade in the range of $324.48 and $433.43 within the past 30 days.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.