Bitcoin (BTC) has increased considerably since January 24, but has yet to confirm that it has reached a bottom.

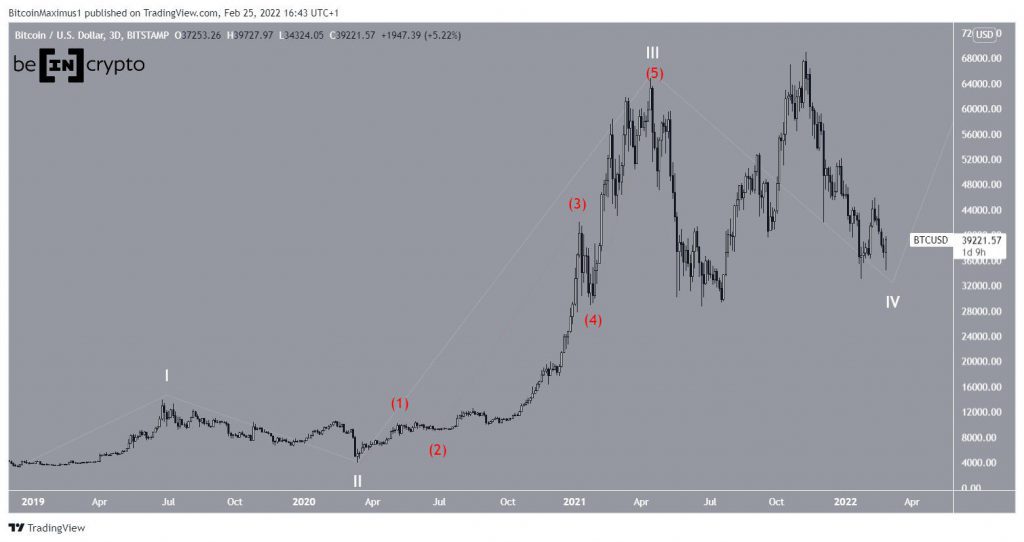

The long-term chart shows that BTC has been increasing since Dec 2018. The most likely wave count suggests that it began a five wave upward movement (white) from a low of $3,122 on this date. This movement has led to the current all-time high price. However, since April 2020, BTC has been correcting inside wave four.

In this article, several possibilities for the construction of wave four will be analyzed in order to determine which is the correct count.

Triangle count

The first potential wave count suggests that wave four is taking the shape of a symmetrical triangle. In it, BTC is currently in wave D (red). In this possibility, BTC would increase towards $51,000 – $55,250, an area created by the 0.5-0.618 Fib retracement support levels before another drop.

As of right now, the count is still valid.

However, the issue with it lies in the short-term movement. The decrease since Feb 10 (highlighted) looks like a five wave downward movement (red). Therefore, this puts the entire count in doubt, since the descent should be a three wave movement instead.

While it is possible that the structure is a very extended flat correction (yellow), the ratio between A and C is unusual.

Ongoing BTC correction

Cryptocurrency trader @24kcrypto tweeted a chart of BTC, stating that the correction is not yet complete.

This possibility would suggest that BTC is still mired in a complex corrective structure.

The issue with this count is the sheer length of the correction, which has been ongoing since April. Therefore, until it is complete, the entire structure would take more than a year.

Completed correction

Another possible count suggests that BTC has bottomed on Jan 24. The ratios between the sub-waves (black) fit perfectly, since A:C have close to a 1:0.618 ratio.

In addition to this, the entire movement is contained inside an ascending parallel channel, which has so far been validated twice(green icons).

However, similarly to the triangle count, the issue here is the short-term decrease, which has so far been a five wave downward movement.

Short-term BTC movement

As stated above, the short-term movement suggests that the decrease since Feb 10 is a five wave downward movement (red line). Therefore, what often follows is an A-B-C corrective structure, prior to another decrease.

The most likely level to act as the top of the current increase would be near $41,450. This is the 0.618 Fib retracement resistance level and would coincide with the resistance line of the previous descending parallel channel.

An increase above the Feb 10 high at $45,821 (red line) would suggest that the count is bullish instead.

Conclusion

To conclude, there are several counts which are still valid, but all of them have some irregularities between the wave ratios. However, all the counts suggest that a bottom is very close and will likely be reached in the next few months.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.