Since I started investing, a concept I learned in my scientific background has helped me realize that there is a great mix of noise and signal in the information available to the average investor. In all news portals, there is always a great mix between information that is relevant and information that is useless.

The Bitcoin ecosystem is no different. It is possible to find both excellent quality information for free, as well as videos on YouTube with traders making weird mouths and amplifying any FUD or FOMO triggered by the media. Information for long-term fundamentalists (we the HODLers) and for day traders is always presented to beginners in a disorganized manner, so confusion is the common state. Basically, the beginner doesn’t know how to separate the wheat from the chaff.

Despite this being the common scenario, I’ve never seen much good content with a macro view that teaches someone to interpret and understand which of these news is useful and which is not. In other words, what is the chaff and what is the wheat for your investments?

What Is Signal, And What Is Noise?

This “noise and signal” thinking comes from telecommunications. According to Wikipedia: “Signal-to-noise ratio is a measure used in science and engineering that compares the level of a desired signal to the level of background noise.” This concept of signal and noise was appropriated from telecommunications to various fields of science and engineering, because it is useful as a mental model to understand how the world works.

Explaining this concept in a simple way, the signal is a macro pattern that can be observed and that carries information. Noise is random and does not affect the macro pattern. For example: noise is the continuous “hummmm” the amp makes when an instrument is not plugged into it, while signal is the guitar sound that the amp communicates when the guitarist plays their solo.

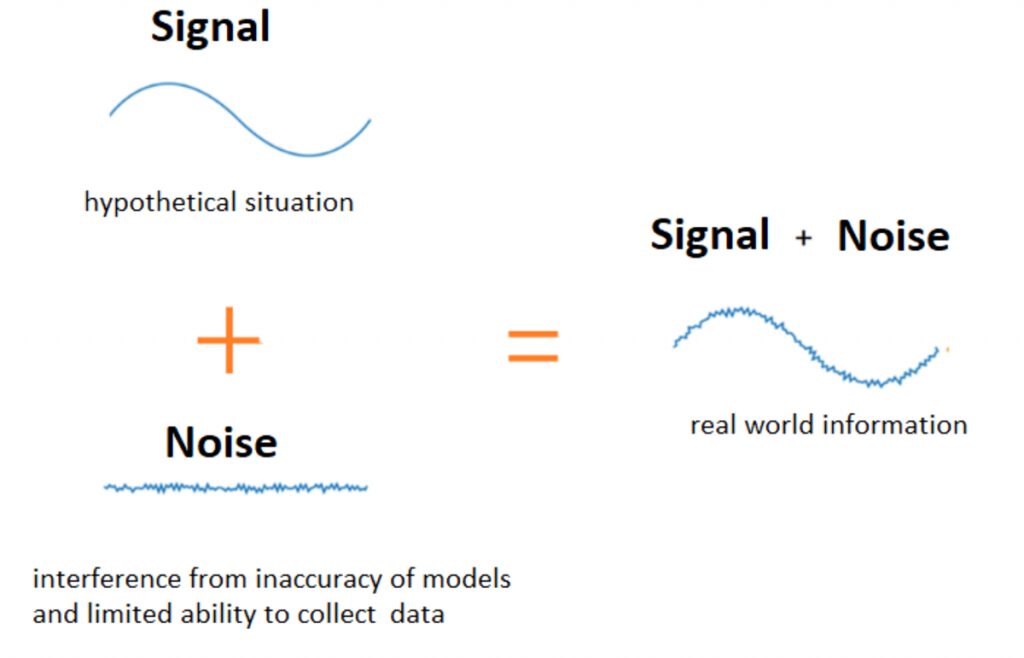

In science, this language of noise and signal is used to observe what makes sense and what is irrelevant to larger processes. In several experiments, the data obtained by scientists needs to be “cleaned” and interpreted, removing the noise and allowing a more accurate interpretation of the signal. These next two images illustrate this thought:

Figure 1. Illustration of noise, signal and the result of the sum of both generating in the real world.

In Figure 1, it is possible to see that the result in the real world is the sum of the noise with the signal and that it is possible to separate one from the other when interpreting data.

The signal is the ideal conditions that do not exist in the real world. Noise, on the other hand, is related to human limits, whether in models that do not cover the entirety of a phenomenon, or in the technical capacity of building equipment that can capture information more precisely.

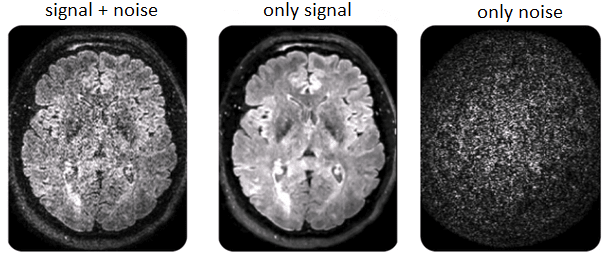

Figure 2 exemplifies the difference between noise and signal in practice, with an MRI scan of a brain:

Figure 2. Today’s MRI imaging is getting better because of increasingly effective noise filtering techniques. Adapted from Manjon et al. (2010).

How Does This Apply To Investments?

Okay, but how does this signal and noise story apply to investments?

The first step of every investor is to understand what his profile is and what his strategy is. Without a defined strategy, it is impossible to know what is noise and what is signal. Or, in other words, for those who don’t know where to go, any path will do, poorly.

Using my own case as an example, I am a long-term investor who invested in the stock market with the plan of building a pension portfolio (retirement money without depending on the state). I continued with this long-term view when I shifted my focus to bitcoin and became a HODLer. In my specific case, adoption news, companies starting to use bitcoin and other things related to the bitcoin adoption curve are the signal; while short-term volatility viewed through graphical analysis with the ascending triangle pattern smacked down by Thor’s hammer or a double-twisted whatever … are all noise.

But for someone who studies technical and onchain analysis, and takes relevant information from the news, i.e., for day trades, all of this is your signal, while El Salvador’s adoption of Bitcoin or Taproot activation are noise that do not affect the price in the near term.

In other words, there is no right and wrong, each person must interpret according to their strategy what is noise and what is a signal for them. But I do have a reason to choose to invest in the long term and not the short term. I do that because I believe that it is simpler to filter out the noise in the signal, and to determine why this is related to game theory.

Zero-Sum Games, Non-Zero-Sum Games

In game theory, a zero-sum game refers to a game in which there is necessarily a winner and a loser. In other words, for someone to win something, someone else is necessarily losing. While a non-zero sum game is a collaborative game where one player’s success does not represent another player’s loss. In nature, the zero-sum game is the game played between predator and prey, while the non-zero-sum game is the game played by species that have a mutualistic relationship, such as humans and dogs.

Translating these game theory concepts to the investment world, short-term investments (day trades and short-term trades) are zero-sum games in which there are no significant changes in the thesis and fundamentals. There are only people betting against each other and trying to arbitrage the short-term price of an asset in order to extract money from other people who are also trying to arbitrate the short-term price and extract money from other people (and so on …). A direct implication of this is the emergence and expansion of an entire news industry that gains more clicks when headlines are more sensationalized. In other words, those who focus on the short term and try to trade news are the ideal target for those who want to manipulate the market using FUD.

Meanwhile, long-term investing surfs the foundations of the thesis. In the case of Bitcoin, the long-term adoption curve and the scarcity generated by the halving cycles ensure a constant and predictable long-term appreciation. But many who focus on the short term are “not gonna make it” (NGMI) because they do not know how to differentiate between noise and signal.

In other words, what is noise and what is a signal is different for each person and strategy. My personal strategy is simple: study Bitcoin fundamentals and focus on the long term. I make my weekly buys without looking at the price because I know that volatility is short-term noise and that the adoption curve is the long-term signal. In this strategy (known as dollar-cost averaging, or DCA) technical analysis figures, weird-eyed YouTubers, and sensationalist headlines are noise which can be ignored. Life is simpler and more peaceful as a HODLer playing this non-zero sum game called “the long run.”

This is a guest post by Pudim. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.