Bitcoin and its struggle with this level have been a matter of discussion for every trader, investor, and analyst throughout this year. The king coin comes back to either test it as support or resistance every once in a while, regardless of all its rallies.

Back at it once again…?

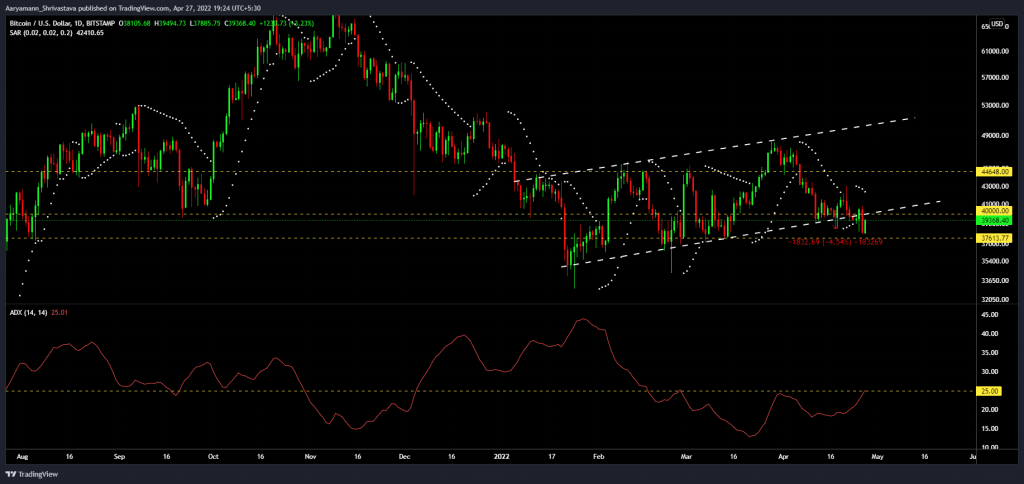

Now, the coin was in an ascending channel on a macro timeframe and would have been expected to set $40k as concrete support. However, the price action over the last ten days invalidated the possibility of that happening.

Bitcoin Price action | Source: TradingView – AMBCrypto

After yesterday’s 5.7% price drop, investors were expected to turn bearish or at the very least, hold on to their buying spree. Alas, surprisingly, that won’t be happening either.

The intention of HODLing that began gaining strength towards the end of February seems to have gotten stronger through March and April. Over this period, 163,490 BTCs worth over $6.3 billion were bought out of exchanges.

Bitcoin balance on exchanges | Source: Glassnode – AMBCrypto

This, because Bitcoin also began rising in that time period and ended up touching $46k by the end of March. Naturally, investors expected it to turn into a bull run, one which would’ve pushed Bitcoin further ahead towards $60k.

A contractual thing

This was also visible on the Options Open Interest, where the highest calls were placed at $60k, followed by the second-highest at $50k.

On the contrary, those who understood the market and the practical course of action made their Puts at $40k. Here, some thousand contracts were at $45k, $44k, and $42k.

Bitcoin Options Open Interest | Source: Skew- AMBCrypto

And, with about 54k contracts set to expire in 48 hours from now on 29 April, it seems like the contracts at $40k are going to make some profit, provided it can actually climb back up.

Price indicators, at press time, were heavily bearish, with the Parabolic SAR indicating an active downtrend. This, as per the Average Directional Index, has been gaining strength too.

Besides, the probability of Bitcoin closing at $38k and $39k seemed much higher at 72% and 50%, respectively, than that of $40k (26%).

Bitcoin’s probability of touching $40k is low right now | Source: Skew- AMBCrypto

Trading at $38,979 at the time of writing, Bitcoin still has an opportunity of tweaking its trend. IF it can register a 2.34% rally over the next 24 hours.