Bitcoin, the largest cryptocurrency, achieved a new three-month high this week, thereby wiping all the incurred losses in 2022. The cryptocurrency hit $48,070 on 29 March, before sliding back below the $47,810 mark. Nevertheless, at last, the Fear and Greed index ticked towards ‘Greed’ after a very long time.

Time to accumulate?

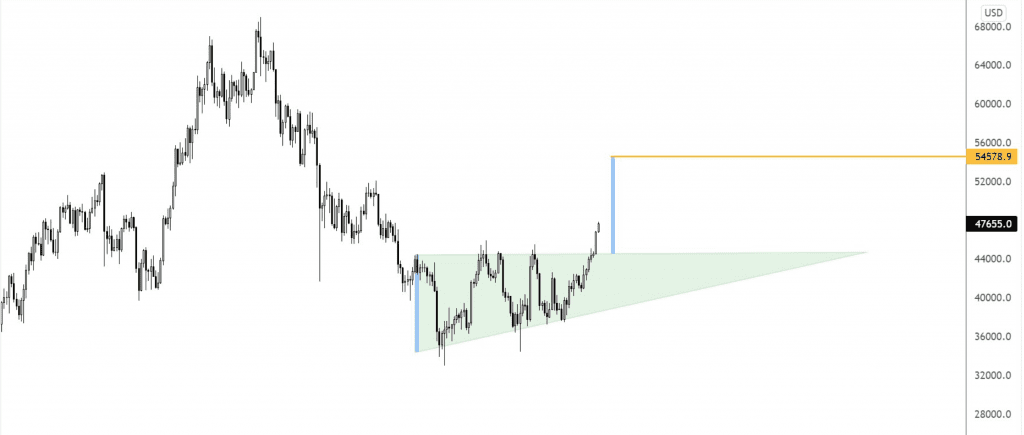

Bitcoin is attempting to reclaim a key long-term moving average as optimism increased that Bitcoin could challenge November’s all-time highs based on that fact. Market analyst and pseudonymous Twitter user filbfilb posted the following chart. The graph showcased the “strong weekly close by Bitcoin,” which closed “above the 20 WMA and 50/100 DMA.”

Bitcoin…

Very strong weekly close by Bitcoin, closing above the 20 WMA and 50/100 DMA.

Critically also breaking the key weekly support/resistance level defining the middle of the range.

Now sat below the 100 DMA and yearly pivot & a high vol node:https://t.co/NCJlne4t5E

— filbfilb (@filbfilb) March 28, 2022

The 200-day moving average (DMA), currently stood at around $48,300. The 200 DMA is a critical component of the Mayer Multiple metric, which measures spot price ratio in order to determine potentially profitable market entry points.

In a series of tweets on 29 March, on-chain monitoring resource Ecoinometrics eyed a classic entry for BTC/USD as flagged by the Mayer Multiple.

“That’s a good time to buy,” Ecoinometrics asserted in comments. Even if a breakout from the 200DMA is a bull trap, losses in such situations have historically been small.”

Using this momentum, BTC could achieve a target above the $50K mark. Twitter user Nunya Bizniz highlighted this scenario where the following chart outlined a possible move above $54,500.

The aforementioned analyst also stated:

“Measured move target of [the] breakout from ascending triangle. Get there?”

Another fellow trader and technical analyst Crypto Yoddha posted a similar narrative that kept pushing “higher to take equal highs at $52,000.”

The king coin indeed enjoyed a much needed sunshine after heavy showers. One of the major boosts came from the Luna Foundation Guard (LFG). The foundation purchased more than 11,700 bitcoin, worth about $520 million, to build a reserve for its stablecoin UST.

As per Wu Blockchain‘s 28 March tweet, the said foundation continued to accumulate more BTC.

The Bitcoin address (bc1q9d4ywgfnd8h43da5tpcxcn6ajv590cg6d3tg6axemvljvt2k76zs50tv4q) has been marked by the OKLink as the Luna Foundation address, which continued to accumulate 2,830 BTC today, and the current address balance reaches 27,784.96 BTC. https://t.co/93L3GPumm0

— Wu Blockchain (@WuBlockchain) March 28, 2022

Overall, whatever the reason might be, it certainly intensified the bullishness within the crypto community, especially BTC holders. According to Glassnode, the percent supply in profit of BTC had reached 81.807% on 29 March.

How high can you go?

Bitcoin’s options contracts used to hedge spot and futures market exposure exhibited bullish sentiment across all time frames. A sign of confidence in the cryptocurrency’s price rally.

Source: Skew

Data from Skew suggested that in the immediate future, most call options were priced at two levels – $50,000 and $60,000. This is based on the Bitcoin options’ open interest as of 29 March. As the calls overpowered the puts, traders can expect Bitcoin to break past $47K if momentum builds up and thereby, move into the $50,000-$60,000 range.

Overall, ahead of the options expiry on 1 April, the April Fool’s Day might be an excellent time to invite more bulls.

Source: coinoptionstrack.com