Despite the current macro headwinds, Bitcoin and the broader cryptocurrency market held strong last week. The crypto market is currently undergoing a partial retracement and it will be interesting to see if it can hold up to the $1 trillion benchmark.

Glassnode brings some on-chain metrics to understand whether this is just a bear market rally or a bullish trend reversal.

Bitcoin On-Chain Metrics

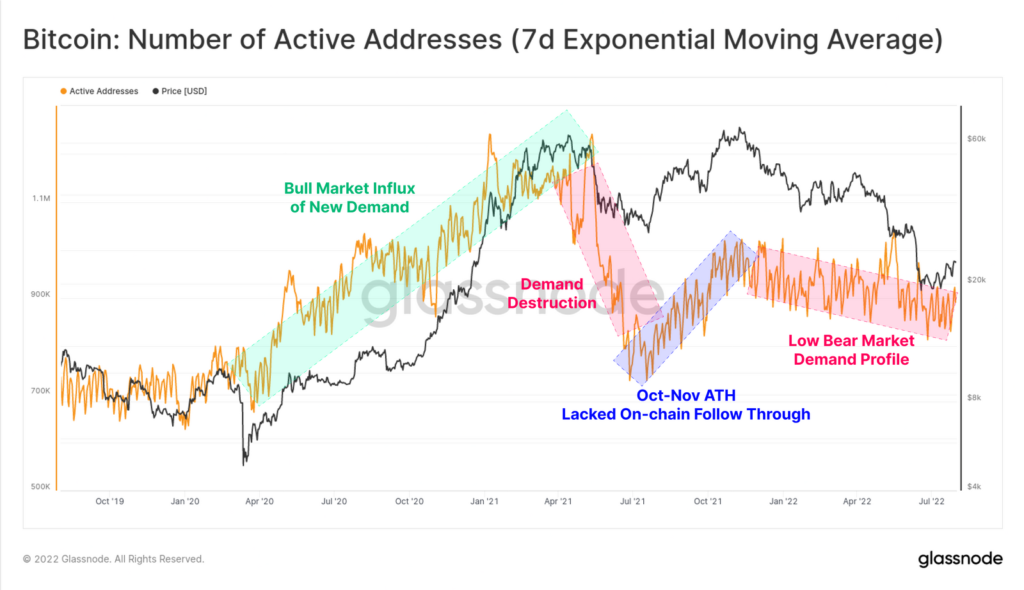

The data provider refers to the current price surge as bearish impulses since Bitcoin active addresses continue to remain in a downtrend channel. Although there have been few activity spikes during the capitulation events, however, the broader network activity suggests that there is little influx of new demand as of now.

Furthermore, the on-chain transaction fees show that we are still in the bear market territory. Currently, there’s only 13.4 BTC in total fees paid every day. Unlike the current bear market, the bull markets often maintain elevated fee rates showing up first signs of demand recovery.

As of the current scenario, the Bitcoin network blocks are remaining partially empty with low network congestion. Glassnode notes: “This indicates that overall, the Bitcoin network remains HODLer dominated, and as yet, there has not been any noteworthy return of new demand, as viewed through the lens of on-chain activity”.

Trending Stories

But on an optimistic note, the public channels for the Bitcoin Lightning Network continue to make new all-time highs. The Lightning Network public capacity has now reached a total of 4,405 BTC. The Lightning network capacity has jumped by nearly 20% in the last two months despite strong bearish sentiment.

Ethereum On-Chain Metrics

Ethereum experienced the same trends as Bitcoin over the last 12 months. There’s been a gradual deterioration in aggregate network usage and congestion. Despite the recent ETH price pump, the network congestion remains the lowest. Over the last year, Ethereum transaction demand has been on a gradual decline.

As Glassnode explains: “Ethereum gas prices have recently declined to just 17.5 Gwei on a 7-day median basis. This is the lowest network congestion and gas price since May 2020, which was prior to DeFi Summer, and before the initiation of the bull market”.