The world’s largest cryptocurrency Bitcoin (BTC) has once again come under selling pressure and is currently trading 2.15% down at a price of $20,686 with a market cap of $394 billion.

This is for the very first time that Bitcoin has formed a third consecutive weekly candle below its 200-Week Moving Average.

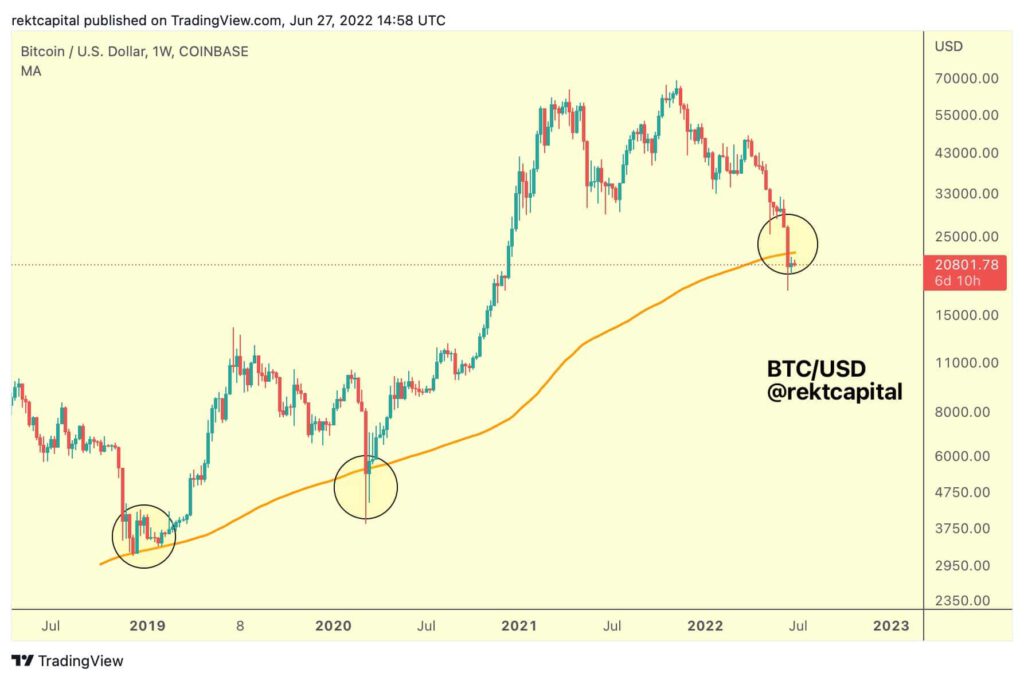

Last week, Bitcoin witnessed some buy-side volumes pulling the crypto to $22,000. Popular market analyst Rekt Capital draws an analogy to the 2018 bear market. The analyst writes:

Last week, BTC printed similar buy-side volume to the 2018 Bear Market Bottom at the 200-week MA During the formation of the 2018 bottom however, that buyer volume preceded extra -20% downside If $BTC were to drop an extra -20% soon, price would reach ~$16400.

Will Bitcoin DownTrend Continue Further?

The recent Bitcoin price correction comes on the heels of heavy offloading done by Bitcoin miners. As per banking giant JPMorgan, these sales might continue to put pressure on Bitcoin. In a note to clients, the JPMorgan strategists said:

Trending Stories

“Offloading of Bitcoins by miners, in order to meet ongoing costs or to delever, could continue into Q3 if their profitability fails to improve. The offloading has likely already weighed on prices in May and June, though there is a risk that this pressure could continue.”

advertisement

The cost of Bitcoin mining as of date could vary depending on the size of Bitcoin production. For a large mining company, the BTC production costs stand somewhere around $8,000.

Also, on-chain data provider Glassnode explains that the 2020 bear market has been the worst on record. In its report, Glassnode notes: “Spot prices are currently trading at an 11.3% discount to the realized price, signifying that the average market participant is now underwater on their position”.

During the Bitcoin price crash earlier this month, investors locked a loss of -$4.234B in a single day, a huge 22.5% higher than its previous record of $3.457B set in mid-2021.