Despite a sharp correction in the U.S. equity markets on Thursday, September 29, Bitcoin (BTC) and the broader crypto market have remained rock solid with little volatility. As of press time, BTC is trading 0.42% down at a price of $19,357 with a market cap of $371 billion.

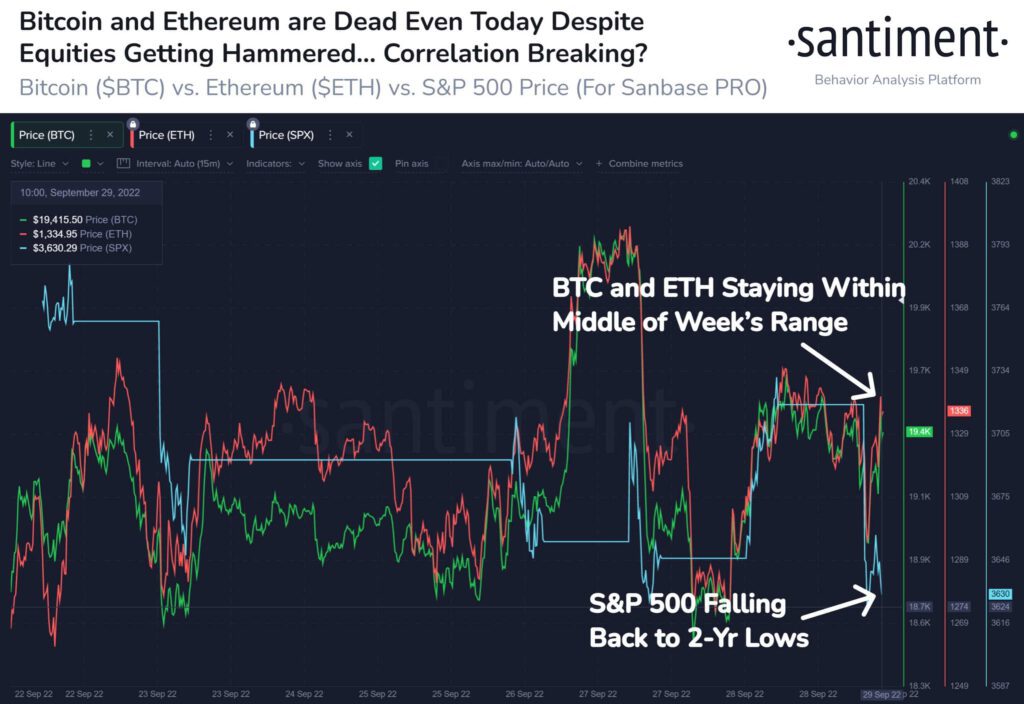

On the weekly chart also, the BTC has shown less than 1% movement and has been holding up pretty well. At the same time, the S&P 500 underwent a very strong on Thursday, tanking more than 2%. So what we are seeing now could be the initial signs of Bitcoin’s long-term decoupling from the U.S. equity market. As on-chain data provider Santiment reports:

#Bitcoin has stuck around $19.4k and #Ethereum at $1,340 today. But the story is the fact that they are doing so without the support of the #SP500, which is down -2.4%. If the correlation is easing between #crypto & #equities, this is very encouraging.

Bitcoin vs Banks

As we know, central banks across the globe have been struggling to deal with current macro conditions. Amid its quantitative tightening measures, the British central bank has pivoted to money printing measures to protect its bond market.

Speaking at CNBC’s Delivering Alpha conference on Wednesday, legendary investor Stanley Druckenmiller believes that crypto could see a revival as the trust in the central bank fades away. The investor believes that the U.S. economy is already in deep trouble and that recession is very likely by 2023. He added:

Trending Stories

I could see cryptocurrency having a big role in a Renaissance because people just aren’t going to trust the central banks.

The investor said that he doesn’t own any crypto as of now but added “it’s tough for me to own anything like that with central banks tightening”. Sven Henrich, the founder of NorthmanTrader, a markets research firm said: “You know we’ve reached a unique time in history when #Bitcoin suddenly is less volatile than fiat currencies”.