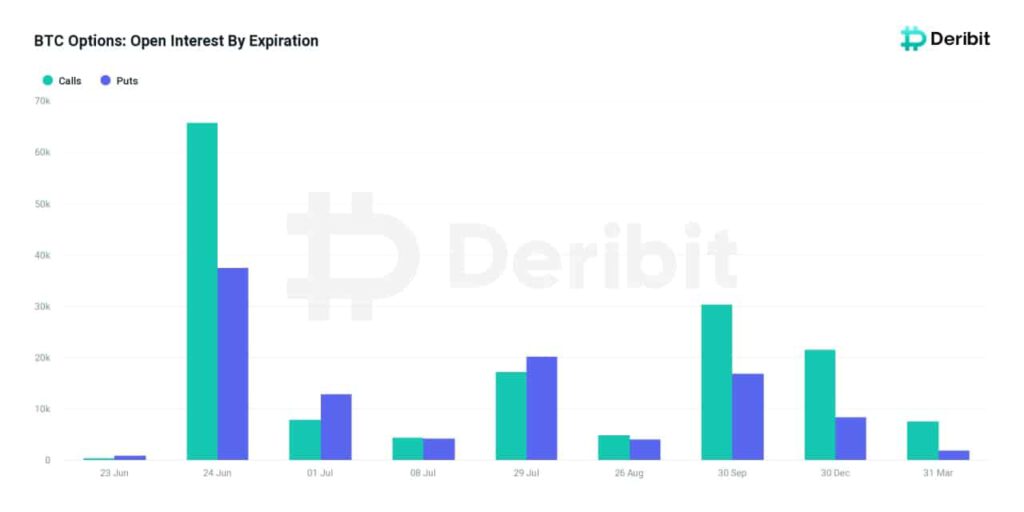

Friday’s Bitcoin (BTC) and Ethereum (ETH) options expiry will be one of the biggest quarterly expiry seen in recent times. Around 103,000 Bitcoin contracts with a notional value of $2.1 billion and almost 1.1 million Ethereum contracts with a notional value of 1.2 billion set to expire on June 24. In total, 3.3 billion in options open interest will expire.

Bitcoin and Ethereum Prices Could Break Record Low Levels

The max pain price for Bitcoin is $20,500, with most traders making bullish calls for prices above $60,000. Max pain is the price at which the largest number of options holders face financial loss. The BTC Put to Call ratio is 0.57, with calls of 66013 and puts of 37495. Currently, the BTC price is trading near the $20,500 level.

Moreover, the Deribit Implied Volatility Index for BTC indicates that volatility has jumped to 114% after the crypto market crash on June 13. Before the crash, the volatility was below 60%.

The Bitcoin (BTC) has been finding resistance at the $21,500 level and has failed every time it tries to break above the descending channel. Currently, the trend is sideways, with the Bitcoin price continuously diving below $20k.

If Bitcoin fails to breakout, then the bearish pressure will become strong due to expiry, which could push prices below the $17k level. In fact, the bearish sentiment is strong due to regulatory pressure and miners’ selloffs. Traders can expect higher volatility before and on the expiry day.

Trending Stories

On the other side, the max pain price for Ethereum (ETH) is $1800. With Ethereum’s price currently trading at $1,100, the ETH price could dive to $800 as the put-to-call ratio of options is 0.43, with calls of 750,859 and puts of 321,012.

Moreover, the ETH volatility has jumped to 164%, from 75% on June 12. Currently, the ETH price is trading sideways in a range and the next resistance is at $1250.

If bulls fail to show strength, bears are likely to push prices to next the support level at $800.

BTC Price Trading Under the 200-WMA

The Bitcoin price is still trading under the 200-week moving average (WMA). Historically, Bitcoin price generally rebounds from the 200-WMA. Also, Bitcoin has rebounded quickly if it had fallen below the 200-WMA. The general sentiment is Bitcoin price should rebound this time too from the bottom.

Analysts believe the next support level is near the $13k. If the BTC price falls again below the latest low of $17,708, the possibility of falling to $13k is higher as there is no support for BTC before it.