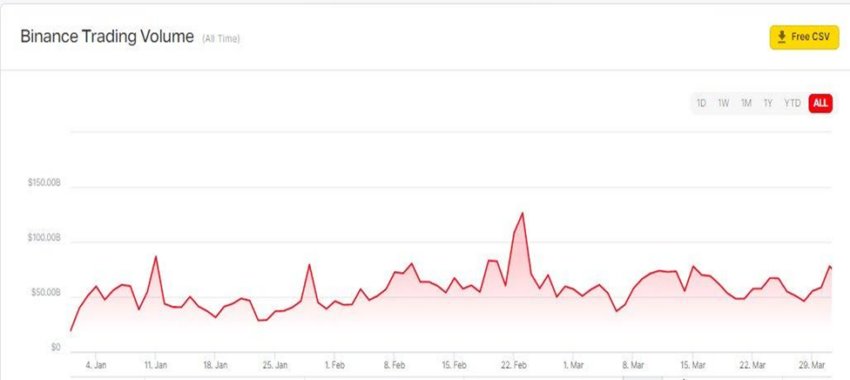

Despite a market that has seen the prices of thousands of cryptocurrencies plunge to new lows, Binance recorded more trading volume in the first quarter of 2022 than in the same period in 2021.

According to Be[In]Crypto Research, the trading volume of the biggest cryptocurrency exchange in the space during the first quarter of the year was approximately $5.54 trillion.

This was an 8% increase in the trading volume recorded between Jan and March 2021 – around $5.09 trillion.

What caused the Binance spike?

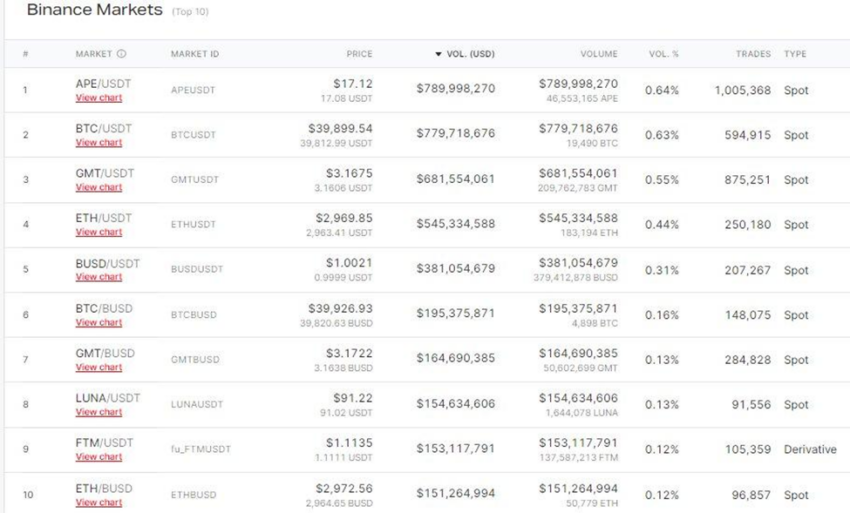

An increase in the number of cryptocurrencies supported by Binance is the primary reason for the increase in trading volume.

These include ApeCoin (APE) (launched in March 2022), and others such as Bitcoin (BTC), Ethereum (ETH), Terra (LUNA), Fantom (FTM), and GMT Token (GMT) paired against USDT and BUSD.

Binance has four times the spot trading volume of its nearest competitor on a typical day.

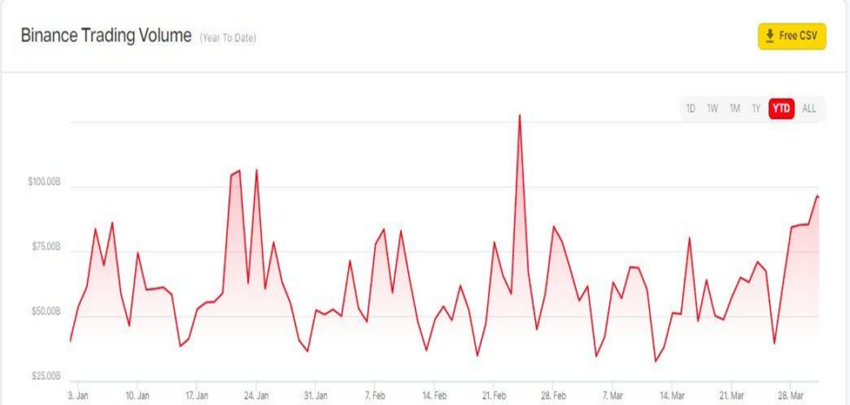

To understand the trading pattern of investors, we need to examine the monthly trading volumes of the first quarters of 2021 and 2022.

In Jan 2021, the trading volume was approximately $1.42 trillion with a single-day high of $86.81 billion. In Jan 2022, the trading volume was around $1.93 trillion and had a single-day high of $106.55 billion.

While in Feb 2021, the trading volume was in the region of $1.82 trillion with a single-day high of $126.26 billion. In Febr 2022, it was approximately $1.71 trillion with a single-day high of $127.92 billion.

And in March 2021, the trading volume reached $1.85 trillion with a single-day high of $77.92 billion. By March 2022, it was in the region of $1.90 trillion, reaching a single-day high of $96.47 billion.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.