BUSD joined USDC as one of the few cryptocurrencies that withstood the market crash of May which led to a steep decline in prices that saw billions of dollars wiped off the market.

The token issued by Binance remains a top 10 digital asset by market capitalization in June. According to Be[In]Crypto Research, BUSD closed the fifth month of the year with a market capitalization of around $18.2 billion.

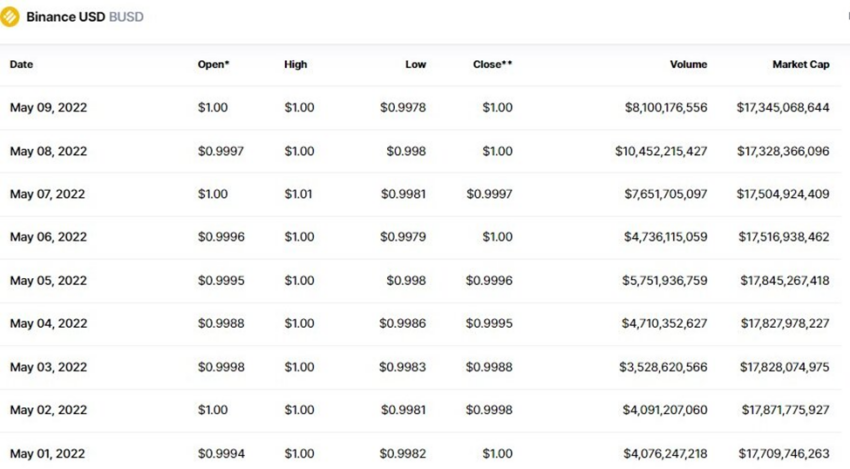

This marked a 2% increase from the opening day’s market value. BUSD saw a trading volume in the region of $4.08 billion which corresponded to a market capitalization of approximately $17.71 billion on May 1.

Why the increasing market capitalization?

The high demand for the stablecoin during the peak of the crash on May 9 to 13 can be credited for the soaring market capitalization of the token.

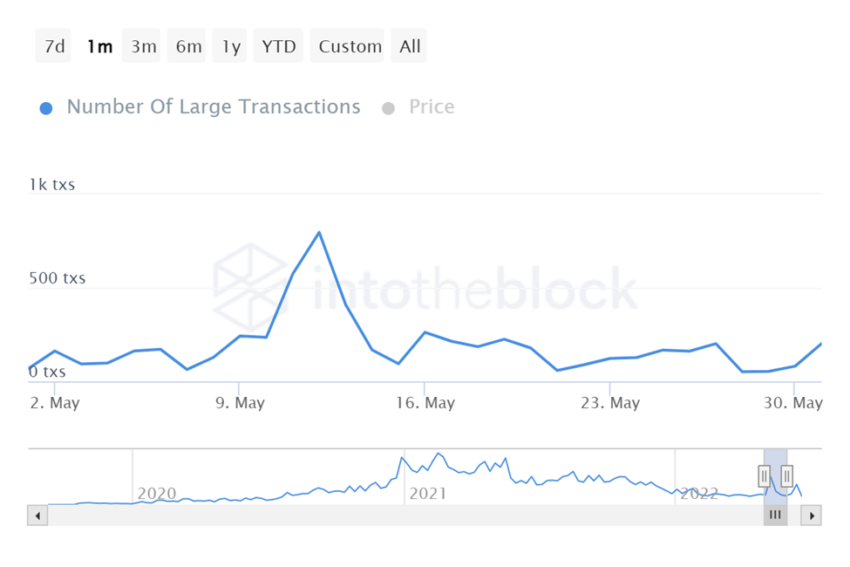

The number of large transactions peaked on May 12. On that day, transactions involving BUSD were 796,000 at a price of $0.966500.

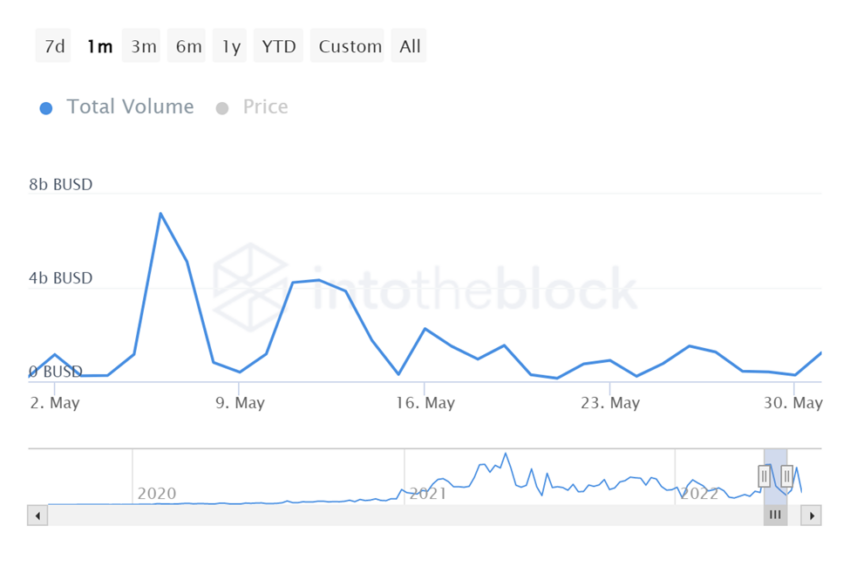

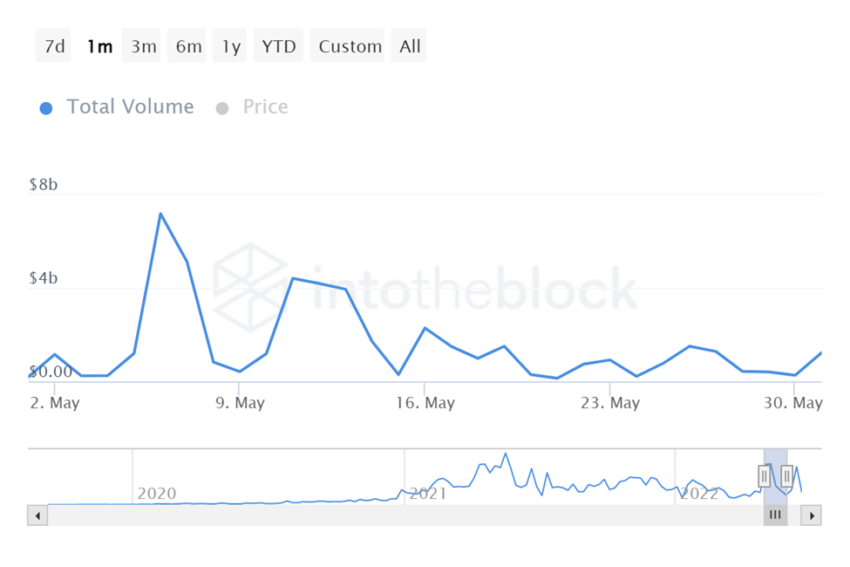

This corresponded with a transaction volume of 4.33 billion tokens at the same price.

The total transaction volume of 4.33 billion BUSD multiplied by $0.966500 equals $4.18 billion.

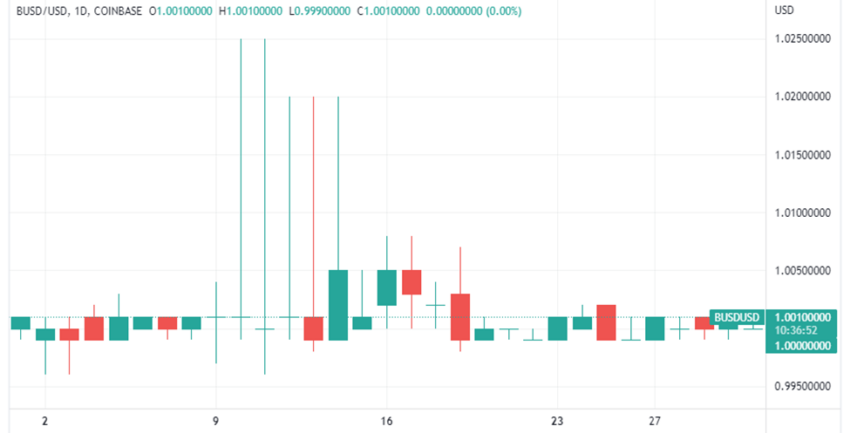

On May 12, it opened at $1, reached an intraday high of $1.02, tested an intraday low of $1, and closed at $1.

The trading volume for the day was $19.14 billion and corresponded to a market capitalization of $17.09 billion. Increased demand by traders to offset huge losses saw the token maintain its peg by the close of the month.

BUSD price reaction

BUSD opened on May 1, at $0.9994, reached a monthly high of $1.02 on May 12, tested a monthly low of $0.9978 on May 9, and ended the month with a trading price of $1. Overall, there was a 0.6% increase in the opening and closing price of the token in May.

What do you think about this subject? Write to us and tell us!

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.