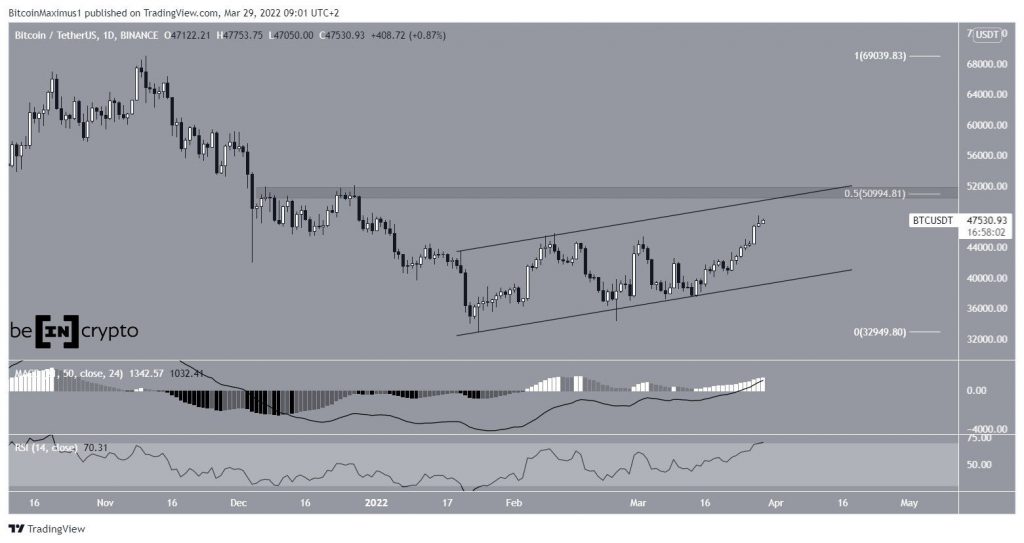

Bitcoin (BTC) reached a high above $48,000 on March 28 and is now approaching an important resistance level near $51,000.

Bitcoin has been moving upwards since Jan. 24 and has so far reached a high of $48,189 on March 28. It’s possible that the entire movement has been contained inside an ascending parallel channel.

However, due to the numerous long wicks, the exact slope of the channel is undetermined.

If the upward move continues, the closest resistance area would be found near $51,000. This is the 0.5 Fib retracement resistance level and a long-term horizontal resistance area. Furthermore, it coincides with the resistance line of the channel.

Technical indicators in the daily time frame are bullish. Both the MACD and RSI are increasing. The MACD is currently positive and the RSI has moved above 70, both of which are common signs of a bullish trend.

Short-term BTC breakout

The six-hour chart shows that BTC has broken out from a descending resistance line that had previously been in place since Feb. 10. It did so after three attempts and already validated the line as support (green icon).

Neither the MACD nor RSI are showing any signs of weakness, meaning that it’s possible that the upward trend will continue without any considerable retracement.

Wave count analysis

The most likely wave count suggests that BTC has begun wave C of an A-B-C structure (black). The beginning of the wave was on March 14 and was validated on March 23 with the breakout from the symmetrical triangle.

The sub-wave count is shown in white and suggests that BTC is now in sub-wave three or four.

If BTC reaches a high close to $50,700, it would give waves A and C a 1:1 ratio. This would also fall close to the $51,000 resistance area outlined in the first section, creating a confluence of resistance levels between $50,700-$51,000.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.