Bitcoin exchange reserves have shown a sudden sharp spike recently, despite being in a declining trend for months.

After Months Of Downtrend, Bitcoin Exchange Reserves Shoot Up

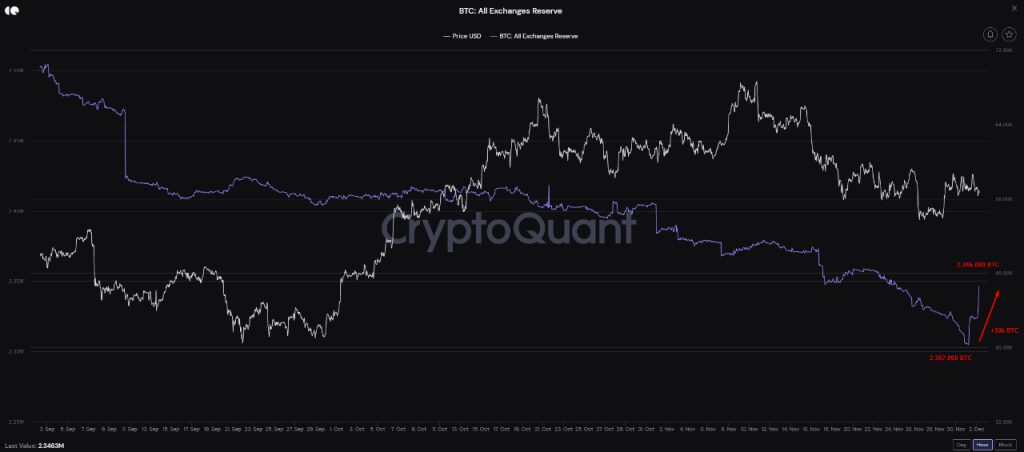

As pointed out by a CryptoQuant post, on-chain data shows that BTC exchange reserves have spiked up in the past couple of weeks.

The “all exchanges reserve” is an indicator that measures the total amount of Bitcoin stored in wallets of all exchanges at a particular point in time.

If the value of the metric goes down, it means investors are taking their coins off exchanges. Holders may be withdrawing their BTC to accumulate them as they might believe that the price would appreciate further. As a result, this trend could be bullish for the crypto.

On the other hand, if the indicator increases in value, it implies holders are transferring their Bitcoin to exchanges, possibly for withdrawing to fiat or for purchasing altcoins. Such a trend can prove to be bearish for the coin.

Related Reading | Bitcoin Open Interest Remains Elevated Post Dramatic Dip

Now, here is a chart that shows the trend in the BTC exchange reserves over the past few months:

The indicator seems to have spiked up recently | Source: CryptoQuant

As you can see in the above graph, the Bitcoin exchange reserves have been falling down for a while now. However, in the past couple of days, the indicator’s value has shown a sudden increase.

This rise in the reserve amounts to around 39k BTC being deposited to exchanges between yesterday and today alone.

Related Reading | The Bitcoin Saga: A Look At BTC’s History Of Up’s And Down’s

Such sharp trend is usually an indication of whale activity. The price of Bitcoin has struggled recently so it’s possible some institutional investors could be preparing to pull out from the market.

If it’s indeed a sign of whale dumping, then the outlook of the crypto’s price could be bearish at least in the near future.

BTC Price

At the time of writing, Bitcoin’s price floats around $56.4k, down 2% in the last seven days. Over the past month, the crypto has lost 8% in value.

The below chart shows the trend in the price of the coin over the last five days.

BTC's price has mostly consolidated in the past few days | Source: BTCUSD on TradingView

Over a week ago, Bitcoin had a crash triggered by fud from the Omicron COVID variant. The coin’s price dropped to as low as $53k, but a few days ago the coin recovered its losses.

However, since then, the crypto has mostly trended sideways. It’s unclear at the moment which direction the coin might break out of this consolidation, but if the exchange reserve is anything to go by, BTC might face bearish trend soon.

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com